Unilever had bad news for investors today: Thanks to slow growth and cheaper currencies in emerging markets, sales will only grow 3 to 3.5% this quarter, after expanding 5% in the first half of the year. Sales are expected to be flat in wealthier economies.

Unilever is known for adeptly marketing products to consumers in emerging markets, which make up 40% of its sales base. But the depreciation of those countries’ currencies is eating into the company’s revenue. The higher cost of imported products Unilever sells is driving down sales, which in turn makes it harder for the company to raise prices.

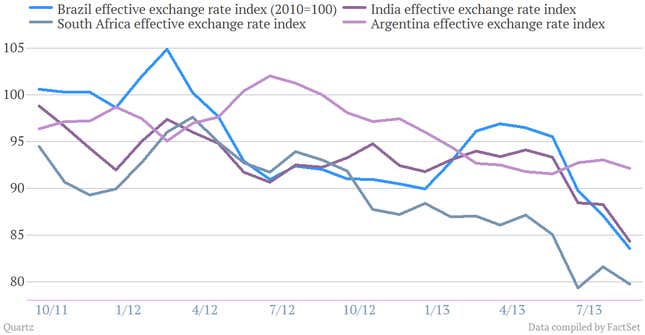

The chart below shows an effective exchange rate index in four countries that Unilever executives singled out in July as contributing to the company’s sales problem. You can see this summer’s plunge fairly clearly:

The slump in these currencies is attributed to the Fed’s misread hints about when to end its stimulus plan, which prompted outflows of investment from these markets. It also reflects concerns about these countries’ growth prospects, absent fairly costly reforms to promote economic activity. While China, another major Unilever market, has been preventing its currency’s value from fluctuating, its economy is growing more slowly than it has in previous years as part of the government’s reform efforts.

On July’s earnings call, CEO Paulus Polman reminded analysts that he’s taking a longterm view of the macroeconomic situation, with a focus on introducing new brands from Unilever’s stable and expanding distribution networks, which range from stores to networks of low-income women selling products themselves.

“Let me just remind you that we have been in the emerging markets for quite a long time, over 100 years in many of these places,” Polman said. “You take India, for example. We’ve added one million stores. I mean, it’s hard to believe. This is a country we’ve been in since 1888, where we established our operations in 1903. … We can find another one million stores. We’ve added 20,000 shakti ladies.”