A new kind of art auction is taking paintings out of the picture. You can go online and buy shares in an iconic Andy Warhol work using cryptocurrency—but the physical object will not hang in your home, and you can’t own it all.

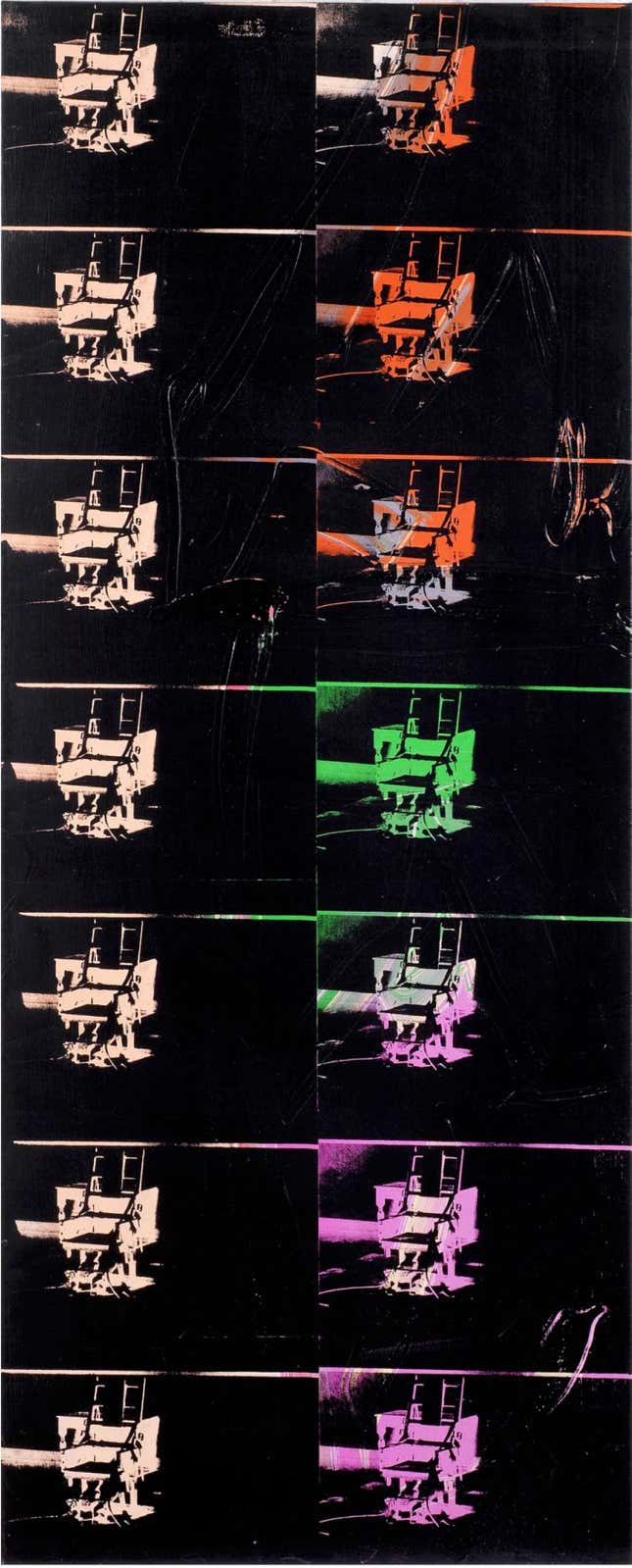

Today (June 20), the first such blockchain art auction begins. Up for sale is a 1980 Warhol silkscreen called 14 Small Electric Chairs. Only 49% of the painting—so just under 7 small electric chairs—is available for purchase. The other 51% will remain with the current owner, Eleesa Dadiani. That means she’ll hold chief control over the artwork, but offer digital certificates of ownership to successful bidders.

Dadiani owns the gallery Dadiani Fine Art and is known as “the Queen of Crypto.” She has accepted cryptocurrency for art purchases before, though not in an online auction that offers shares. She claims this new approach will change the way art is bought and sold and will open the art market to many, if not the masses.

The gallery owner told The Times of London on June 7 that the move reflects a shift “in consciousness, money and culture.” Investors seeking creative options are “becoming more and more open to expanding their portfolio, which they’ll able to do with this Warhol,” she says.

Dadiani doesn’t yet know where exactly the work will go once it’s nearly-half-sold. That will be decided with investors. She suggests “giving it back to the public” by displaying it in galleries internationally.

The painting—a 79-inch by 32-inch silkscreen—is valued at $5.6 million, which is about 850 Bitcoin right now. The reserve price is set at $4 million. Digital certificates in the work can be purchased using Bitcoin (BTC), Ethereum (ETH) and a cryptocurrency called ART, created by Maecanas Fine Art, the blockchain platform selling the work.

Maecanas Fine Art is, essentially, serving as the online auctioneer. The platform claims to be “democratizing access to fine art” with this new approach to ownership and investment. The Maecanas website proposes that art owners and galleries can use the blockchain platform to raise money for new purchases, without seeking high-interest art loans by selling shares in works they already own. For “high net worth investors” who want to diversify their portfolios, buying shares rather than whole works would allow them to jump into the art world without setting up a major fund dedicated to the luxury endeavor. As works gain value over time, shares will too, so a resale of a painting or sculpture could lead to profits for shareholders. Marcelo García Casil, chief executive of Maecanas Fine Art, told The Times, “We’re making history. This Warhol is the first artwork of many more to come.”

As for Warhol, who died in 1987, he’d probably be pleased with the auction scheme—perhaps even deeming it artistic. The artist was an unabashed capitalist who began his career in advertising and thoroughly embraced consumer culture, making it the subject of fine art. He wasn’t subtle about his love of money—in 1982, he painted dollar signs. Warhol had plenty of business acumen himself. He famously said, “Making money is art and working is art and good business is the best art.”