The followers of a cultishly beloved economic database have a new data series: cryptocurrencies.

The addition of digital assets to the Federal Reserve Economic Data (FRED) database, perhaps the most important source of data on the global economy, is yet another validation for virtual tokens.

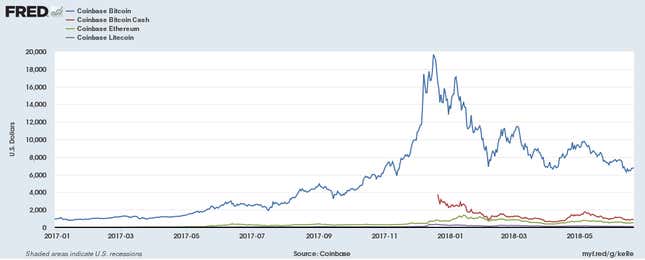

FRED, maintained by the Federal Reserve Bank of St. Louis, recently announced the addition of daily data on the prices of bitcoin, bitcoin cash, ethereum, and litecoin. The prices come from Coinbase, one of the largest cryptocurrency exchanges.

The announcement may be taken as another sign of the legitimacy of cryptocurrency and of growing mainstream interest. Other top-tier financial institutions have also validated crypto—Wall Street traders have been able to access bitcoin prices on their Bloomberg terminals since 2014, and the company continues adding crypto features. Late last year, two of the biggest global exchanges introduced bitcoin derivatives, and Goldman Sachs (paywall) provides bids and offers for bitcoin futures.

FRED is beloved by economic researchers and journalists for its accuracy and comprehensiveness. Whether you are looking for data on the US unemployment rate, inflation in South Africa, or oil exports from Iran, FRED is the resource.

The beauty of FRED is that it combines flexibility with ease of use. If all you want to do is find basic statistics, like yearly US GDP, to download or chart, it is straightforward. And if you want to go further, and find out how the annual rate of GDP growth compares with employment in manufacturing, the learning curve is not steep.

The database inspires a surprising amount of passion. “To say ‘I love FRED’ is too weak, too glib,” wrote Jared Bernstein, former chief economist to US vice president Joe Biden, in the Washington Post. “I depend on FRED. I count on FRED to help provide a better future for economic policy.” FRED’s data coordinator was mobbed when he attended a conference of economics teachers, according to a profile in the St. Louis Post-Dispatch.

The crypto data available on the internet could use an upgrade. Bitcoin and other virtual assets were jolted in January when the widely used price website Coinmarketcap.com, based in an apartment in Queens, NY (paywall), surprised users by changing its algorithms.

Coinbase is bigger and more cooperative with regulators than most other platforms. Its data’s addition to FRED allows for easy comparison of the price of cryptocurrencies to other economic measures.

Cryptocurrency analysts will almost certainly find FRED useful. Want to know how bitcoin’s price relates the volatility of the US dollar? It’s never been simpler. The crypto community should be prepared to fall in love.