The markets seem to think the US might just be crazy enough to default

Ok, it’s probably not going to happen. But markets seem to be increasingly considering the remote possibility that the US might not meet its financial obligations.

Ok, it’s probably not going to happen. But markets seem to be increasingly considering the remote possibility that the US might not meet its financial obligations.

How do we know?

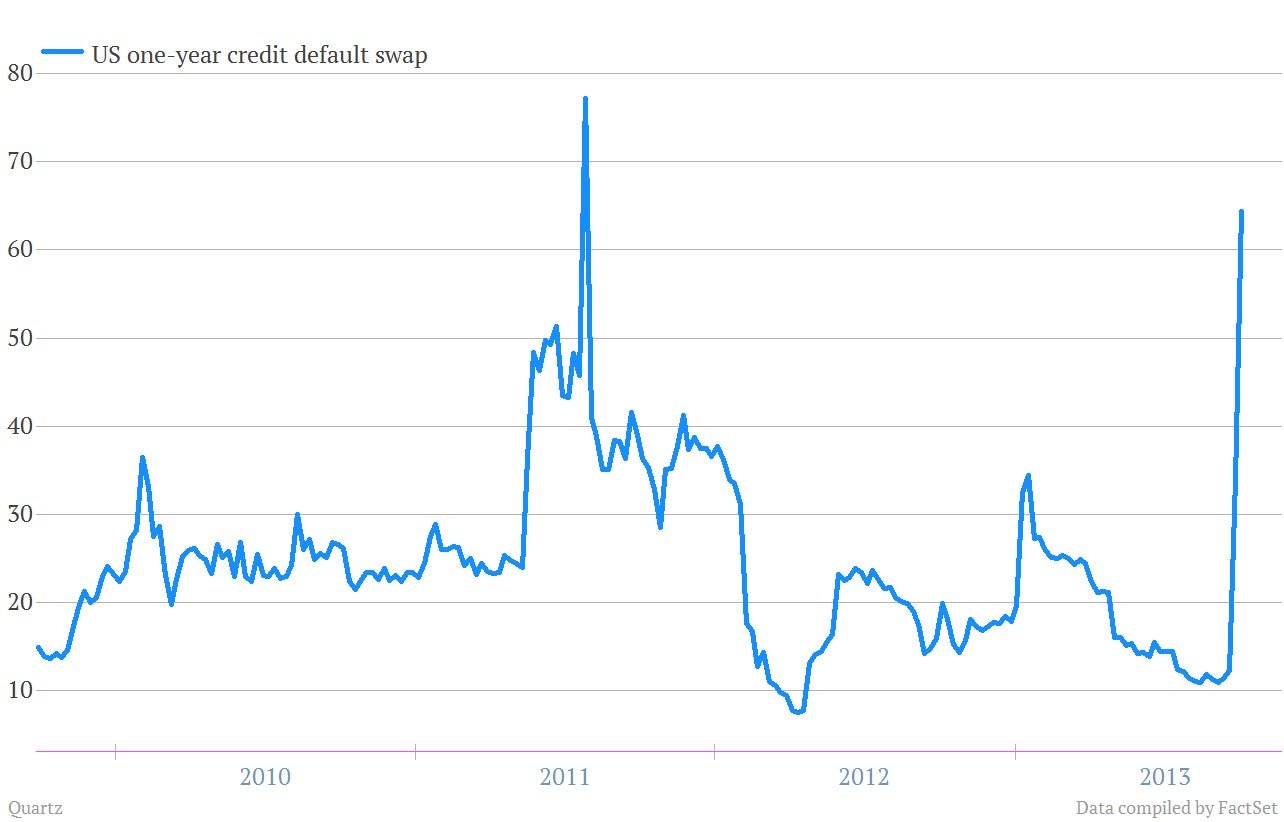

One way is from looking at the markets for credit-default swaps, the insurance bond investors buy to protect against flaky borrowers. In recent days the price of buying such protection on US government debt maturing over the next year—which rises along with investor concern about a borrower’s credit-worthiness—has jumped sharply. In fact, the price of such protection is as high as it’s been since the destructive US debt ceiling fight during the summer of 2011. Here’s a weekly look at US one-year CDS going back four years.

Now, there are plenty of caveats when it comes to looking at CDS numbers. The most important is that the market is pretty thinly traded, which means that any particularly large entity that wants to make a bet could move prices significantly.

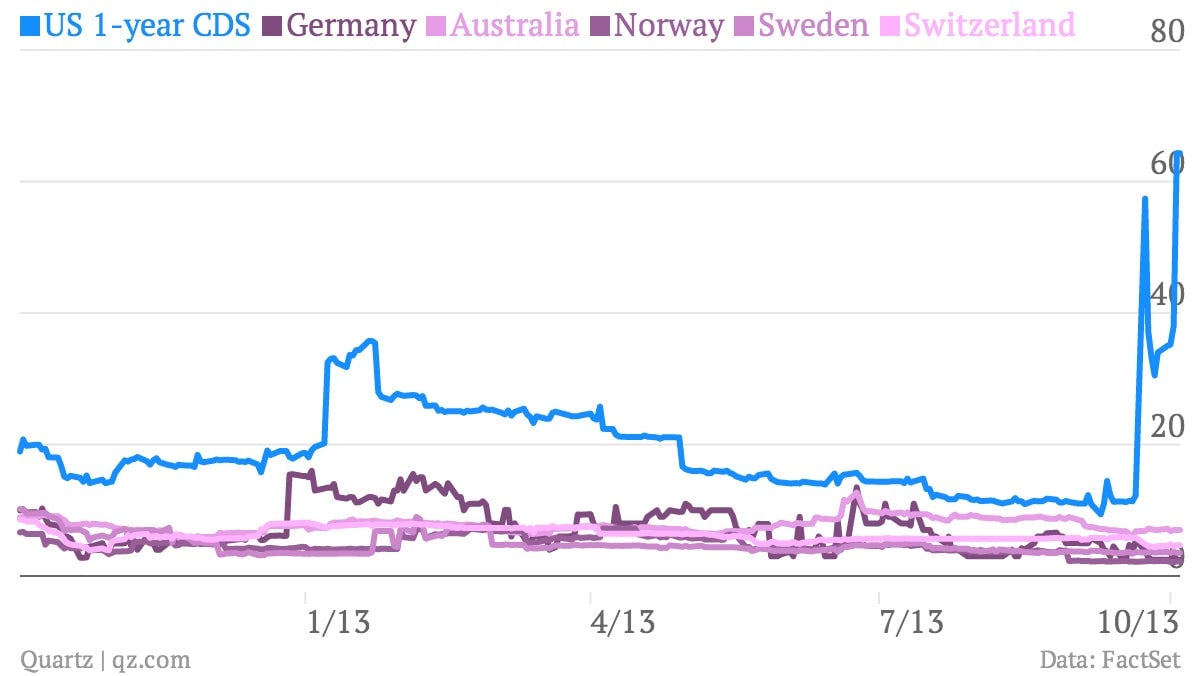

Still, CDS can be a helpful barometer for getting a quick-and-dirty view on the way the markets are looking at the credit-worthiness of different countries. (Differences in currencies and inflation rates can make it dicey to just compare the yields on various government bonds.)

So, with that in mind, look at the one-year CDS—we’re looking at a one-year time frame because of the impending nature of the US debt-ceiling fight— on some of the safest countries in the world. (All of these are labeled Aaa, by credit ratings agency Moody’s Investors Service.) You can see that prices on default insurance for the US have shot sharply higher in recent days, effectively moving the US out of this “safe borrowers” club. Here’s a daily chart of one-year CDS over the last year.

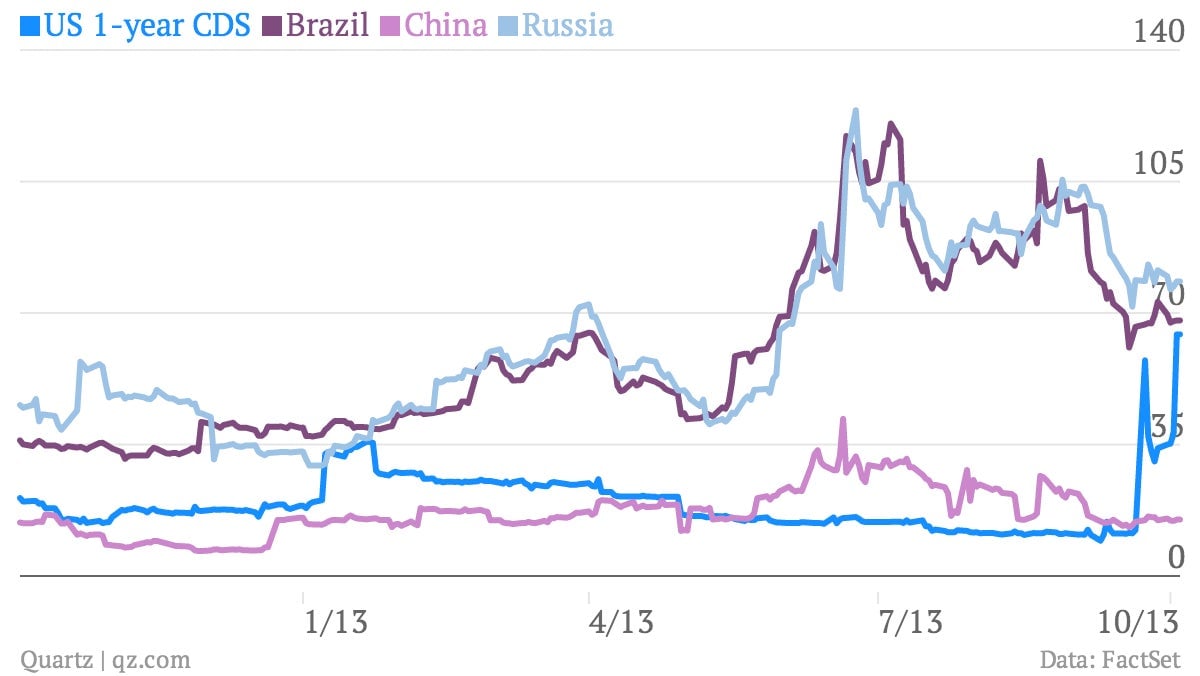

In fact, by the CDS market’s reckoning, the US is only slightly safer than Brazil and Russia over the next year. Bear in mind Brazil had a large, disruptive currency devaluation in 1999. And Russia inflicted an ugly default on creditors in 1998. That’s not exactly great company to keep, especially for a country reputed to have never defaulted. (Although, we’ve already discussed how that’s not really true.)