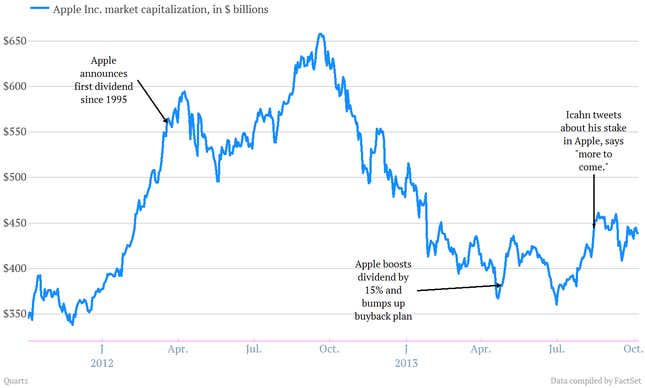

Activist investor Carl Icahn’s rabble-rousing about Apple on Twitter getting a lot of attention and even succeeding in moving the stock some days, the New York Times’ David Carr points out. But it’s still not clear how much money Icahn has been able to print with his megaphone. As a quick reminder, Icahn started banging the drum on Apple in Twitter posts back in August, with a pair of tweets.

Apple’s market value jumped by about $17 billion after the first two 140-character salvos, Carr writes, citing Fortune numbers.

Then, last Tuesday, Icahn took to Twitter to recount a dinner he had with Apple Chief executive Tim Cook.

Icahn followed up with some jawboning on business news network CNBC later that day. All told, the stock’s market cap was up about $1 billion by the end of day on Tuesday. Carr writes:

By the close of trading on Tuesday night, Apple’s market capitalization had increased by $1 billion, to $443 billion, with a big bump after Mr. Icahn’s Twitter post and his comments on CNBC.

That’s $18 billion for three posts, or an average of $6 billion a post, give or take a few bucks for the impact of the CNBC appearance.

Nice work if you can get it. Of course, it’s not as if Icahn himself made $6 billion on those posts. His estimated stake is $2 billion, or about 0.5% of Apple, according to the Times. (Still, that would mean his stake jumped in value by some $80 million—not too shabby.) And it may well be that Icahn is making a bigger splashes in the press with his Apple bet than profits. Apple’s share price is actually down slightly since Aug. 13, when Icahn’s Twitter campaign on Apple started. (Though by definition he bought before that, so he’s still likely in positive territory.) Here’s a look at a chart of a few key events for Apple—along with its market capitalization—in recent years.