Disney and Comcast’s battle for Fox may come to a surprisingly amicable end

Did Comcast’s Brian Roberts ever really want 21st Century Fox?

Did Comcast’s Brian Roberts ever really want 21st Century Fox?

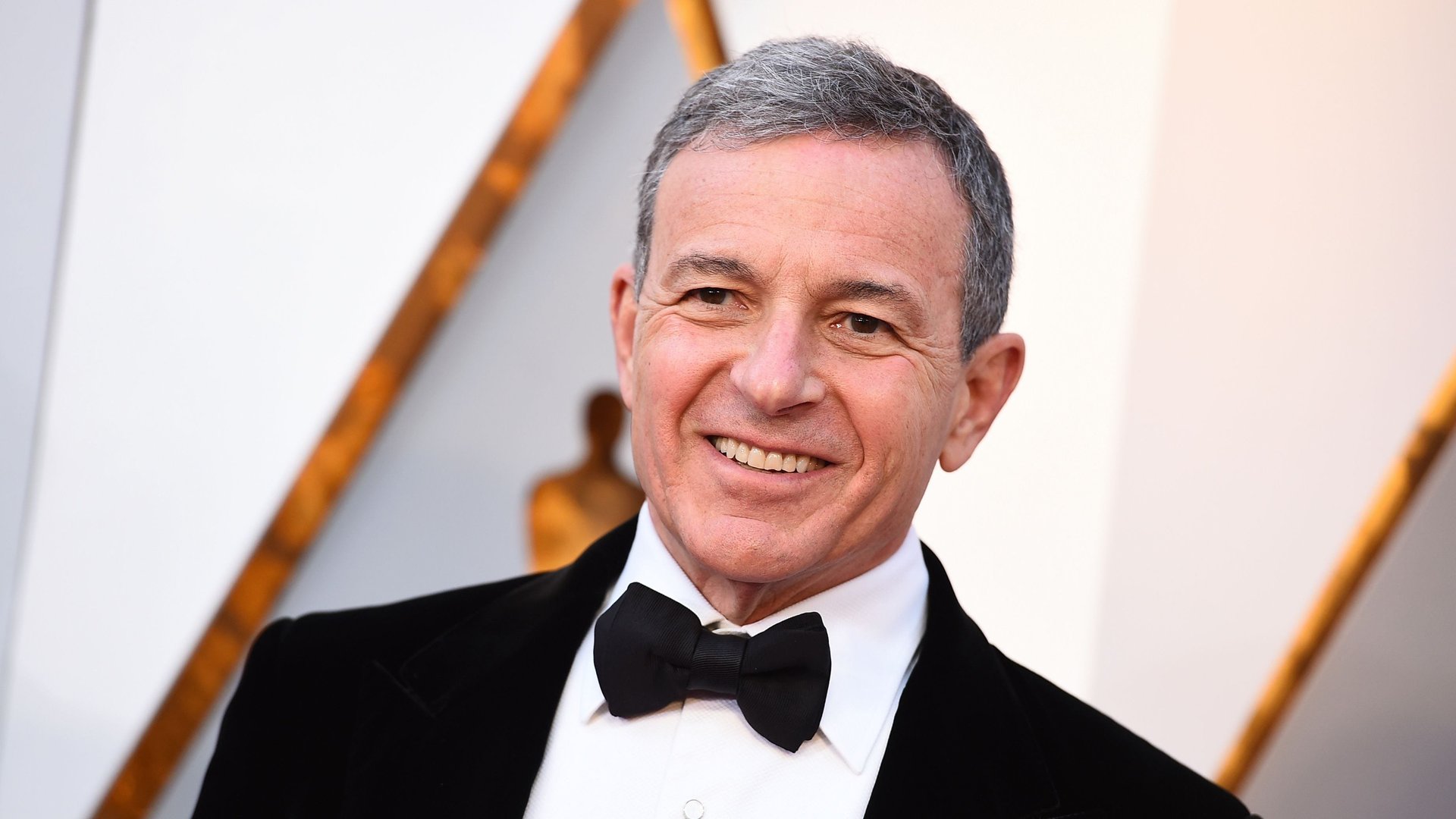

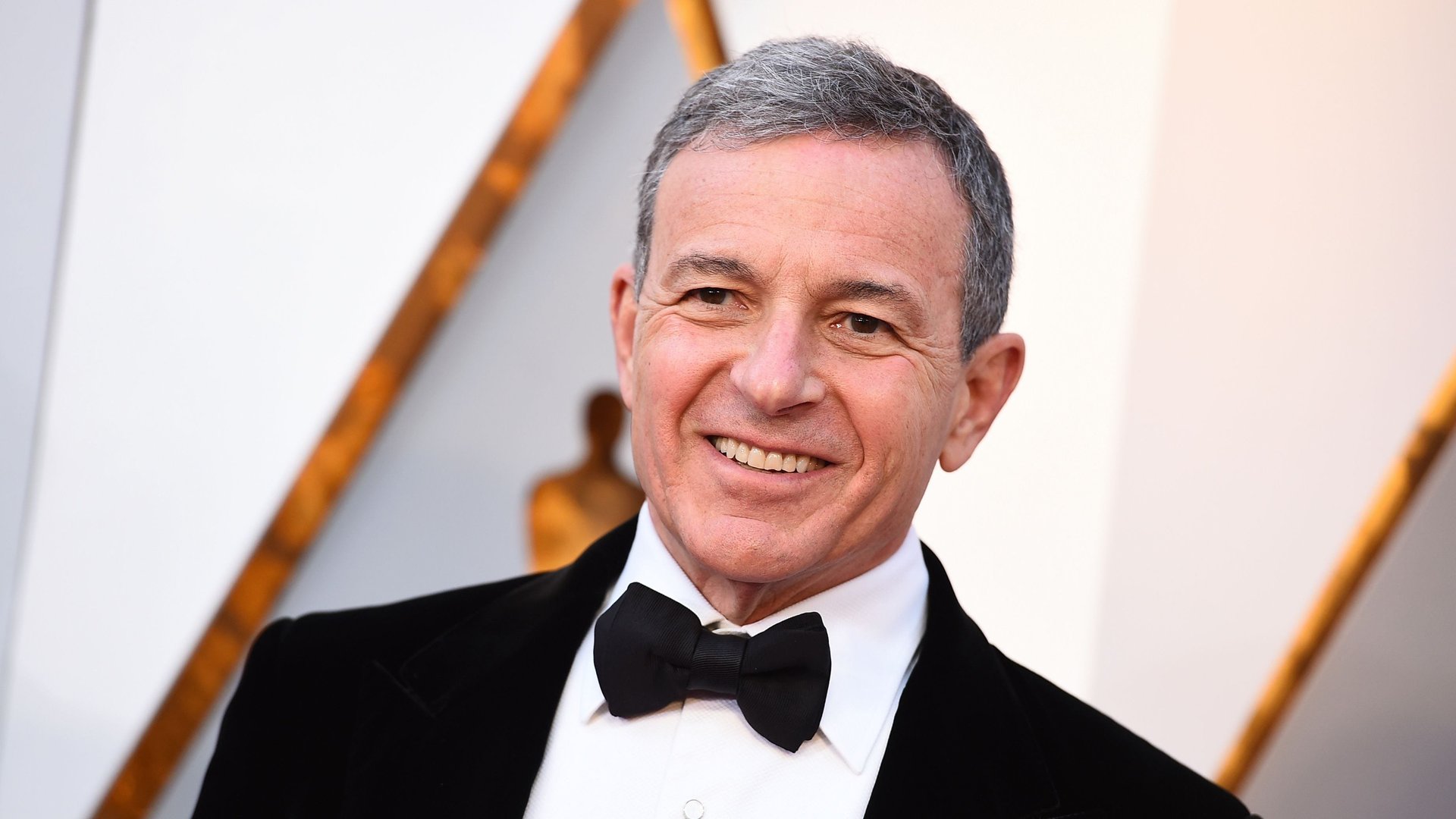

The CEO of the US’s largest cable company abandoned the bidding war he started over Rupert Murdoch’s media empire surprisingly easily, conceding to Disney’s Bob Iger today after a single round of bidding.

“I’d like to congratulate Bob Iger and the team at Disney and commend the Murdoch family and Fox for creating such a desirable and respected company,” Roberts said in a statement today.

Roberts may have lost Fox, but he succeeded in considerably driving up the price competitor Disney would have to pay for the company. Disney originally planned to pay $52.4 billion in stock for Fox’s assets, but upped the offer to about $71 billion in cash and stock after Comcast made a surprise bid.

With Comcast out of the running, Disney and Fox shareholders will almost certainly approve the deal during the vote on July 27 (paywall). Disney will be acquiring Fox’s franchises like The Simpsons and X-Men, its movie and TV studios, cable networks like FX and National Geographic, its stake in Hulu, and its international distributors like Star India.

Comcast said it is now setting its sights firmly on satellite service Sky, which it has also been competing with Fox to acquire in the UK.

The stage is now set for the media merger war between Disney and Comcast for Fox and Sky to end amicably, with Disney winning Fox, and Comcast taking Sky.

Comcast was planning to take on a lot of debt to buy Fox. Ditching that conquest leaves Comcast with more financial runway to compete for Sky. To complicate matters, however, Fox owns 39% of Sky, and has been trying to acquiring the rest of the company for years.

The soon-to-be owner of Fox’s stake, Disney, isn’t a pay-TV provider, however. On the other hand, Comcast is, and Sky would fit more seamlessly into its business and give the US cable company the international footing it craves. Comcast raised its offer last week (paywall) to acquire the company, including Fox’s stake, for £14.75 in cash per share, or about $34 billion.

Murdoch, who has lead the charge at Fox to takeover Sky, will take home a healthier pile of cash because Roberts drove up the price for Fox. It may make him and Fox’s shareholders more amenable to parting with Sky. Disney shareholders may not have the stomach for a prolonged bidding war, either, though Disney and Fox maintain that Sky is an important part of the proposed plans for the merged company, which they plan to blandly call New Disney.

If that was Roberts’s plan all along, that is some next-level scheming that would be right at home on an episode of the media drama Succession on HBO (which was involved in its own protracted media merger). Murdoch and Iger could pull a similar move and stay in the running for Sky simply to make Comcast sweat. To be sure, Bloomberg reports Comcast may have been spooked by the high price to acquire Fox and the regulatory environment. The battle for Sky will continue to shake out in Europe in the coming weeks.