With or without Amazon, asset management is getting disrupted

If Amazon makes a serious move into financial services, it will be one of the most talked about pivots in tech history. Finance executives regularly discuss a potential invasion by the likes of Apple, Google, and the Seattle e-commerce giant. There are good reasons to think this could eventually happen, but it’s worth noting that a large part of the industry—asset management—is already hard at work disrupting itself.

If Amazon makes a serious move into financial services, it will be one of the most talked about pivots in tech history. Finance executives regularly discuss a potential invasion by the likes of Apple, Google, and the Seattle e-commerce giant. There are good reasons to think this could eventually happen, but it’s worth noting that a large part of the industry—asset management—is already hard at work disrupting itself.

Research firm Bernstein analyzed whether it would make sense for Amazon to add wealth management to its stable of services. The short answer is yes: “We think Amazon is well placed to disrupt the industry and, given the industry’s profitability, may well be minded to do so,” Edward Houghton wrote in a research report this week.

Houghton isn’t alone in his thinking. In a March conference call, Morgan Stanley president Thomas Kelleher told analysts that retail wealth management is “very clearly open to disruption.” The investment bank made its own pivot into wealth management not long ago.

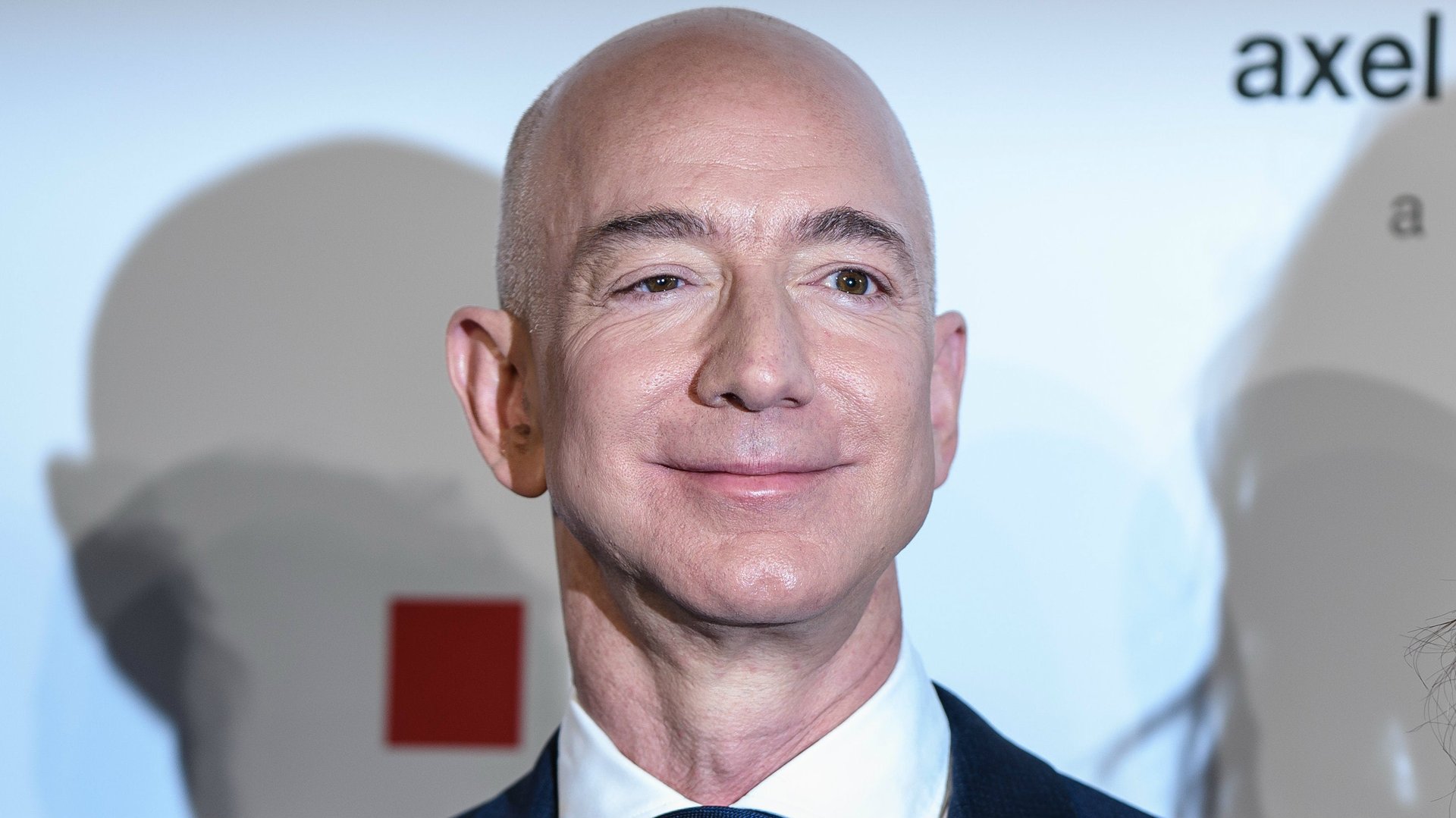

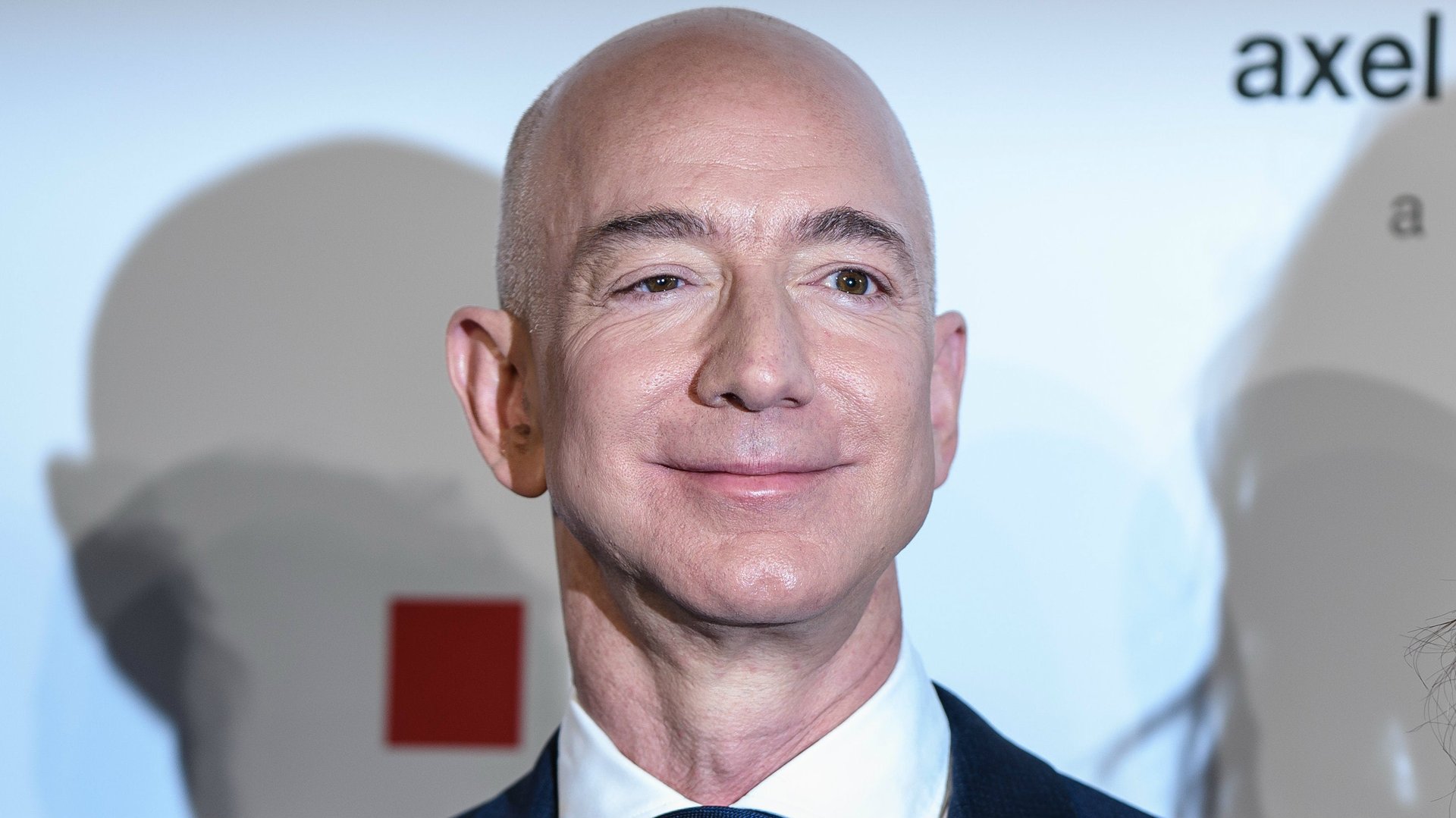

Jeff Bezos’s company could quickly make a splash because it already has millions of customers. Getting users onto a platform is one of the hardest tasks, the thinking goes, and Amazon already has vast reach. There are some 100 million Amazon Prime subscribers, according to Bernstein, which compares with 47 million active digital customers at JPMorgan Chase.

Big Tech may also be more trusted than Big Finance. That might seem odd, given that Facebook’s CEO was recently grilled by politicians in Washington and Brussels about its shortcomings in protecting personal data. But Amazon, at least, is seen as more of a threat to retail companies than it is to liberal democracy. Bernstein pointed to recent surveys that suggest US consumers trust Amazon more than fund managers, and that 37% of Amazon Prime customers would use the company’s robo-investment advisory if it offered it.

Robo-advisors, which use algorithms to help people make financial decisions, could be the sweet spot for Amazon. For Bernstein, this could mean offering another firm’s robots to customers—similar to its Marketplace site for goods—or building out its own “enhanced robo,” which would allow it to use customer data to tailor investment advice. The company’s immense user base would give it an advantage versus fintech startups in this burgeoning sector.

So why hasn’t it happened already? For one thing, Big Tech already makes a ton of money. From April to June, Amazon’s net income ballooned 12-fold, even as its $53 billion of revenue came up a touch short of analyst expectations.

There’s also the heavy wall of regulation surrounding the financial sector, which Bernstein thinks is surmountable.

One of the biggest problems Bernstein foresees is that, sometimes, investors will inevitably lose money. While this is a problem that all money managers face, it’s a reputation risk that may not be worth the hassle for a company like Amazon.

What’s more, rather than upending a sleepy industry, Amazon would be marching into a brutal price war. Management fees have been steadily eroding, meaning regular people can invest and trade for peanuts. Low margins haven’t deterred Amazon from pushing into new markets, like groceries, but more promising returns could be on offer elsewhere, like healthcare.

Tech companies, meanwhile, have built fortunes out of creating services that cost users (seemingly) nothing. There are signs that the asset management business has already learned that trick.

The future of finance on Quartz

- Americans are splurging on personal loans made by fintechs. More options for consumers is a good thing, but upstart lenders are making an increasing number of loans to borrowers with bad credit.

- Square’s app ranking is pulling further ahead of JPMorgan’s. As more banking takes place on our mobile phones, the popularity of PayPal and Square’s apps shows where startups can make inroads.

- Ken Griffin says there’s no need for cryptocurrencies. The founder of hedge fund Citadel says none of his portfolio managers think the firm should jump into digital assets, which are “a solution in search of a problem.”

- Hackers account for 90% of login attempts at online retailers. US community banks are attacked more than 200 million times each day.

- Africa’s dominant mobile money service is in talks to launch in Ethiopia. Kenya’s Safaricom could introduce its M-Pesa mobile money service in the country, which could help boost financial inclusion.

The future of finance elsewhere

- The Securities and Exchange Commission rejected the Winklevoss twins’ second attempt to list shares in what would be the first-ever bitcoin ETF. The agency cited the risk of manipulation and a lack of adequate surveillance among the reasons.

- Third Point made a new investment in PayPal. The hedge fund likened the company to Netflix and Amazon, saying it has high and increasing market share and pricing power. The company handled 2.3 billion payment transactions in the second quarter, a 28% increase from a year earlier.

- Quant funds (paywall) are sagging this year. Performance and inflows into trading strategies using high-powered computers and complex algorithms has fallen sharply.

- Crypto investment bank Galaxy Digital lost $134 million in the first quarter amid a bear market for digital assets. The company is chaired by billionaire investor Michael Novogratz and is seeking a listing in Canada.

- Digital banking helped boost profits (paywall) at Spanish bank BBVA. The lender says it has 25.1 million digital customers, up 26% from a year earlier.

Previously, in Future of Finance Friday

July 13: A simple way to make America’s trillion-dollar student loan system more sane