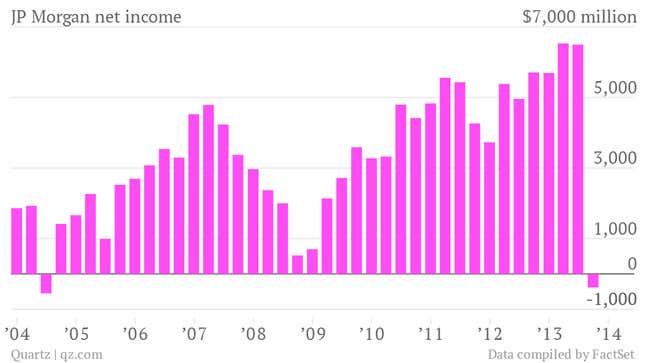

The numbers: JPMorgan Chase lost $380 million in the third quarter, but only if you count its massive legal expenses. If not, then the bank more than beat expectations, earning $1.42 per share versus estimates of $1.21 per share.

The takeaway: Since JP Morgan has to pay $9.2 billion in fines, it’s hard for the bank’s investors not to be excited that the bank didn’t lose more money. Although the bank still has legal issues pending, which could cost it some $11 billion, investors seem to take each settlement announcement as a sign that JPMorgan is putting its issues in the past and moving to a positive–and profitable–future. Shares had risen more than 2% higher in pre-market trading.

What’s interesting: There is one red flag in JPMorgan’s earnings, however, and it’s likely to appear in banks’ earnings statements across the board this season. JPMorgan gained handily—indeed, a benefit of $0.26 per share—from “releasing” the reserves it holds against losses in consumer banking. That’s essentially a funky accounting trick that allows the bank to count those funds as earnings, but it’s also an artificial measure of profitability. “For some banks, the ease with which the [loan loss] allowance could be repurposed as earnings has proved habit-forming,” Thomas Curry, the comptroller of the Currency said last month.