China’s central bank now has $3.66 trillion in foreign-exchange reserves. That’s more than the combined reserves of the four runners-up: Japan, the euro zone, Saudi Arabia and Switzerland.

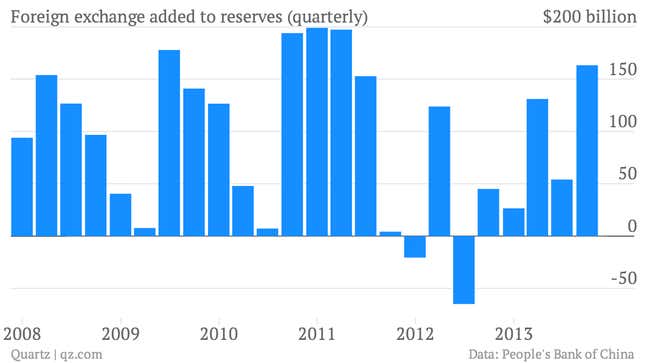

What’s even more remarkable is that China amassed these dollars (and other foreign currencies, but for the sake of simplicity, we’ll say “dollars”) while capital fled countries like India and Indonesia. And even more remarkable than that, China sucked in so many dollars at a time when the economy was looking kind of shaky. In fact, its reserves saw an increase of $163 billion, the biggest quarterly increase since Q2 2011, when the GDP was still humming along at 9.5% annual growth.

Why do we care?

Reserves mainly tell us two important things: how worried the government is about exports and how much liquidity is pumping into China. Liquidity is especially important. When inflows halted in late May and June, a shortage of money caused rates to soar and threatened to trigger bank defaults. So if there’s a lot of liquidity, it should be a good sign. What’s nagging, though, is that despite all these inflows, money is still tight.

Where did the latest $163 billion come from?

In order to prevent the yuan from strengthening—and hurting exporters, therefore—the People’s Bank of China (PBOC) buys dollars that are flowing into the country. Between July and September, the central bank only let the yuan strengthen 0.49% against the dollar, compared with 1.34% in Q2. That means it’s been buying dollars more aggressively. And the two main sources of dollars are the trade surplus and foreign direct investment (FDI).

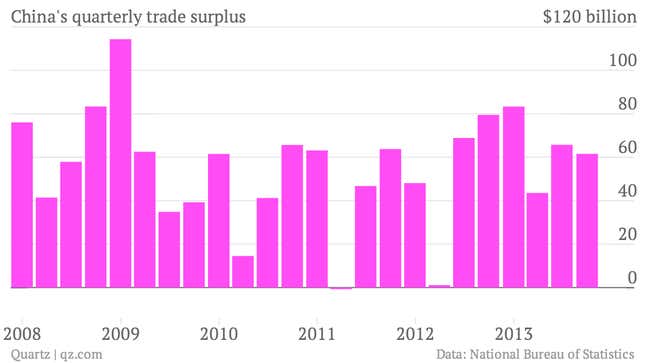

Some of it came from the Q3 trade gap

The Q3 trade gap was $61.5 billion, down considerably on the $79.5 billion in Q3 2012. In other words, there wasn’t an unusually high amount of export dollars gushing into China.

And some from FDI

The government hasn’t released September FDI data, but Bank of America/Merrill Lynch economist Ting Lu estimates that as much as $27 billion in FDI may have come into China in Q3 2012, less than the $32 billion that came in in Q2.

So where’d the rest come from?

But if you add up $27 billion and $65.7 billion, you get $87.7 billion—way short of the $163 billion the PBOC stashed away in Q3. Factoring in all the variables, Société Générale’s Wei Yao estimates that the bank amassed $100 billion in mystery money.

This suggests that investors are exploiting low interest rates in Hong Kong (compared to those in China) to borrow dollars from Hong Kong, change those to yuan, and sink those into higher-yield investments in China. Most of this inflow seemed to happen in September, Yao notes, when fear of the Federal Reserve’s imminent “taper” died down.

What we can conclude from this is that the government is vigilantly protecting exporters by keeping the yuan’s value from growing too much—particularly given that exports tumbled 0.3% in September, compared with September 2012.

As for liquidity, even after billions surged into China in September, credit supply tightened, Yao highlights. This suggests that the shadow banking system is slashing its debt—a good thing. But it also means that it wouldn’t take much to cause cash to freeze up again, which makes one worry about what will happen when that money starts again flowing out.