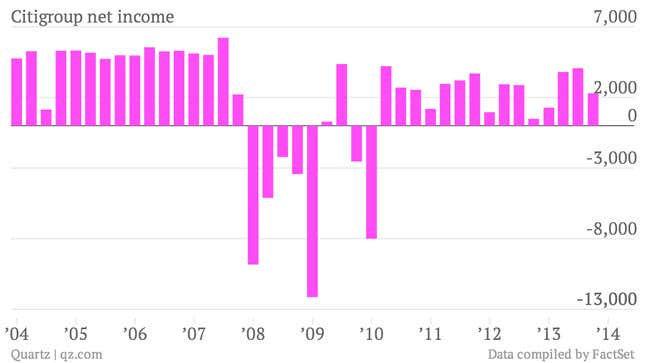

The numbers: Citigroup reported profits of $2.3 billion in the third quarter, seemingly a huge improvement from the $468 million it earned a year ago. Or was it? Adjusted for one-time charges and credit adjustments, the bank earned $1.02 per share, down 4% from the third quarter of 2012. Citi’s suffering was most pronounced (paywall) in its fixed income (bonds) and mortgage businesses; it’s not the only bank that’s been affected by fears of a pullback in Federal Reserve stimulus, which has been dragging housing markets and the value of bonds downwards since earlier this year.

The takeaway: Citi’s earnings demonstrate why US banks have to protect themselves against a domestic and global market that’s still growing in fits and starts. Wells Fargo, which like Citi depends heavily on revenue from mortgage banking, has been expanding into new businesses so it can diversify its revenue stream. But relying on the US and global consumer is a tricky endeavor, and that’s a lesson Citi is apparently learning the hard way as its retail business stalls. The non-US consumer certainly isn’t picking up the slack either; profits from its international consumer banking business fell 17% from a year ago.

What’s interesting: Citi has “earned” $827 million since last year simply because credit conditions have improved around the world. Banks have had to pay less to borrow. They’ve also been able to predict more favorable rates of delinquency in their loans. As a result, they’re allowed to release loan reserves they’ve been holding in case the unthinkable happens and the market takes a turn for the worse. This isn’t a strategy specific to Citi—most of its peers are doing it—but it’s yet another indication that bank earnings are worth taking with a grain of salt.