For the last year, Nvidia has essentially been selling pickaxes to gold miners. Graphics processing units (GPUs) have proven to be necessary tools for cryptocurrency miners, and the company is the world’s largest manufacturer of the devices.

But despite the demand that’s come from the crypto boom, the company has repeatedly warned investors not to expect sizable revenue from the business over the short or long term.

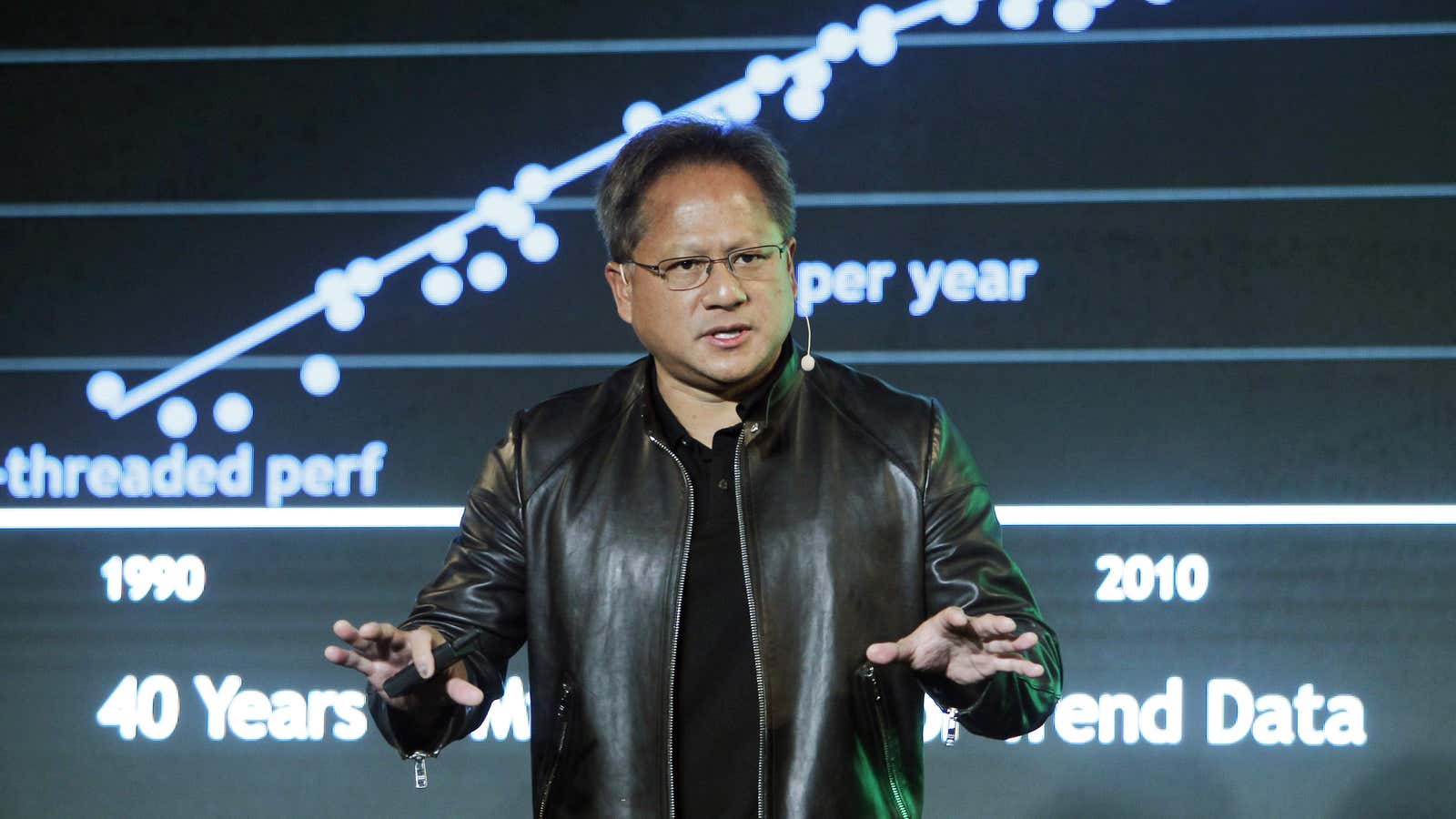

“I believe that crypto will be around for some time, kind of like today,” Nvidia CEO Jensen Huang said in November 2017. “We’re going to see that crypto will be a small but not zero, small but not zero part of our business.”

It wasn’t the last time Huang preached restraint: In February 2018, he said he modeled crypto revenue as flat for the coming quarter, and in May 2018 Huang said he expected Q2 2019 revenue, which ended July 31, to be down by 66%.

But when Nvidia CFO Colette Kress told investors yesterday (August 16) that cryptocurrency revenue was $18 million—$82 million short of what the company had previously expected for the quarter—the stock plunged nearly 5%. The crypto news wasn’t the only downside of the fiscal quarter, though, Nvidia beat Wall Street’s expectations on revenue and earnings per share, but also predicted slightly lower revenue in the coming quarter.

“We are including no contribution from crypto in our outlook,” Kress told investors.

Nvidia didn’t play the crypto-hype game and it still got burned—and it’s far from the only company that’s been in this position. Facebook had been telling investors that its profit would slow as it battled misinformation and abuse of its platform, but when it actually became real last month in an earnings miss, the stock dropped catastrophically. It was the largest ever loss of market cap in the history of publicly-traded companies. For Nvidia, the 5% drop wasn’t particularly damaging—the stock is up more than 60% since this time last year, now trading at $261 per share.

But Nvidia’s stock drop does point to how investors can pump a stock on their own perceptions of the market, especially one as volatile as cryptocurrency, only to run away when reality catches up with them. Luckily for Nvidia, GPUs aren’t yet complicit in massive disinformation campaigns (unless you count the potential for deepfakes), and cryptocurrency was an unexpected source of revenue for the company.