Wells Fargo analysts say that the interest rates Americans pay if they lease a car for 48 months are the cheapest they’ve been for 40 years, at around 4.25%. Interest rates on auto loans have continued to fall despite expectations this year that the US Federal Reserve would cut back its monetary stimulus program.

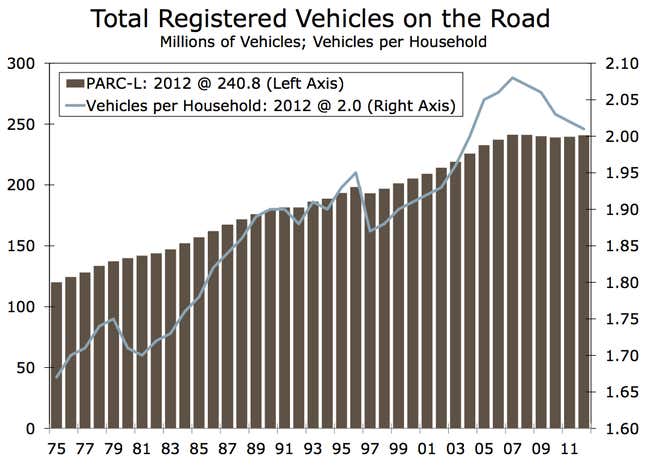

But the number of cars on the road has remained stagnant for the last six years or more. The housing market is on its way back, so why not car leasing?

Jay Bryson, global economist at Wells Fargo, points to two recent trends:

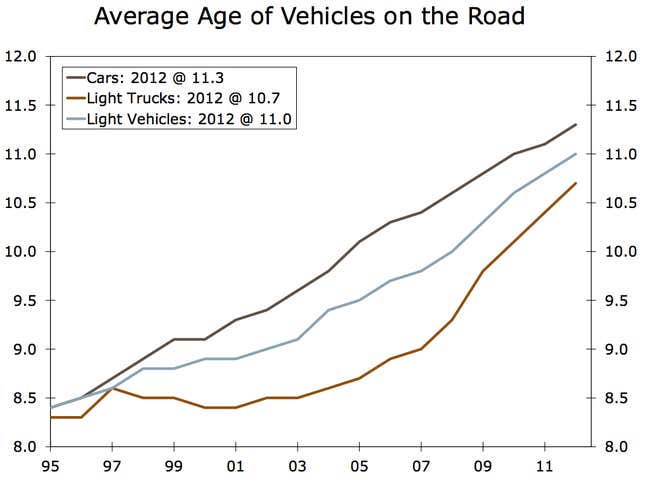

1. People drive older cars than they used to.

2. Families are sharing cars between their members.

Bryson thinks most of this is still a hangover from the financial crisis. “Cars are starting to come back but they still remain relatively depressed,” he told Quartz in a phone interview. “Perhaps one of the biggest things explaining it is that people are trying to repair their balance sheets, and…taking out a car loan would obviously get in the way of that.”

But could the real problem be the millennials, who just aren’t driving? Our colleague Derek Thompson at The Atlantic has explained in the past why he thinks that’s a factor. Americans between the ages of 16 and 34 drove 23% less in 2009 than they did in 2001, according to a report (pdf) from the US PIRG Education Fund and the Frontier Group. The same study found that car-sharing services like Zipcar had already saved Americans from driving 1.1 billion miles as of early 2013. Wells Fargo speculates that the higher number of people working from home these days might make having a car less essential.

For his part, Grayson thinks that the trend is a temporary one, and that more Americans will return to buying new cars once they are in better financial shape. Young people face unemployment rates more than double those of workers of all ages, and that could be part of why they’re not buying cars. In the future, Grayson predicts, ”Spending on [motor vehicles and parts] appears to be well below its long-run trend at present, and the old age of cars on the road should eventually be supportive of new car sales.”

But what if this were a secular change? What if Americans really don’t need as many cars anymore? Could it hurt the economy? Consumer spending on durable goods—items that are expected to last more than three years—comprised 38% of the United States’ real economic growth last year. Car sales were responsible for 30% of that.

The short answer, says Grayson, is no. Consumers will always find something to spend their money on. If this were a permanent change, he says, “Maybe we don’t pay as much attention to motor vehicles, maybe we pay more attention to sales of Apple computers.”