On the whole, the Chinese government has been pretty restrained throughout the debt ceiling standoff. But apparently, it was saving the moralizing for after a bargain was struck. First we have this from a Xinhua (English-only) commentary, by the same writer who recently called for “de-Americanization“:

If the U.S. government continues with its irresponsible dilatory approach over its debt disease, there will be a day when Uncle Sam busts his borrowing limit…. With the protracted U.S. fiscal failure hanging high up there as a Sword of Damocles, the international financial stability and the lackluster global economic recovery are locked in an egregiously dangerous situation…

Then China’s top credit ratings agency, Dagong, downgraded US debt, arguing that the dollar’s weakening as a result of quantitative easing has pushed the US to insolvency:

Since the outbreak of the U.S. debt crisis in 2008, the deviation between the federal government’s sources of debt repayments and the country’s real wealth creation capacity has been constantly broadened.

In other words, the US’s insolvency is endangering the global recovery. And that’s because the US hasn’t grown its economy fast enough to keep up with its borrowing. Here’s what’s ironic:

- The US’s borrowing isn’t endangering the global recovery—it’s powering it. The most precious commodity in the global economy right now is demand. And whether sustainable or not, the US’s loose monetary and fiscal policies have boosted consumer demand at a time when the China, the EU and Japan have made it harder for their people to consume—let alone to import.

- Part of why the US has a debt addiction is because China has a dollar addiction. China buys dollars—and, therefore, Treasurys—from exporters and investors because it must do so to keep the yuan cheap relative to the dollar. If it stops promoting Chinese exporters that way it won’t accumulate dollars, or have to fret about where to invest them (paywall).

- Floating the yuan would help the US slash its debt. The US wouldn’t have to take on as much debt if only China didn’t keep its yuan artificially cheap. The cheap yuan makes US exports less competitive in other marketplaces and more expensive than they should be within China. Letting the yuan float would likely boost US exports, spurring growth and helping reduce its debt.

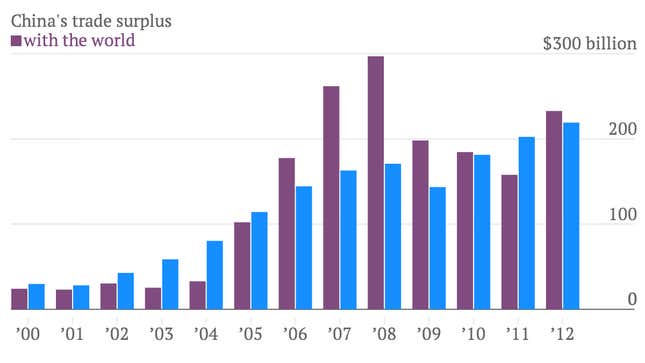

- But China desperately needs captive US demand. China’s vice finance minister, Shen Danyang, affirmed this today (link in Chinese) in comments about a US default. ”The US is China’s second biggest export market, and its debt default could lead to rapid depreciation of the dollar, thereby increasing risks to Chinese exporters, affecting the stable growth in trade,” said Shen. He’s right. In the first nine months of the year, more than 60% of China’s global trade surplus of $254 billion came from the US. That might sound like a lot, but it’s much less than in previous years:

The funny thing is that, as long as China controls the yuan by buying dollars, it has to buy US Treasurys, as a retired Chinese politician explained today. And until it stops, the yuan will never be a major global currency. If China wants to free itself from dollar dominion, it first needs to stop rigging its own financial system.