Investors are tiptoeing back into emerging markets after abandoning them just months ago

The great emerging market freak-out seems to have abated—for now.

The great emerging market freak-out seems to have abated—for now.

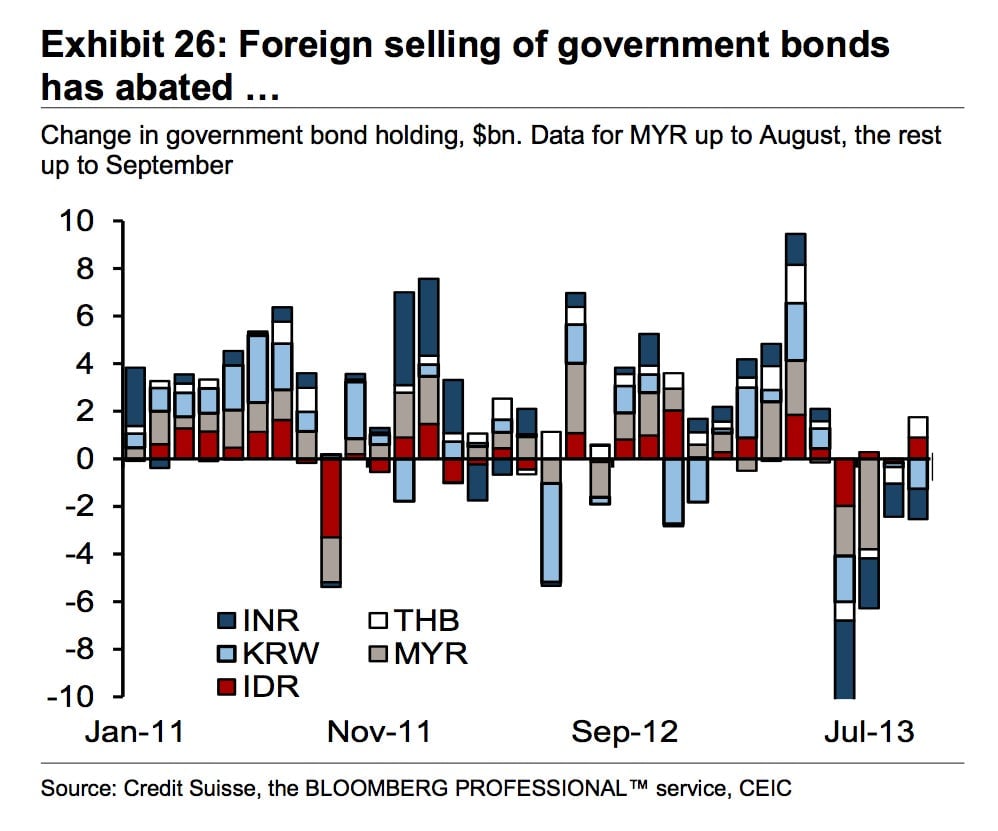

After cash poured out of emerging markets with abandon a few months ago, investors seem to be willing to test the waters yet again. This Credit Suisse chart seems to show the dynamics pretty clearly. You can see money creeping back into countries such as Indonesia and Thailand, countries that saw big outflows during the sell-off. Investors sold Thai and Indonesian securities en masse, converted the cash to their home currencies and pulled it out of the countries, resulting in sharp falls for both the baht and the rupiah.

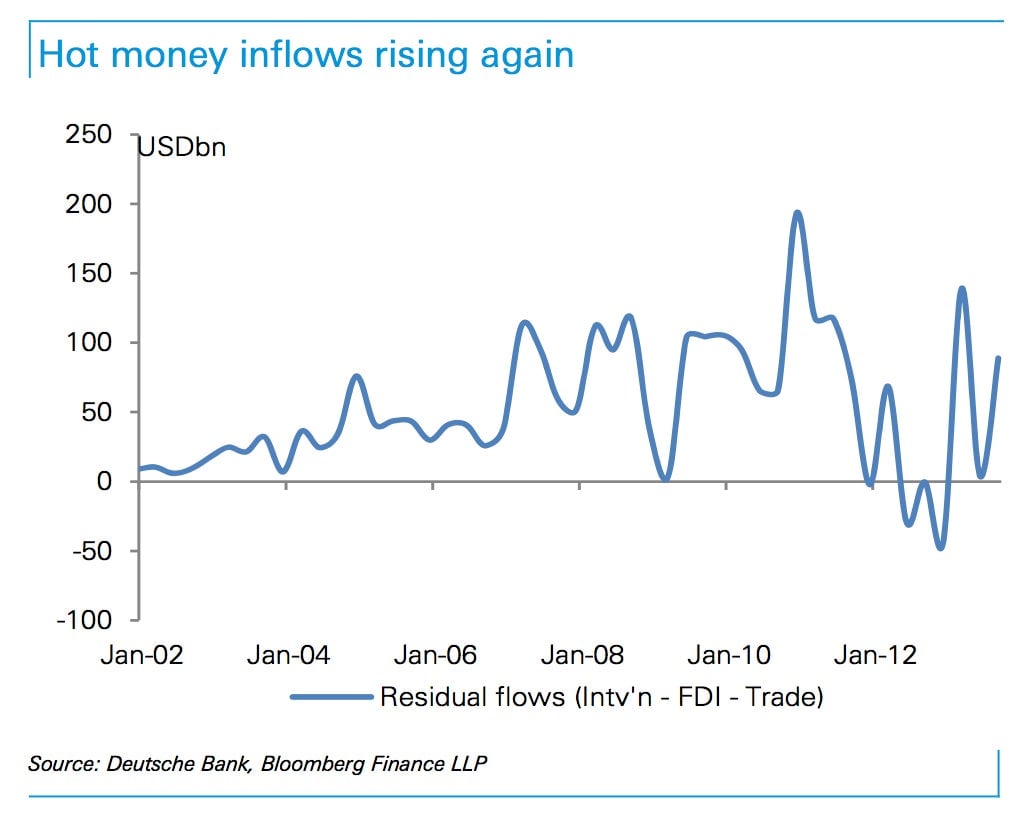

Over the summer, money also seemed to be reversing course and flowing out of the giant EM bellwethers like China and India. But Deutsche Bank analysts say that some of the selling pressure has now abated and investment capital—despite official efforts to insulate the economy from its ebbs and flows—is starting to come back. “‘Hot money inflows have returned strongly,” Deutsche Bank foreign exchange analysts wrote in their weekend research note. Here’s a look at one of their gauges of money movement into and out of the People’s Republic.

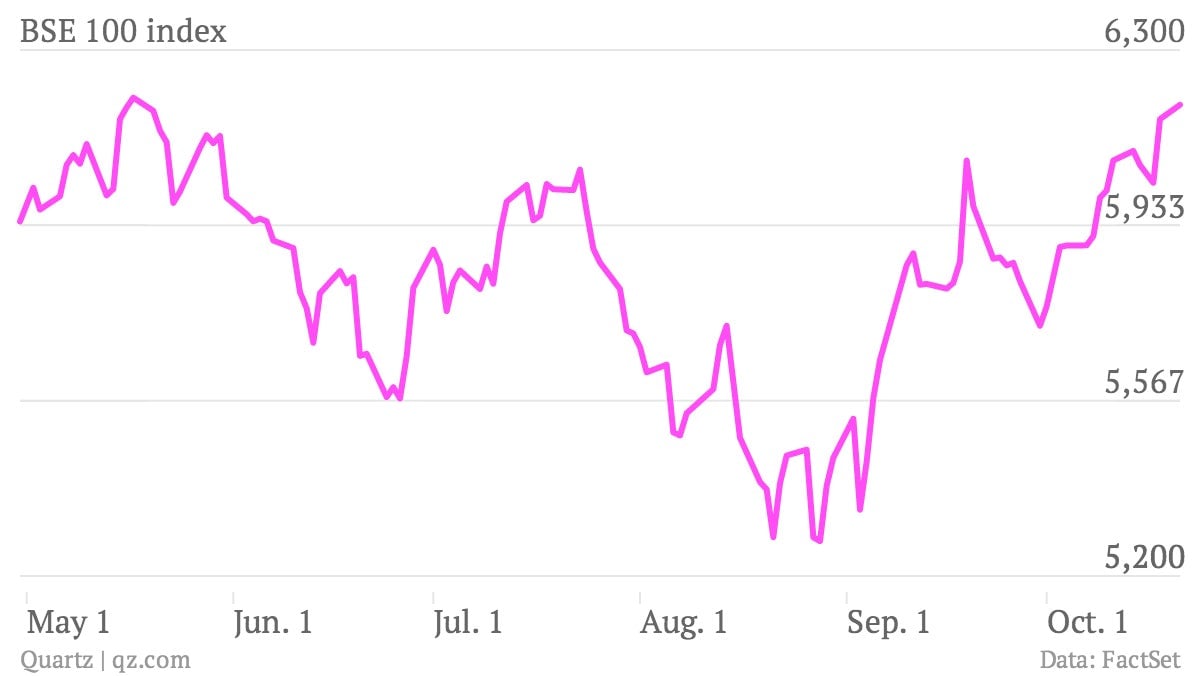

In India, a rebound in the stock market—India’s financial flows are heavily tilted toward equities rather than bonds—and the recent stability of the rupee also suggests at least some interest from foreign buyers. In fact, the Indian stock market has almost completely recovered from this summer’s trauma. Since late August, when the rupee hit its lowest levels, India stocks are up about 17%, if you use the Bombay Stock Exchange 100 index as the benchmark.

Of course, that doesn’t mean that you should consider emerging markets in the clear for the foreseeable future. Potential problem areas—such as a worrisome surge in credit growth in Thailand—are worth keeping an eye on.