This is a big deal. Hot money is now fleeing China “abruptly”

An important reason why countries like China have capital controls is to keep tidal flows of incoming foreign cash from creating destabilizing asset bubbles.

An important reason why countries like China have capital controls is to keep tidal flows of incoming foreign cash from creating destabilizing asset bubbles.

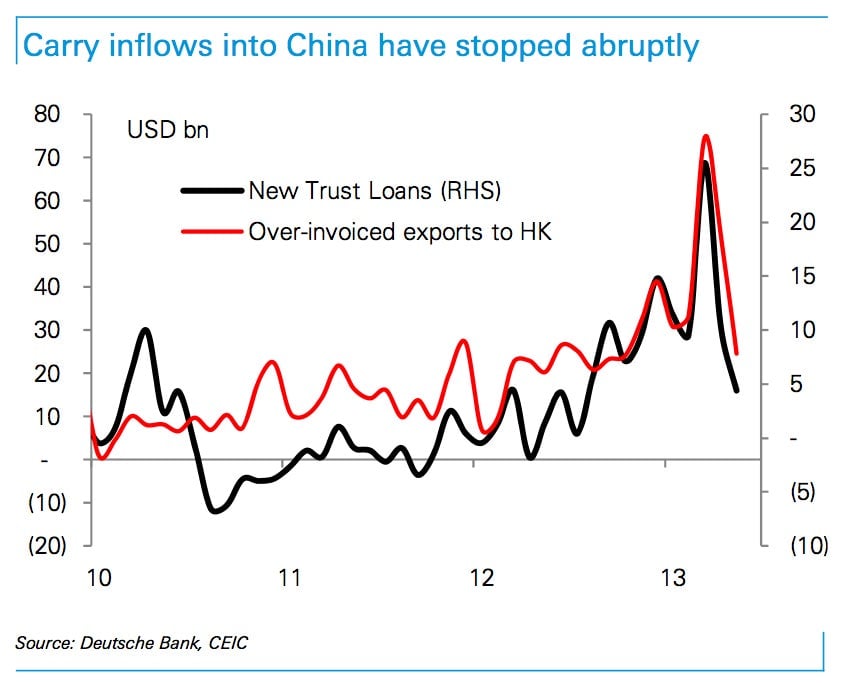

But foreign capital has wormed its way into the mainland anyway. One creative method that got attention recently was phantom sales of “exports” to places like Hong Kong. Investors have salivated over opportunities—even if they are somewhat shadowy—to tap into Chinese growth.

But the saliva glands seem to be drying up. Deutsche Bank FX analysts point out that flows of capital have started to change course in recent weeks, and they use so-called “over-invoiced” exports to Hong Kong as a proxy.

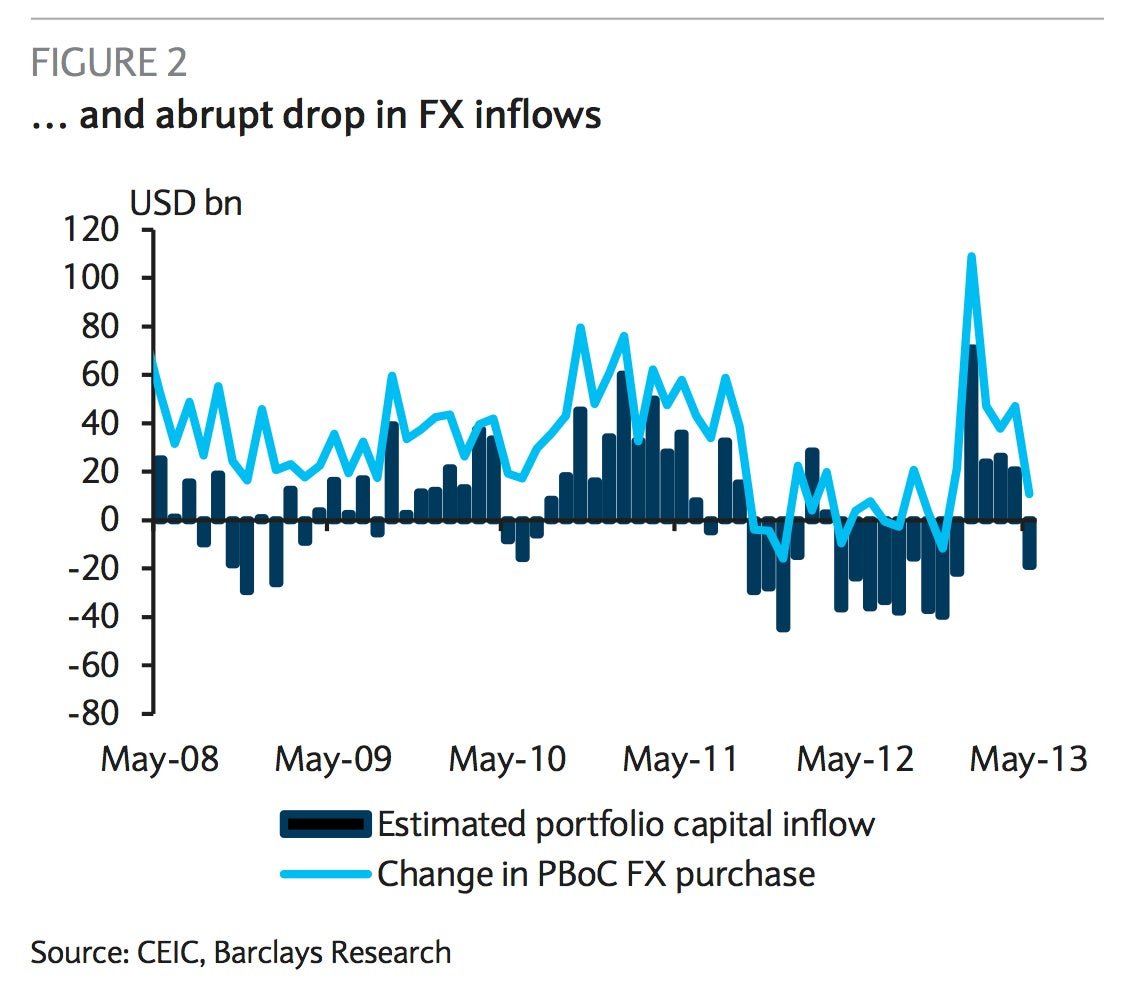

Analyst at Barclays have also noticed the “abrupt” turn in financial flows into China. In the chart below, they’re looking at estimates of portfolio investment as well as central-bank purchases of foreign currencies. (The way China keeps capital flows in check is by forcing the private sector to convert foreign currencies in to Chinese yuan at the fixed government rate. So you can look at how much foreign currency the People’s Bank of China buys as a proxy for the amount of foreign currency that’s weaseled its way into the country.)

We’re in the opening phase of this reversal. And whatever the causes of it might be—fears about the solidity of China’s financial system, slowing growth, the unwinding of the Fed’s easy-money policy—it could have wide-ranging implications.

Domestically, the departure of foreign cash from China may have played a role in the recent credit crunch that sent a shiver through China’s banks. Government media minders have told the local press to tone down its coverage of financial worries (paywall), but that will only undermine confidence further.

Internationally, if a decline of investment slows China’s economy, large trade partners such as Taiwan and Australia would feel it.

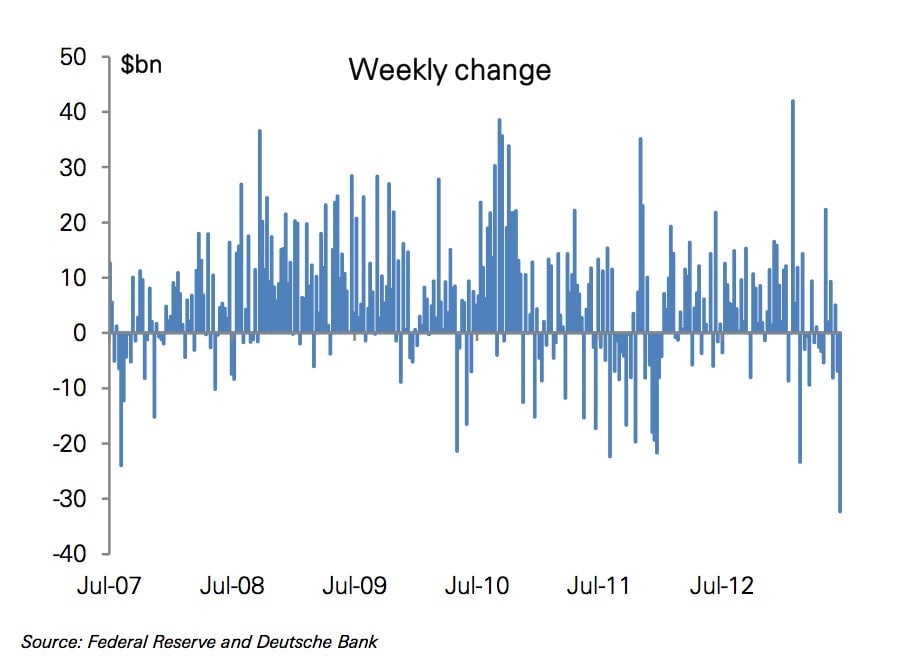

Oh, and one other thing. Do you know where China happens to stow all that foreign cash it buy out of the markets? US government bonds. China is the largest foreign buyers of Uncle Sam’s IOUs, which helps finance the US’s persistently large current-account deficit. And coincidentally, last week saw the largest outflow on record from the Federal Reserve’s so-called “custody holdings” of Treasurys. Those are the Treasurys that the Fed holds in accounts for official entities, such as foreign central banks that use US government debt to store foreign exchange reserves. Here’s a look at a Deutsche Bank chart, which suggests that what happens in China will most definitely reverberate outward.

Food for thought.