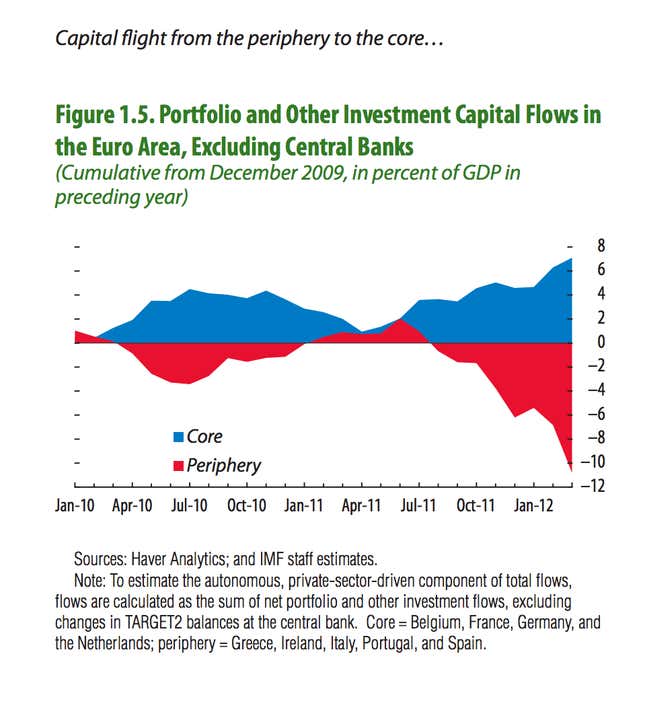

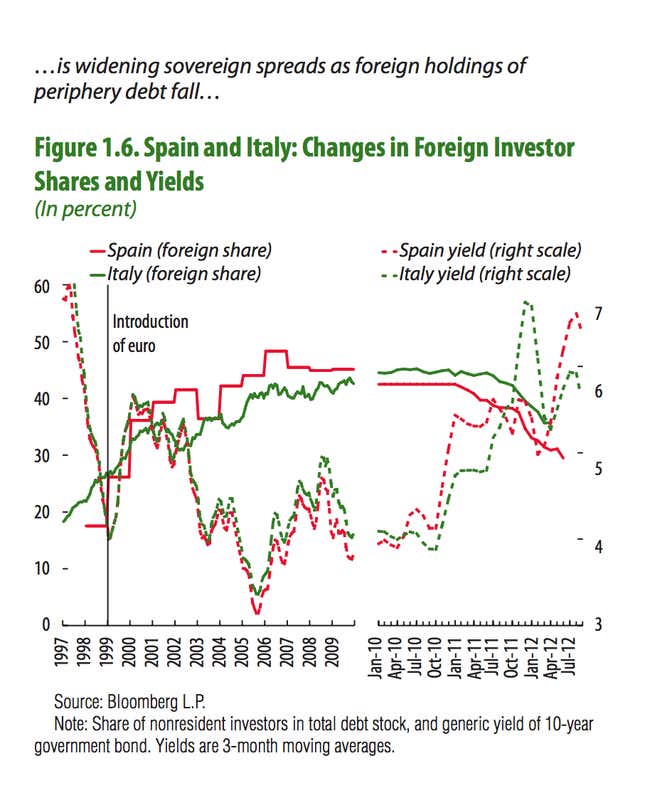

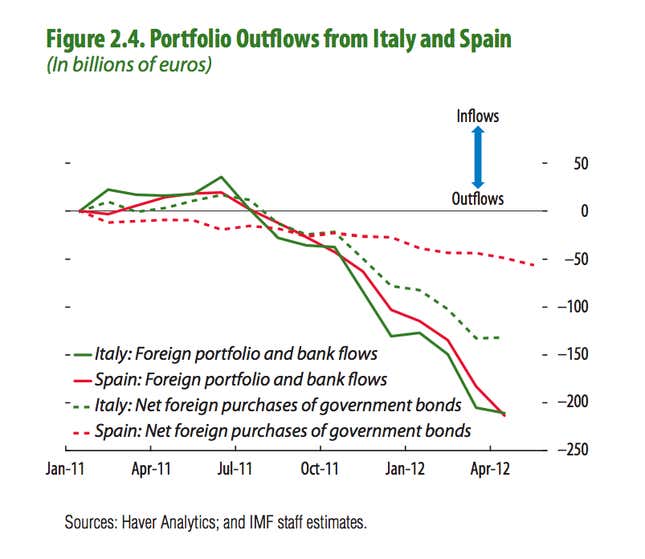

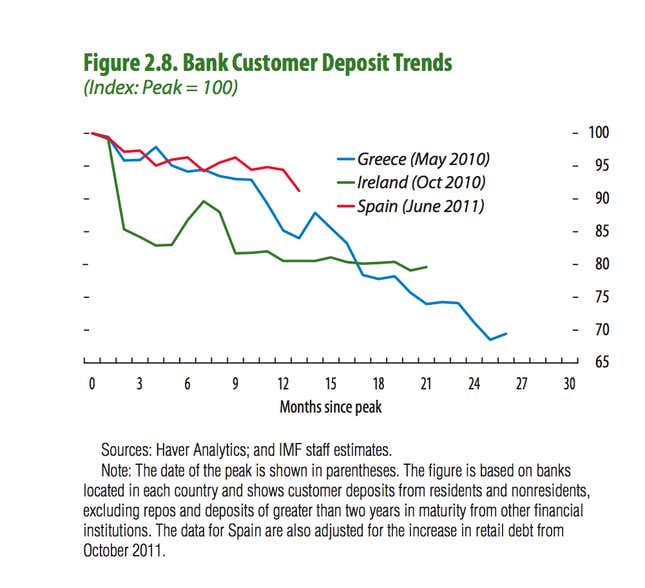

The IMF’s Global Financial Stability Report is sounding rather dire warnings on the potential risk that capital flight from troubled European countries — let’s just say it: Spain and Italy — could cause. Below, some charts from the report looking at how banks, investors and depositors have all been yanking money out of some European economies in recent months.

Outflows like this cause all kinds of problems. If investors dump the bonds of European sovereigns, that effectively shrinks the capital base of the European banks. And if the European banks see their capital shrink they will likely cut lending, hurting the European economies further, and making the situation for the governments that much tougher. Then the whole sordid spiral starts over again. Not good.