Americans are terrible savers. Have been for decades. In fact, even some countries at the heart of the current euro-zone debt worries—such as Spain and France—are far better savers than the US, or at least their households are. Between 1999 and 2009, the last year for which full data is available, the household savings rate in Italy averaged 9.4%. In France it ran 12.1%, according to the OECD. The US over the same period? A mere 3.3%.

Why?

Writing for the Federal Reserve Bank of St. Louis, Sheldon Garon, professor of history and east Asian studies at Princeton University, notes that a widespread savings culture in the US took hold only in the decade or so before the second world war. And after the war, while other war-ravaged countries encouraged their citizens to keep saving to finance economic recovery, the US, which came out of the war much richer, did not:

Politicians, businessmen and labor leaders all encouraged Americans to spend to foster economic growth. An array of policies also stimulated the growth of homeownership, which further increased consumer spending. Beginning in the 1980s, several developments combined to stop millions of Americans from saving altogether. Deregulation permitted the financial industry to offer massive amounts of credit on strikingly favorable terms—even to very poor households and students. The new instruments included credit cards, home equity loans and subprime mortgages. Many Americans wondered: Why save when I can buy things with easy money? When the housing bubble burst in 2008, so too did this unsustainable culture of debt.

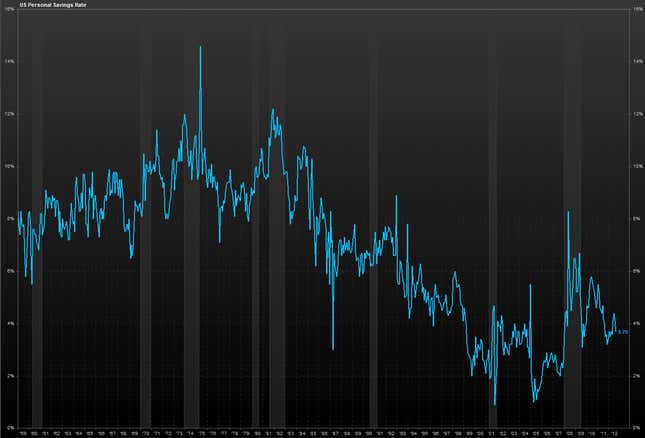

As the chart above shows, despite the post-war pro-spending policies, the savings rate did generally rise… up until the 1980s, when it took a nosedive and kept going down until the mid-2000s. It leapt again during the financial crisis. But if US households did discover the virtues of thrift, they didn’t seem to stick, as the trend is now moving lower again. And as we’ve mentioned in recent posts, the US culture of subprime borrowing is alive and well in some sectors of the economy, such as auto sales.