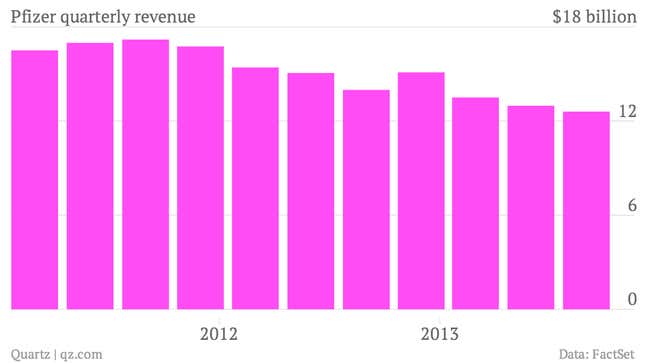

The numbers: Mixed. Profits were $2.59 billion, $0.58 per share, beating Wall Street expectations for $0.57. But Pfizer’s total revenue for the third quarter shrank 2% from a year ago to $12.6 billion, slightly worse than expected. Two of its blockbuster products, the cholesterol drug Lipitor and the erectile dysfunction pill Viagra, now face competition from cheaper generics in many markets. Shares are up about 1% in early morning trading.

The takeaway: The company’s oncology division was the standout, posting a 26% increase in revenue. Pfizer attributed much of this strength to its kidney cancer product, Inlyta, which is winning market share thanks to high reimbursement rates and low prices in Europe. Emerging markets were also positive, with a 5% rise in revenue driven by strong take-up of Lipitor in China.

What’s interesting: Pfizer has been hit relatively hard from the expiration of patents on some of its most successful products in recent quarters. But it hopes to get regulatory approval for some of its new products in development over the next several months. These include Prevnar 13, a meningitis treatment for adults; Xeljanz, a rheumatoid arthritis treatment; and lung cancer product Dacomitinib. This news comes amid speculation that Pfizer could be broken up into two or their pieces to unlock value for shareholders (the world’s biggest drug company split itself into three operating units earlier this year—a generics division, another with products protected beyond patent until 2015, and a third focused on vaccines, oncology and consumer healthcare.) If any of its drugs in development miss the mark, expect this speculation to intensify.