By Tamara Gaffney

It used to be that Christmas arrived on Thanksgiving weekend as merchandisers kept Halloween and fall seasonal stock on the shelves through early November. Nowadays Christmas starts to appear in stores the first week of October. You can thank the Internet for that.

Christmas shoppers start to budget in October

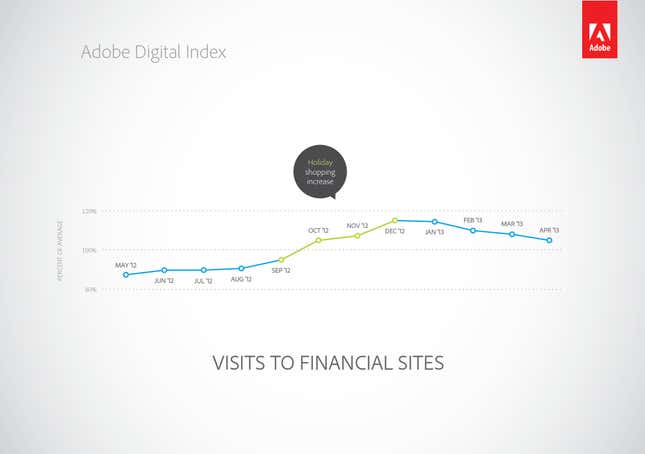

Adobe Digital Index analyzed nearly 8 billion visits to 100+ financial websites and discovered why. The data clearly demonstrates that consumers begin to escalate account viewing beginning in October, peaking on December 3rd at 35% higher volume than a normal day. As it turns out, retailers that jump on Christmas shopping in October are on the right track.

Access to financial data online or from a mobile device have given consumers unprecedented access to information and planning tools. Consumers are accessing financial data online at record levels as consumer visits to financial sites are up 27% year-over-year (YoY). Marketers can pick up some valuable clues about consumer shopping by analyzing consumer access of financial records. As more and more consumers have transitioned to online banking and have access to a variety of planning and budgeting tools, their traffic patterns illustrate their budgeting activates, providing marketers with important clues on how and when to deliver marketing messages.

Financial marketers specifically may find the rise in visit in January when consumers are checking their Christmas bills a great time to target marketing campaigns for credit cards, personal loans, and savings plans as consumers are clearly thinking about financial matters at this time. These offers could also prime the consumer for other upsells along the way.

Consumers delay checking on direct deposits

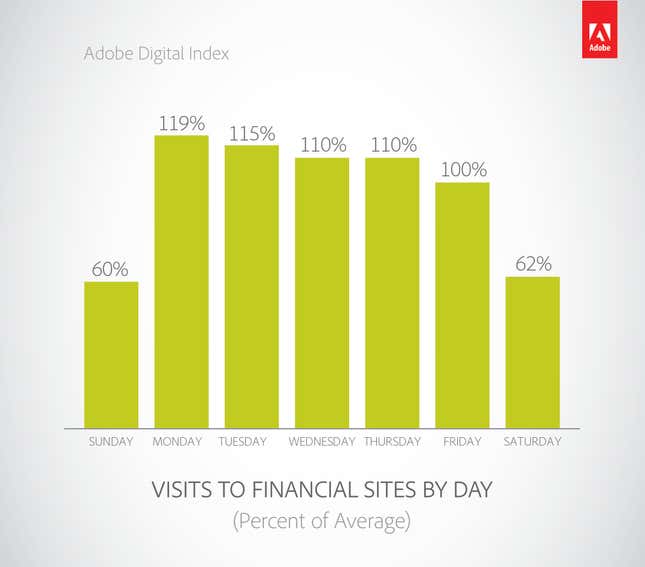

Another time for marketers to reach customers is around their pay cycles. Spikes in visits demonstrate consumers are visiting financial sites three days after a pay period, with the largest number of visits occurring on the 4th and 18th of the month–generating 10% more traffic than other days during the month. Consumers also prefer to visit financial sites during the week, with Monday being the highest at 19% higher than an average day.

Targeting consumers with discounts, promotions, or similar offers leading up to and on days when consumers are thinking about their budgets offers the opportunity to increase click through, conversion and average order value as the masses look for ways to use their hard earned money.

Learn how to measure and optimize digital experiences to accelerate marketing performance.

This article is written by Adobe and not by the Quartz editorial staff.