Indian corporates? Sure!

Vietnamese dollar-denominated sovereigns? Why not!

Exposure to South Africa, buoyed up by Chinese investment, even as the People’s Republic slows? Yes, please.

Global investors are mindlessly gobbling up emerging-market debt, even amid signs of emerging problems nearly everywhere.

Driven by the miserable yields in the West, where central bankers like America’s Ben Bernanke have interest rates floored to try to stimulate economic growth, investors are channeling tons of cash into emerging market bonds. Because growth in those countries has been trucking along fairly well until quite recently, the central banks have kept interest rates relatively high, keeping bond yields up too. This is how Morgan Stanley analysts describe the process, in the genteel language of Wall Street.

QE measures [quantitative easing, i.e., money-printing] have provided the market with abundant liquidity, which in turn generated substantial inflows into risky assets overall. In EM, these inflows have pushed spreads lower with little differentiation among credits – particularly so in the investment grade space.

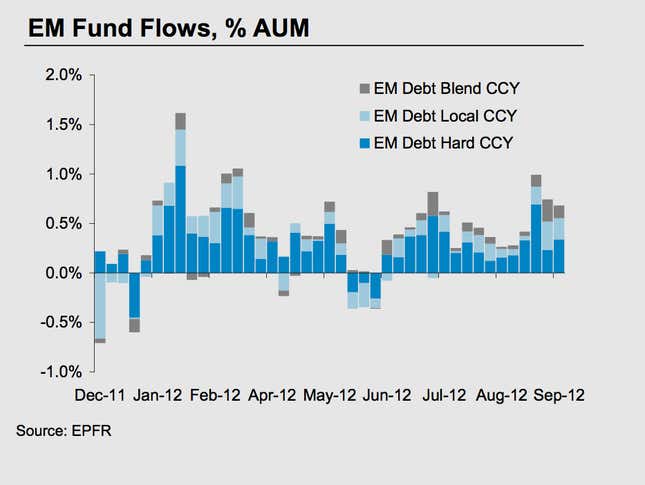

Translation: Investors are barreling into emerging markets (EM) without giving much attention to what they’re buying. Take a look at inflows into EM debt funds, from a recent Morgan Stanley note: that spike on the right is the reaction to the third round of QE that Bernanke announced in September:

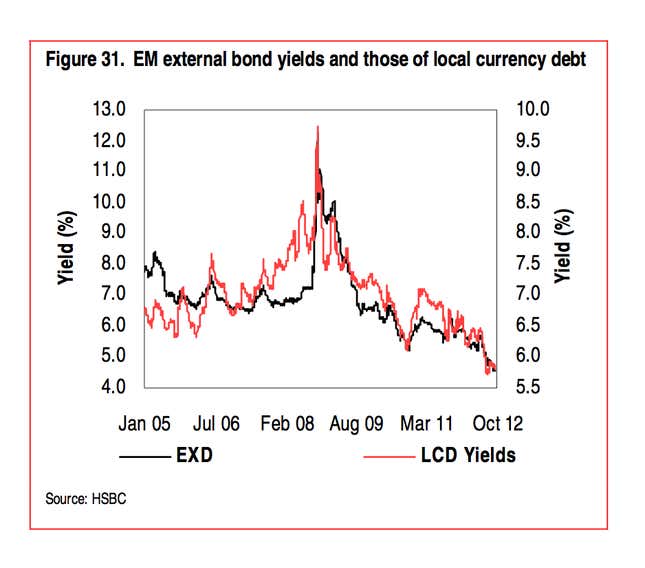

The influx is pushing the price of these bonds higher, which is pushing yields–which move in the opposite direction–much lower. If you already own the bonds, the fact that their price is rising is great. But if you’re buying them at higher and higher prices for lower and lower yields, that leaves you far less room for error if anything goes wrong on your bets.

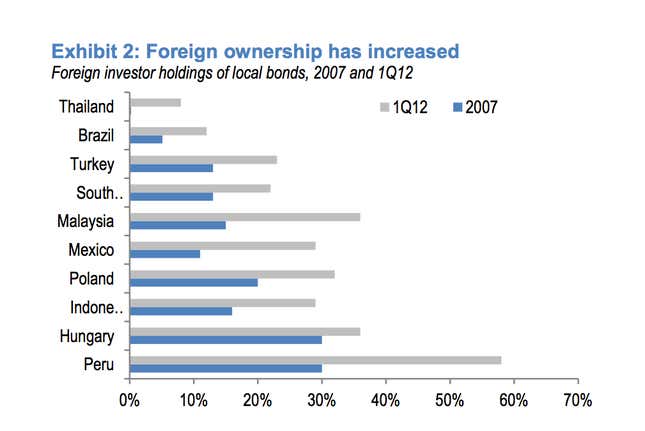

The influx of foreign cash has fundamentally reshaped how a lot of emerging-market bond markets look, as the chart from JP Morgan, below, shows.

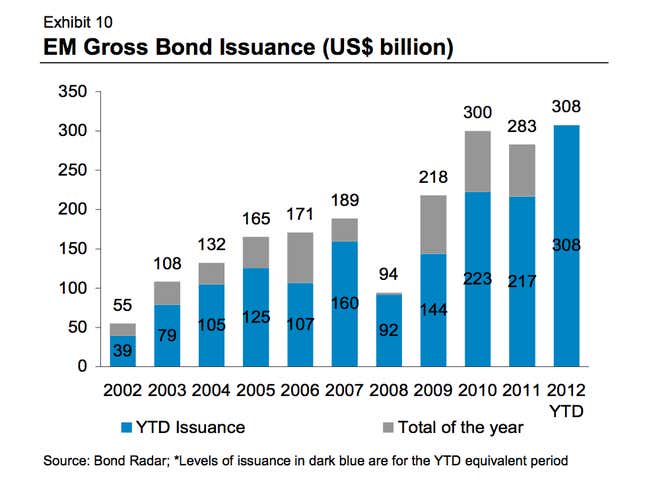

And, hey, if people are so desperate to buy this stuff, investment bankers are going to find a way to supply them. Here’s a look at EM bond issuance—this is companies and countries actually borrowing from investors by selling bonds.

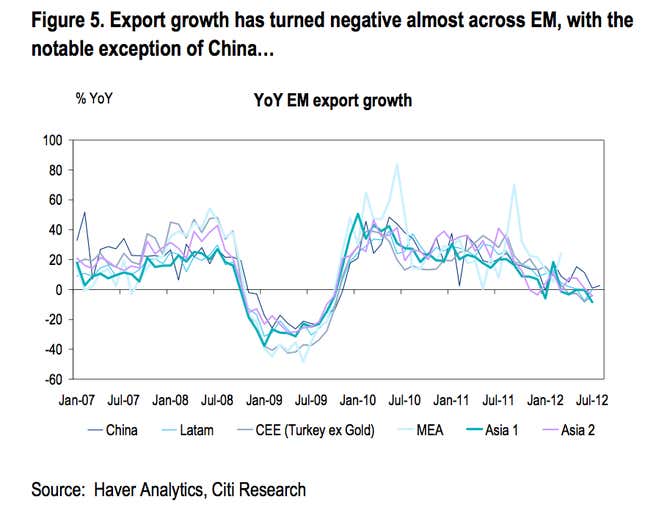

Meanwhile, as all these investors are scrambling to climb on board, EM economic growth is expected to slow, as its export engine downshifts.

So what’s going to happen? Well, what usually happens when a whole lot of people buy a whole lot of debt, including a fair amount of risky stuff. At a certain point investors will head for the exit, only to find it’s not as easy to get out as they had planned. As a result, more than a few will suffer losses. But more broadly, foreigners yanking cash from emerging markets has been at the heart of a number of unpleasant financial panics in the past. And that’s something to keep an eye on.