The only scarce resource on the internet is attention.

Scores of digital media companies—from BuzzFeed to YouTube to Pandora to Facebook—have proven adept at carving out a chunk of the web and making money from it. But comparing them can be difficult because each captures attention in a different way. Reading a BuzzFeed listicle is not the same as watching a YouTube video, which is entirely different from listening to Pandora in the background or checking Facebook on your phone several times a day.

The distinctions are crucial to finding where the real value is in digital media. BuzzFeed is attracting 85 million visitors to its website every month, and it was last valued at $200 million. Facebook has 14 times the user base, but its valuation of $115 billion is 575 times that of BuzzFeed. Clearly, the market puts a higher premium on the attention that social networks are able to command, compared to content sites.

Netflix is actually the best example. It’s valued at $19.8 billion with just 45 million subscribers, or $440 per person. For Facebook, the equivalent figure is about $96 per person. Obviously, what it means to use each service varies widely, and only one charges its users, but that’s kind of the point. Netflix commands better attention.

Attention is a nebulous metric, and it can’t simply be measured in time. An open browser with 20 tabs is a different experience than watching a movie with the lights dimmed. But a good proxy for measuring attention is bandwidth. New data from Sandvine (pdf), which provides broadband internet services, makes it clear:

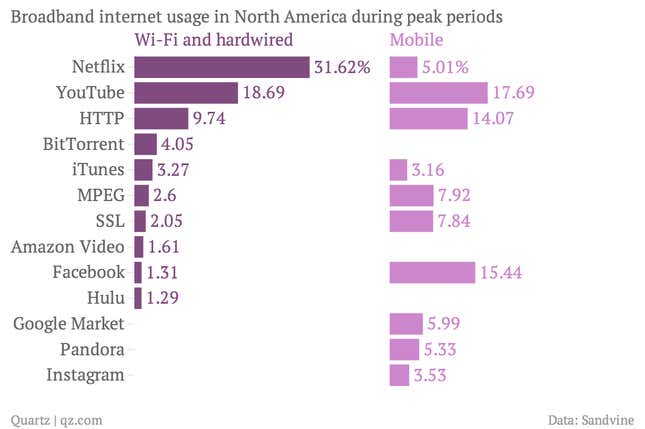

During peak periods of internet use in North America, about a third of bandwidth going into homes and businesses is from Netflix. Another 19% is from YouTube. Facebook trails far behind with 1%, which makes sense because it primarily serves text and images that use up less bandwidth than video. Twitter, which is largely text-based and has only recently started to emphasize images and video, doesn’t make the list.

Bandwidth is affected by the type of media, resolution, screen size and time. Bandwidth hog Netflix is streaming video in very high definition on increasingly large screens for longer periods. Each of those trends is apt to capture a larger share of attention, even if Netflix didn’t add any more subscribers. Other companies, stuck with less attention-grabbing media, are much more reliant on scale to grow their businesses.

Netflix has topped the bandwidth charts for a few years, but the shift to mobile threatens its dominance. Though Netflix still makes the top 10 for mobile bandwidth during peak internet usage in North America, it trails YouTube, Facebook and the broader web (HTTP). There’s only so much more attention to be grabbed among people using Wi-Fi and hardwired connections. Mobile is where attention is going.

Fast-growing startups in digital media, like BuzzFeed and Vox Media, are investing heavily in—what do you know—video meant to be viewed on mobile phones.