Economics often boils down to a lot of smoke and mirrors. Take the case of Abenomics. People are touting Shinzo Abe’s economic policies as a great success, mainly because they cater to the No. 1 prevalent prejudice—that printing money is the solution to any economic slowdown. The results of these policies, however, are not that clear. In fact, the data generated since he became prime minister in December 2012 does not point in that direction.

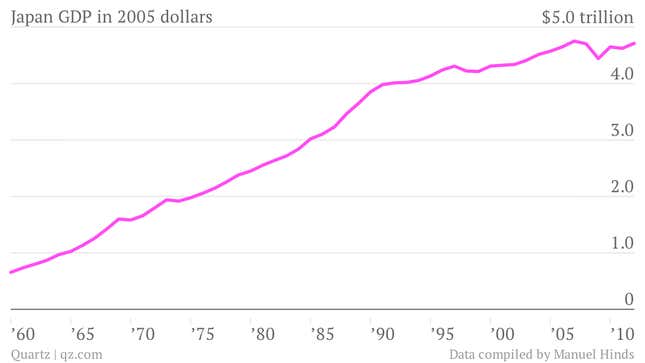

When Abe became prime minister, the rate of growth of Japan’s GDP had been declining for several decades in a row.

Moreover, in the last few months the country had been experiencing a decline in exports, which had been the economy’s engine of growth since its industrialization in the late 19th century.

Abe promised to reverse these trends. His plan was simple: Go back to export-driven growth by accelerating monetary printing, which would depreciate the currency, which would in turn make Japanese exports cheaper. Abe’s plan had another advantage: The additional monetary printing would also increase domestic demand, which in turn would increase domestic production.

Almost everybody applauded. Quite an idea! Although not very original. Currency debasement has been used since times immemorial. Abe was not aiming at being original, but effective.

Was he?

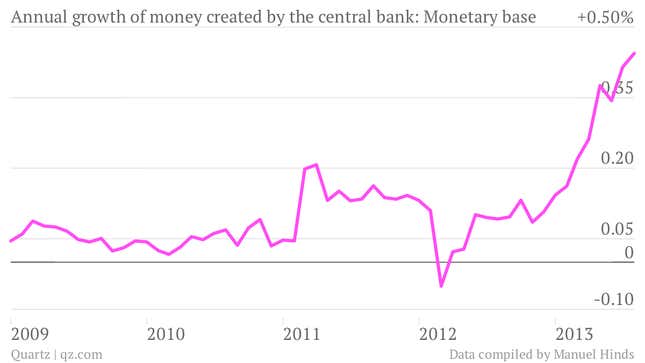

The country’s central bank printed plenty of money by expanding credit, mainly to the government. The 12-month rate of growth of the currency created by the central banks, the monetary base, went up from 10% in December 2012 to 40% in August 2013. Almost everybody applauded again.

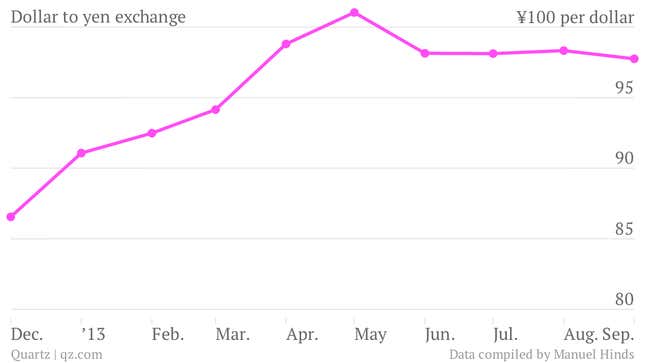

As expected, the rapid monetary creation led to an also rapid depreciation of the currency.

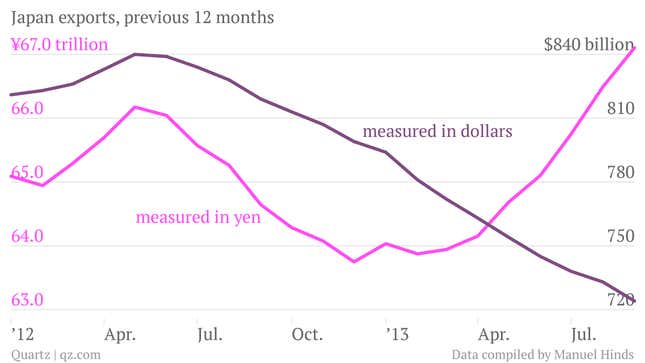

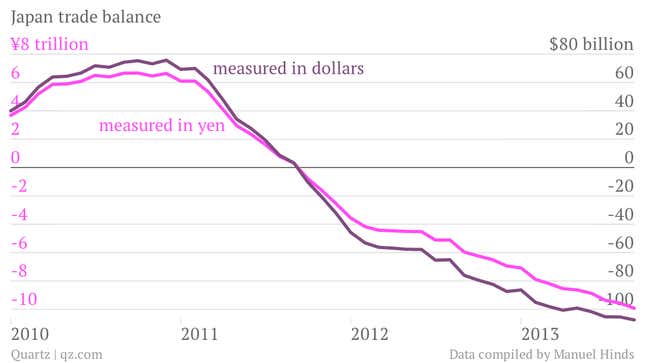

And then exports shot up as expected … but only when measured in yen. When measured in dollars, exports kept on declining, creating the strange situation shown in the next graph: Exports increasing or decreasing depending on the currency you measure them.

How do you interpret this? Is Japan gaining or losing? One reasonable way of answering this question is to ask whether Japan is gaining importing ability—which is to say can Japan import more things today as opposed to December 2012 as a result of its new level of exports? The answer is no. Japan pays for most of its imports in dollars, and as a result of the yen depreciation, now it is generating substantially less dollars to pay for its imports. Thus, Abe’s policies have been a failure as a catalyst of export-led domestic supply.

Moreover, the trade deficit (exports minus imports) has increased in both currencies, meaning that imports have increased more than exports, in both currencies. No ambiguity here. This means that foreign producers took more advantage than the domestic ones in satisfying the increased domestic demand generated by the acceleration of money printing.

(NOTE: Data above refers to the previous 12 months, cumulative. SOURCE: International Financial Statistics of the International Monetary Fund)

Well, you can interpret this as a success for Abenomics. It clearly promoted higher production and higher net exports … not in Japan, but in the countries that sell to Japan. They should congratulate him.