Insanity was once thought to be linked to the cycles of the moon. Today, you might diagnose moon madness if someone says they are building a transportation network to reach earth’s nearest astronomical neighbor. After all, the Apollo program already took humanity to the moon 50 years ago this July. Why go back? What would we find there? Who would pay for it?

Welcome to our field guide on humanity’s return to the moon. Check out other parts of our deep dive here.

There are more lunatics out there than you think. A new generation of aspiring pioneers believes it has compelling answers to these questions. A decade of converging scientific discoveries, entrepreneurial visions, and geopolitical pressures is bringing private business on the moon to the cusp of reality.

If they succeed, humanity will learn more about the origins of its own planet and the history of the universe, and private companies could find critical resources that could unlock the $1 trillion space economy being promised by forecasters like Morgan Stanley.

The most tangible example is a $2.6 billion pot of money NASA has reserved for lunar entrepreneurs to make robots that can put NASA-designed sensors on the moon. But the space agency and its new contractors are betting that’s just the beginning of the lunar economy.

The state of the industry is somewhere between Elon Musk’s rocket company SpaceX opening its doors in 2002, and Craig McCaw and Bill Gates’ founding the satellite company Teledesic in 1990: The former was right on time, but the latter was disastrously early and wound up a failure.

This year, more than a billion dollars will be invested in startups building rockets and satellites, a strategy that would have been unthinkable just five years ago.

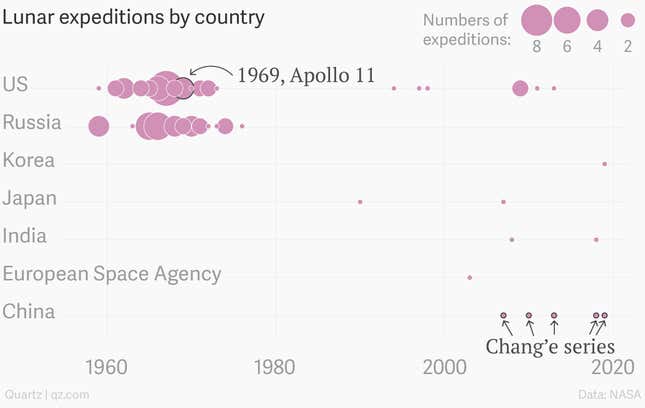

Also unlikely to subside in the near future: US tensions with China, whether driven by American fretting over trade imbalances and industrial espionage, or Beijing’s territorial conflicts in the South China Sea and internment camps full of a million Muslims. And China’s ambitious space program includes a full lunar campaign, including the first rover to reach the far side of the moon, expected to land on Jan 3.

One likely response will be US investment in space technology to deter a ideological rival and win prestige—the same dynamic that drove the original missions to the moon.

And did we mention—the scientific discovery at the center of all these plans, the vital target of all this global scheming? It’s plain old H2.

Who wants to go to the moon?

SCIENTISTS

The Earth, the Moon, and Mars are all conjectured to have formed by superheated rock, but while the Earth and Mars continue to maintain active geology driven by their thermal cores, the moon’s evolution seems to have halted. Understanding how the moon’s geology developed could help explain the Earth’s geologic processes.

“The moon is frozen in time, and we can see that initial differentiation if we had a global seismic network,” Clive Neal, a planetary geologist at the University of Notre Dame, tells Quartz.

Thanks to its unchanging nature, its surface is also a scrapbook, showing off every object that has ever impacted it. Interpreting it could give researchers access to knowledge akin to what tree rings or ice cores reveal about Earth’s history—artifacts that offer important insights on what the solar system was like before humans were around to observe it.

The moon is also a stepping stone to bigger projects: Astronomers would like to put radio telescopes on its far side, where they can peer into the distant solar system while completely shielded from energy interference generated on earth.

“On the far side of the moon, you can receive very low frequency signals from deep space,” explains NASA administrator Jim Bridenstine. “You can actually see back in time—see far, far out in space.”

Scientists have reason on their side, but they need someone to pay for the trip.

BIG GOVERNMENT

Despite the growing importance of private investment in space, the vast majority of money spent on exploring the environment beyond earth comes from governments. The US, Russia, China, and the European Union maintain civil and military space agencies that are driven by the need to demonstrate technological superiority.

Sometimes this is in the service of scientific research; sometimes for the purposes of national security and geopolitical maneuvering; and very often focused on creating jobs for highly trained engineers and technicians. While these goals often overlap, their divergence is often where the biggest decisions in space are made.

NASA, the US space agency, remains the leader—for now. It operates an unmatched suite of satellites and space probes, and has led an international coalition to operate the International Space Station since 2000. But its most ambitious exploration program to send astronauts into deep space has also been trapped in a seemingly never-ending cycle of waste, delay and mismanagement since 2006. President Donald Trump has pushed the agency to focus on the moon and commercial partnerships, but hasn’t won any real budget changes from Congress.

Russia’s Roscosmos, NASA’s key partner in the ISS, is on the downslope thanks to years of lagging investment. Russia’s military space capabilities are a worry to American national security planners—particularly its investment in anti-satellite weapons—but its importance to space exploration remains its role operating the ISS and flying astronauts to it. Next year, however, the US plans to begin flying its own astronauts again, which will mean a loss of hundreds of millions of dollars the US had been paying Roscosmos to do the job.

The most active space agency in the world right now is China’s National Space Administration, which has launched an ambitious exploration program and sent a mission to the far side of the moon in December 2018. Most informed observers think China is more likely to put humans back on the lunar surface than any other nation.

The European Space Agency has the technology and economic chops to compete, but because it is answerable to so many countries, it suffers from a lack of direction. It does have one key advantage: The ESA has been arguing for a focus on the moon and an “International Moon Village,” and now that the US and the private sector are coming around, the agency can play an important convening role. The Japan Aerospace Exploration Agency (JAXA) plays a similar role: It has access to sophisticated technology and plays an important role supplying and operating the International Space Station. But both agencies annual budgets combined are less than half of NASA’s.

Still, the falling cost of access to space is opening up exploration to new players. The India Space Research Organisation has launched several lunar missions, including the important Chandraayan-1 mission, and finding a commercial niche launching small satellites on its PSLV rocket. In 2019, it will launch an ambitious follow-up, Chandraayan-2, that will attempt to place a lander near the moon’s southern pole.

Even newer space agencies formed in countries like the United Arab Emirates and Saudi Arabia promise to bring plenty of oil capital to the business of flying into space—along with tricky political conundrums.

ROCKET BILLIONAIRES

Another big difference between previous decades and today are deep-pocketed entrepreneurs launching space ventures to push toward their own visions of the extra-terrestrial economy. Elon Musk’s SpaceX and Jeff Bezos’ Blue Origin are working to solve the key problem of space business: How much it costs to get there.

Both firms are developing reusable rockets. Thanks to a partnership with NASA, SpaceX has successfully become the world’s leading private rocket-maker, flying more often to orbit in 2018 than any company or country except China. Blue Origin’s orbital rocket is expected to debut in 2021.

Rocket prices are fairly opaque and rarely standardized, but for comparison, SpaceX’s starting price is $62 million for an orbital launch, while its traditional competitors start at $109 million to $167 million, and can go much higher. And that’s before reusability—Musk says his flight-proven rockets can be discounted as much as 30%.

That’s one reason SpaceX has eaten up the market share for orbital launches:

Each company is well capitalized and driven by the founders’ goals of taking humanity off-planet to preserve the earth from industrialization and unlock the as-yet unknown prosperity for humanity. Blue Origin is designing its own lunar lander mission, while SpaceX has sold a Japanese billionaire, Yusaku Maezawa, a cruise around earth’s closest neighbor, both scheduled sometime in the early 2020s.

If it sounds heady, well, that’s what a few billion dollars can buy you. If any single data point suggests things are different in space now, it’s Bezos’ billion dollar-a-year funding pledge for Blue. But most of all it is the technological progress made by the two companies that has led to their rapid rise in importance.

It has also paved the way for other businesses and convinced venture capitalists to invest billions in space-focused startups.

GLOBAL ENTREPRENEURS

Just a few years ago, there was very little you could do in space that you couldn’t do more cheaply and easily on earth. Space was a $345 billion sector in 2017, but that’s less than the $515 billion in 2017 sales from the world’s two largest car companies, Toyota and Volkswagen.

Now, things are changing enough that investors sense they can make a buck in space, thanks to three key trends: the falling cost of transportation to orbit; increases in our ability to make circuits, batteries and solar panels that are cheap, tiny and powerful; and the growing economic importance of the internet and machine-learning driven data analysis. In the years ahead, spacecraft in orbit will do more work for humanity than ever before.

Cheap, earth-observing satellites promise to collect enormous amounts of data for bots to crunch, helping with everything from agriculture to urban planning. Several multi-billion efforts—including by SpaceX, OneWeb, Telesat, Kepler and LeoSat—intend to launch next-generation satellite networks to provide internet access to people below. They believe that the growing demand for connectivity is about to converge with the falling cost of delivering it from space in a very lucrative way.

What the heck does that have do with going back to the moon?

One reason the cost of going to orbit is falling is a novel twist on public-private partnerships pioneered by NASA and SpaceX beginning in 2006. The space agency helped the private company develop a new rocket and spacecraft to carry goods to the International Space Station, but agreed to purchase it as a launch service, not to buy and operate the vehicles themselves. Because SpaceX can use its rocket to fly cargo for other countries and private companies, it’s been able to offer all its customers a vehicle as much as $50 million cheaper than its competitors.

Now, NASA is expanding on that model with similar partnerships. SpaceX and Boeing are working to fly astronauts to the International Space Station next year. And the space agency just announced that it will pay up to $2.6 billion for private companies to carry scientific missions to the moon starting in 2020 through a program called Commercial Lunar Payload Services and known as CLPS (pronounced “Clips”).

The moon is the next frontier for a half-dozen startups around the globe who want to be paid to transport cargo to the lunar surface, including Astrobotic and Moon Express in the US, iSpace in Japan, and SpaceIL in Israel. Some existing space companies are also developing similar schemes: gigantic Lockheed Martin; Draper, an engineering spin-off from MIT; the rocket builders at Masten Space Systems and Firefly; NASA subcontractors Intuitive Machines and Deep Space Systems; and a new international consortium called Orbit Beyond.

These companies are developing spacecraft that can carry landers or rovers to the moon. They will be launched on existing rockets, and will carry payloads, typically sensors, designed by NASA scientists. The idea is that NASA gets cheaper, faster access to the moon than it would otherwise.

But the model depends on other customers down the line for the companies to bring to the moon. Deep-pocketed universities wishing to collect their own data are among the earliest adopters. A company called Elysium will send the cremated remains of your relatives to the moon. There are ideas for social media marketing promotions and sponsorships.

NATIONAL CHAMPIONS

United Launch Alliance is the rocket-building joint venture between Boeing and Lockheed Martin. These are the two largest and most experienced space contractors in the world, and deeply intertwined with the policy and operations of the US space program.

The same is true of Arianespace and Airbus in Europe; in China and Russia, the lines between government and business are more blurred, but RSC Energia in Russia and the Chinese Aerospace Science and Technology Corporation (CAST) are also major players.

These national champions have great advantages in capitalization and expertise, but they are rarely nimble and prone to prioritizing entrenched programs rather than novel approaches. They also tend to have extra costs thanks to politics, like the need to spread investment around to geographic areas represented by powerful lawmakers.

ULA’s rockets are effective, but they’re extremely pricey because the companies had been granted a monopoly. The arrival of SpaceX changed that, forcing ULA to compete and innovate.

One of the biggest differences between SpaceX and the traditional space giants is how their contracts are constructed: SpaceX tries to insist on working for a flat fee, while NASA traditionally guarantees its contractors a profit. That made sense when they were being asked to essentially invent brand-new technologies, but the justification for the new commercial approach to space is that NASA has already done the heavy lifting. Now, private enterprise can make it cheaper.

The big national champions are starting to work with and like the new start-ups. Boeing is working on a fixed-cost spacecraft to carry astronauts to the ISS in competition with SpaceX; ULA is partnering with Blue Origin to build a new engine for its next-generation rocket; and Lockheed Martin is one of the contenders for the new contracts to carry sensors to the lunar surface.

But the transition to this model hasn’t been easy, and is hardly complete: With most government spending going to national champions, it’s not clear if the big giants will compete against the new entrants with spacecraft in the marketplace, or with lobbyists in the capital.

An orbital refueling station

None of these promises sufficient revenue to meet the cost—that’s where all those satellites come in. The more important satellites around the earth become, the more important it will be to operate them cost-effectively.

Lunar water could be that opportunity if rocket fuel (which is hydrogen) can be easily manufactured from it.

Learn more about the promise of water on the moon here.

George Sowers, a veteran aerospace engineer who is now a professor at the Colorado School of Mines, has helped develop architecture that would produce fuel on the moon at a cost of $500 per kilogram. That sounds expensive for something that costs $1 per kilogram on earth—but it costs $4,000 to bring that same fuel into space. If rockets and satellites could be refueled in orbit at a lower cost, it would enable all kinds of businesses—including lunar transportation. It could even enable a faster, cheaper trip to Mars.

Sowers and other analysts at the Space Resources Roundtable, a non-profit that gathers scientists and engineers from around the world to study the issue, estimate that the market for lunar propellant could range from $630 million to $2.4 billion annually. Much of that depends on government space agencies following through with ambitious exploration plans, but a shot at that potential market is what’s driving these lunar startups.

“If these CLPS landers are successful, we’ll have a small lunar economy in the next couple years,” Neal predicts. “It will grow beyond that if the solution steps are successful. It will grow beyond that if political will allows it. And it will grow beyond that if people who want to go to Mars look at the big picture.”

Who’s on whose team?

The world of space is so big and complicated that almost every player has a frenemy relationship with every other. Boeing and SpaceX are competing to fly astronauts, but SpaceX regular launches Boeing-built satellites. ULA and Blue Origin are building competing next generation rockets—that will share the same engine, built by Blue.

And it’s also hard to miss that many players in the sector are driven by a personal obsession with space that makes it difficult for them to begrudge each other’s success.

That doesn’t mean there aren’t some obvious factions. Bezos and Musk, for example, clearly rub each other the wrong way.

The Ronin: SpaceX

Musk is is a Mars man, but he’s not as rich as Bezos, which means that his low-cost rockets are likely to fly to wherever NASA (or anyone else) wants them to in the near-term. His company’s next-generation spacecraft, called Starship, notably added the moon to its list of target destinations once Trump shifted NASA’s focus there.

The company’s Falcon Heavy, the largest operational rocket in existence, debuted in 2018, and its low-cost, high-lift combination has some lunar architects convinced that the US can move faster than currently scheduled toward the moon.

But Musk—who talks trash about his private competitors, NASA, the US Air Force, the SEC, and pretty much anyone else who irks him—has tempered his company’s successes with public-relations hassles. A recent NASA decision to launch a workplace safety review at SpaceX and Boeing, prompted by Musk’s decision to puff on a marijuana cigarette during a podcast taping, is widely seen as a shot across the relentless entrepreneur’s bow. Message: Chill out, Elon.

The Conciliators: Blue Origin, ULA and Airbus

Blue has yet to accomplish what SpaceX has, with its operations limited to flying a novel suborbital rocket called New Shepard it intends to use for short space-tourism and research flights.

At the same time, the company has wormed its way into critical relationships across the space industry as the establishment seeks assistance fending off SpaceX. As well as its rocket engine partnership with ULA, the company also has a partnership with Airbus to hold a contest to develop lunar lander payloads the company could transport to the moon in 2023 on its forthcoming New Glenn rocket.

With a world-class team and backed by the resources of the richest human on earth, Blue is set up to play a major role in post-2020 space exploration.

The Geek Squad: Lunar transport startups

Many of the startups developing lunar transportation technology originated with the Google Lunar X-Prize, a contest beginning in 2007 that offered a $20 million grand prize to any company that could send a robot to the Moon, move it 500 meters across its surface, and transmit HD images and video back to Earth.

Nobody won and the contest was cancelled in 2017. That wasn’t a great sign for the ease of going to the moon, but it had allowed several organizations to devote years of time and money to starting to solve the problem. Many of them won separate private and public backing to continue their work, with NASA’s Commercial Lunar Payload Services program now their primary goal.

In the US, the leading start-ups are Astrobotic, which was spun out of Carnegie Mellon’s robot research department, and Moon Express, a venture-backed effort led by space entrepreneur Bob Richards. Astrobotic has a launch contract to head for the moon in 2021, a suite of payloads and, per CEO John Thornton, a fixed price offer: $1.2 million per kilogram of cargo delivered to the lunar surface.

In Europe, the German Lunar X-Prize team PTScientists, backed by Audi, Vodafone, Omega and Red Bull Media, have developed a pair of rovers to launch next year, but it’s not clear if they are planning to move forward with additional missions afterward.

The Israeli firm SpaceIL, backed by deep-pocketed donors like Sheldon Adelson, will launch its robotic rover in early 2019. India’s entrant in the Lunar X-Prize, TeamIndus, has resurfaced as part of consortium, Orbital Beyond, bidding to participate in NASA’s CLPS program. In Japan, the company iSpace has caught international attention by raising $90 million and planning to launch a lunar orbiter in 2020.

“Money, of course, technology, of course, however I think the most difficult hurdle at this moment is the mindset of the people,” iSpace CEO Takeshi Hakamada says of the challenges his team faces. “Most regular people think, when they hear about space, they think it’s just a dream. We have to show the more realistic directions and then, if many of the people start thinking, ‘well, this is what they could do,’ I think we can accelerate the process to our vision.”

The Space Industrial Complex: NASA and its contractors

NASA’s new administrator, James Bridenstine, is a fan of lunar exploration and the commercial partnerships that might enable it. But the bulk of his budget, set by Congress, is focused on expensive contracts for on-going programs with Boeing and Lockheed Martin.

The architecture NASA is proposing for its next lunar mission also includes something called The Lunar Gateway, an orbiting space station that Brindenstine frames as a “reusable command module” to make access to the moon cheaper and more sustainable. A series of critics, ranging from Buzz Aldrin to former NASA administrator Mike Griffin, think the Gateway is just another costly boondoggle that will get in the way of cheaper, faster missions to the moon.

One blow to lunar dreams is the still-mysterious cancellation of a $100 million NASA-designed moon rover that was meant to hunt for water, and which was shut down the day Bridenstine took office. That cancellation has been repositioned as a pivot to the commercial partners, but experts like Neal say it set back moon exploration at least five years.

But both major contractors are adapting to the new public-private model in different programs. For CLPS, Lockheed has developed the McCandless Lunar Lander, named for the astronaut and later Lockheed employee who made the first untethered space walk in what is essentially an orbital jetpack. The company is hunting for commercial payload customers even as it plans to bid on NASA’s cargo.

Administrator Bridenstine, a former congressman himself, will be tested as he tries to balance the priorities of Congress and his own contractors against achieving NASA’s exploration objectives as quickly and sustainably as possible

The Red Rival: China

China’s space program is squarely pointed at the moon, expected to culminate in the 2030s with humans returning to the lunar surface.

The same geopolitical stakes that drove the original space race are starting to emerge again as the US and China face off as rival global hegemons. Already, private companies eager to set up shop on the moon portray China’s plans as a compelling reason to accelerate America’s return to the moon.

China is using its space technology program to build international relationships just as the US has, soliciting other countries to partner with it in building a new space station in 2022. The ESA and Roscosmos have begun working on joint astronaut training activities with China, with some ESA astronauts beginning to learn Chinese, though there is no formal plan for joint spaceflight right now. US law forbids any cooperation with China’s space program, which is seen as too close to the Red Army for hawkish Republican lawmakers.

For the US military, which relies on its space assets to project power around the world in a way that neither China nor Russia can yet match, this race is anxiety inducing. And if the moon is more than just a useful high ground and a propellant depot, but also has resources like rare earth minerals or isotopes like Helium 3 that can be used for next-generation nuclear power, failing to match China’s pace could be a geopolitical disaster.

“Water on the moon is the new oil in the mid-east,” Sowers argues.

Will politics (or reality) make this impossible?

A multi-billion dollar industry mining propellant from the moon is hardly guaranteed. Even the most passionate advocates see a decade-long struggle to create the lunar economy. There’s a lot that can go wrong.

Technology and engineering troubles

Water may be the moon’s most precious resource, but what if lunar water isn’t easy to get? It could be mixed in tightly with lunar dust, or in conditions so cold—40 kelvin, or nearly -400 degrees Fahrenheit—that getting it out may prove too costly to be feasible. That’s why everyone involved in this effort supports plans to get robotic sensors to the moon as fast as possible to see exactly what lunar water really means.

“We need ground truth,” Sowers says. “We’re making a lot of inferences about what the remote sensing data is telling us.” The goal is to establish enough data to describe a “proven reserve” of lunar water—the kind of information that you can use to take to the bank and get a loan. But, sometimes, there just ain’t gold in them thar hills.

Getting ahead of the business model can be dangerous, too. The tiny European state of Luxembourg successfully became a leader in the satellite industry by embracing it long before most countries offered attractive tax and regulation policies. Today, it is home to SES, the largest commercial satellite operator by revenue, which earned more than $2 billion last year. But Luxembourg is trying a similar bet on asteroid mining, and recently lost $12 million after a firm it invested in, Deep Space Industries, was acquired at a cut rate price by a cryptocurrency venture.

American domestic politics

Much of the vision for the lunar economy comes from the US. But it’s not clear if Congress or NASA itself has the direction and resources to execute this lunar plan. Some lawmakers think that money might be better spent on keeping the International Space Station open longer or going to Mars, not setting up a new moon base. A new Democratic Congress may not want to hand Trump’s NASA everything that it wants in the midst of what are likely to be bitter battles over government spending and borrowing.

Meanwhile, NASA’s recent record of execution when it comes to lunar missions leaves much to be desired, with its Space Launch System and Orion spacecraft blowing through budgets and deadlines like the Kool Aid man through a brick wall.

The other issue is risk. Much of the lunar vision depends on public-private partnerships to become affordable, but that model is still being proven out in low-earth orbit. If, God forbid, something goes wrong with NASA’s astronaut-launching partnerships with Boeing and SpaceX, it could lead to the same kind of pause and about face seen by the space program after the losses of the space shuttles Challenger and Columbia.

Geopolitics

The same competitive concerns that are driving America and China toward the moon might lead them to foreswear it altogether.

International law around what can and can’t be done in space offers mostly high-level principles, and little obvious method of enforcement. They also were largely conceived with the idea that the only groups operating in space would be national governments, not private enterprise.

Companies seeking to do business in space are now seeking legal certainty about what they can do there, mainly so they can turn around and offer it to their investors. In 2015, the US enacted a law that would allow firms that obtain resources in space to own them, even if they cannot “own” any part of the astronomical body where they find them.

Some attorneys, however, fear laws like these are more likely to encourage chaotic land grabs than an orderly exploration of space. A haphazard scramble over the moon could raise international tensions with disputes over territory akin to the rising tensions in the South China Sea, with even less precedent and clarity to rely on. A desire to avoid creating a new zone of controversy may incline governments to let an expensive experiment in space exploration well enough alone.