From 30,000 feet the easiest way to understand the European debt crisis is as a massive flow of cash out of the banks and bond markets in the most unsteady countries.

The torrent of money fleeing the euro-zone was problematic for a bunch of reasons. For one thing, it raised the risks that the short-term lending markets banks depend on could freeze up, potentially sparking a Lehman-like failure of a major financial institution. In such an environment bankers clamped down on lending, further constricting the flow of oxgen to the economy.

Besides banks, investors were avoiding the government debt of the most-troubled countries. To pull their money out, global investors sold bonds of Greece, Portugal, Spain and Italy. That pushed the prices of those bonds down. (And since bond yields and prices move in opposite directions, yields rose.)

For those heavily indebted countries, those higher yields equal higher borrowing costs, so a larger share of GDP has to be used to pay interest. That in turn forces them to constrict government spending, which slows down the economy further, decreasing tax revenues and forcing the country to borrow even more. This is what macro-economists, when they are using technical language, call a “train wreck.”

So, as Mr. Lenin might say, what is to be done?

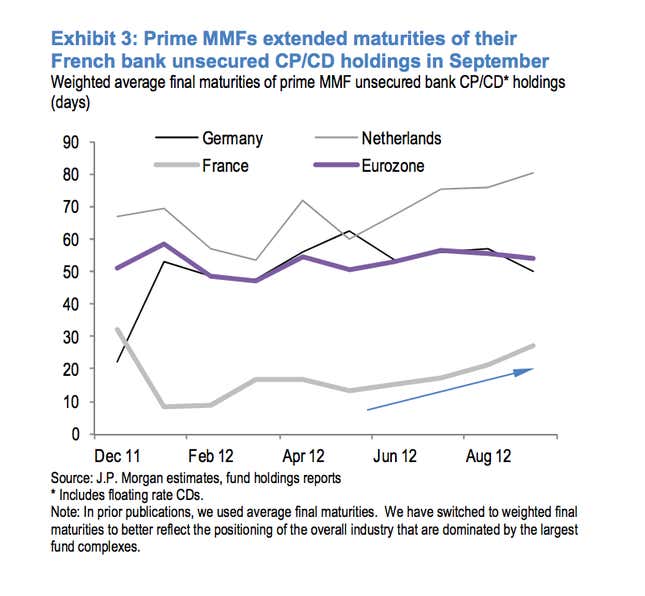

Well, what Europe must do is stop the flow of cash out of the most worrisome countries. And there are signs in recent months that that’s started to happen. For one thing, US money market mutual funds, who for a long time were major lenders of short-term cash to European banks, are starting to tiptoe back into the market. It’s a small move, but they’re lending to French banks again, report JP Morgan analysts. Here’s a chart of investments of prime money market mutual funds starting to flow ever so slightly back into French markets.

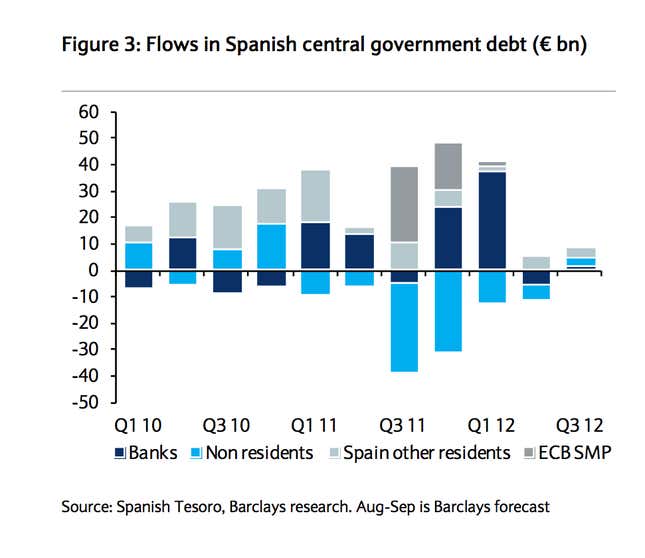

And it appears that some money is flowing back into the Spanish government bond market. Heres a a look at who’s been buying Spanish government debt. You can see that nonresidents—the teal/blue part of the bar chart—yanked cash out like crazy during the worst of the crisis. But in the most recent quarter, foreigners have started nibbling on Spanish government debt.

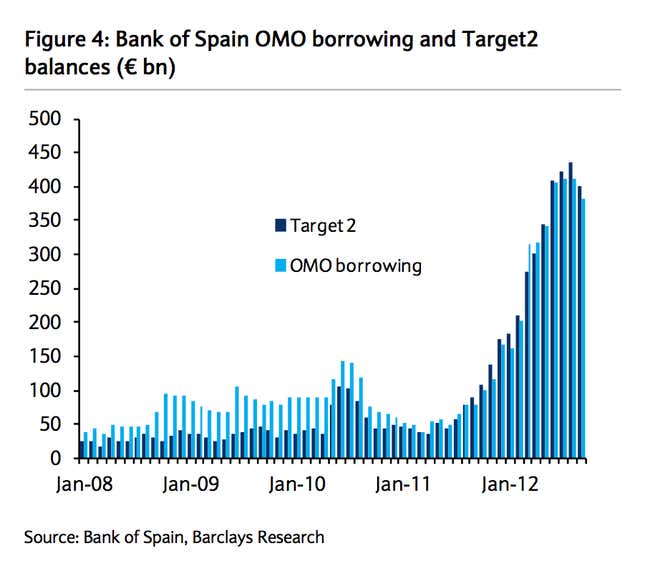

And check this chart, which essentially shows how reliant Spain has become on funding from the European Central Bank (ECB), where it’s had to turn after getting a cold reception from private investors. The situation is still bad, but it has improved at least a little bit in the last couple of months.

For the moment it looks like Mario Draghi’s ECB has managed to quell the panic, stop the outflow of cash, and at least on the margins, convinced some investors to send a little money Europe’s way. But the situation is still far from normal.