The latest poll of manufacturing purchasing managers—a key leading indicator of economic growth—in the euro zone was the strongest in more than two years (pdf). The index, at 51.6 for November, implies that the bloc’s factories are humming along at a decent clip—a quarterly rate of growth of around 0.6% for the current quarter, according to Markit, the research company that administers the survey. A reading above 50 suggests output is growing, and the index has been above this level for five months in a row.

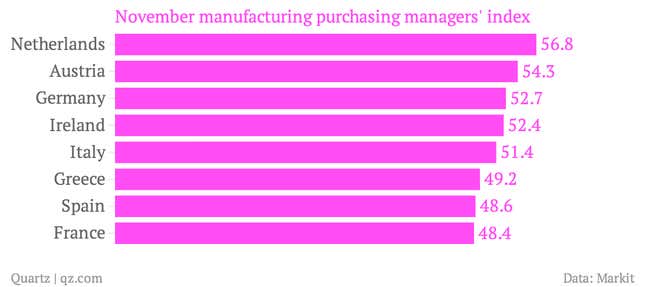

But these solid, if unspectacular, high-level results mask considerable variations between individual countries. At first glance these patterns follow the usual script—strength in the “core” (typically northern) countries and weakness in the “periphery” (typically southern) countries:

But a closer look at the order of countries within the list reveals some surprises. Though France is not one of the euro zone countries that has needed a bailout, it is at the bottom of Markit’s list, below Greece and Spain, which have. And in Greece, the unhappy poster child for Europe’s calamity, manufacturing purchasing managers are more upbeat than their counterparts in either Spain and France, although manufacturing activity in all three countries is contracting, according to the poll.

Factory managers in Ireland, meanwhile, suggest that business there is just about as good as it is in Germany. The top-ranked euro zone country, according to purchasing managers, is another surprise: the Netherlands. A perky 56.8 index reading for the Dutch, a 31-month high, comes shortly after the country’s credit rating was cut by S&P, citing its growth-sapping austerity policies as justification.

Amid the month-to-month volatility of the overall index readings, one thing that nearly all euro zone countries have in common is weak job markets. A sub-index of Markit’s poll asks purchasing managers about hiring plans, and even though overall manufacturing activity is increasing, hiring just recorded its 22nd consecutive month below 50, suggesting more job cuts in the euro zone. The employment readings for Germany, France and Spain all worsened in November. But to continue the topsy-turvy theme in the latest batch of data, Italy was one of the few countries to report a rise in employment, and its economy is hardly a picture of strength.