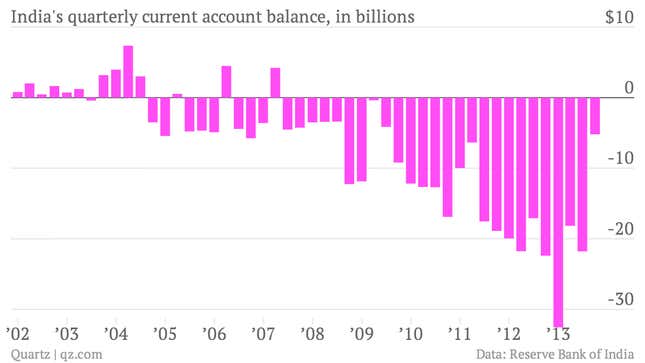

Just a few months ago, India was facing what seemed like a serious currency crisis. Over the prior year, the country had posted larger and larger current account deficits—meaning they bought much more from abroad than they sold. That made India more reliant on dwindling inflows of foreign money. (In general countries that have strong current account surpluses have appreciating currencies. And countries with deficits tend to have weaker currencies.) During the rupee’s worst moments, it was down about 25% against the US dollar.

But things are already looking up.

Just-released data shows that India has axed its current account deficit to a mere $5.2 billion, or roughly 1.2% of GDP during the third quarter. In the second quarter it was about $22 billion.

What happened? A combination of growing exports and public policy changes.

On the public policy front, India has moved swiftly to clamp down on its gold mania. Over the last few fiscal years, imports of gold accounted for about 70% of India’s current account deficit, as the country swapped out its shiny rocks for US dollars. In September, India imposed new taxes and restrictions to curb gold imports, and it worked. Gold imports have dropped sharply.

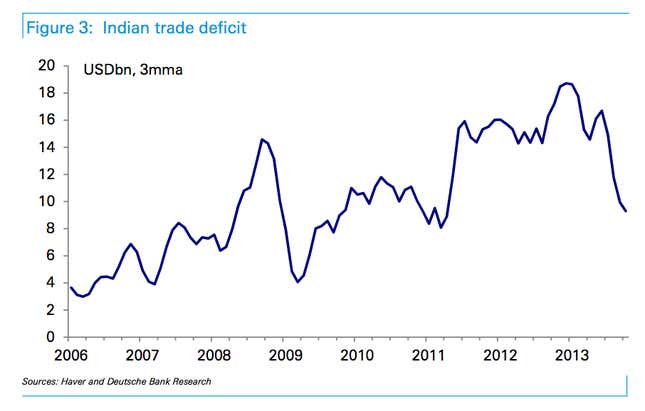

But exports have also showed signs of picking up steam, thanks in part to the weaker rupee which, in theory, makes India’s exports cheaper for foreign buyers. This chart from Deutsche Bank shows how India’s goods trade deficit has been shrinking thanks to the pickup in exports. (The chart looks at the three-month moving average—3mma—to smooth out some of the monthly volatility.)

So is India in the clear?

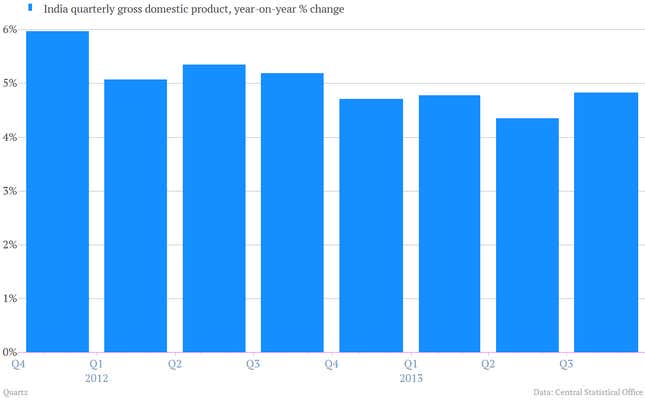

Hard to say. Fresh GDP data released today showed the economy growing at a slightly better-than-expected 4.8% clip between July and September, thanks in part to its robust agricultural and export sectors. But Barclays economists warn that “the underlying momentum of the recovery remains quite tepid.”