Buy more, sell less: Germany is starting to rebalance its economy

There was a trio of important data releases in Germany today. All of the numbers point to an economy that is shifting away from its dependence on exports, although perhaps not as quickly as fellow euro-zone members would like.

There was a trio of important data releases in Germany today. All of the numbers point to an economy that is shifting away from its dependence on exports, although perhaps not as quickly as fellow euro-zone members would like.

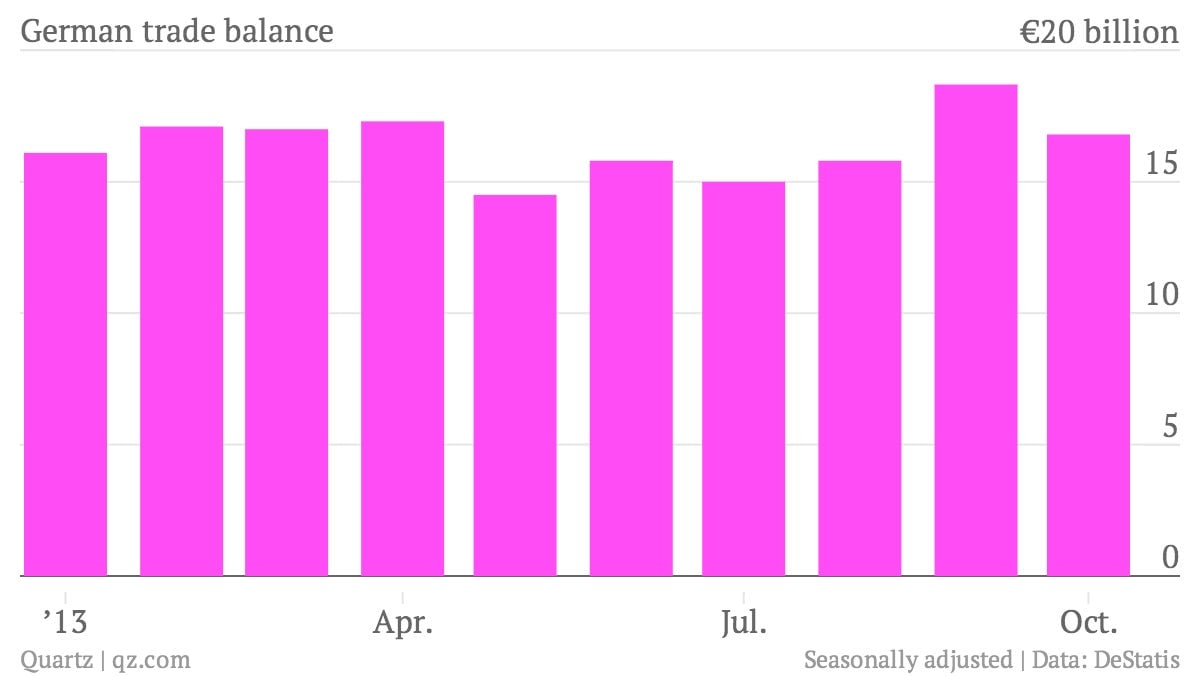

First, and most importantly, Germany’s trade surplus narrowed by much more than expected in October:

Including seasonal adjustments, German imports rose by nearly 3% in October, outpacing a 0.2% gain in exports, which explains the fall in the overall surplus. Imports from the euro zone grew faster than from any other trading group, giving hope to countries that want to sell more to the monetary union’s largest economy.

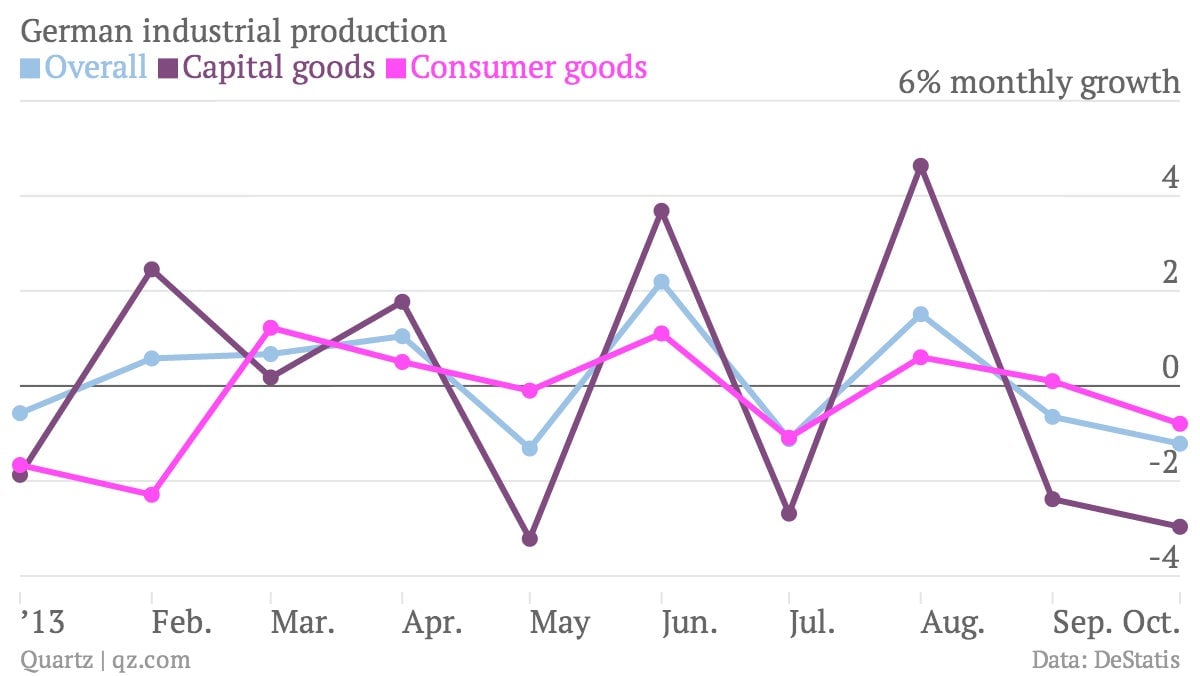

The shift from investment to consumption can also be seen in the latest industrial production figures. These also came in lower than analysts expected, with manufacturing output falling by 1.2% in October (analysts expected an increase). The decline was paced by capital goods, the lifeblood of Germany’s export machine. Production of consumer goods fared much better.

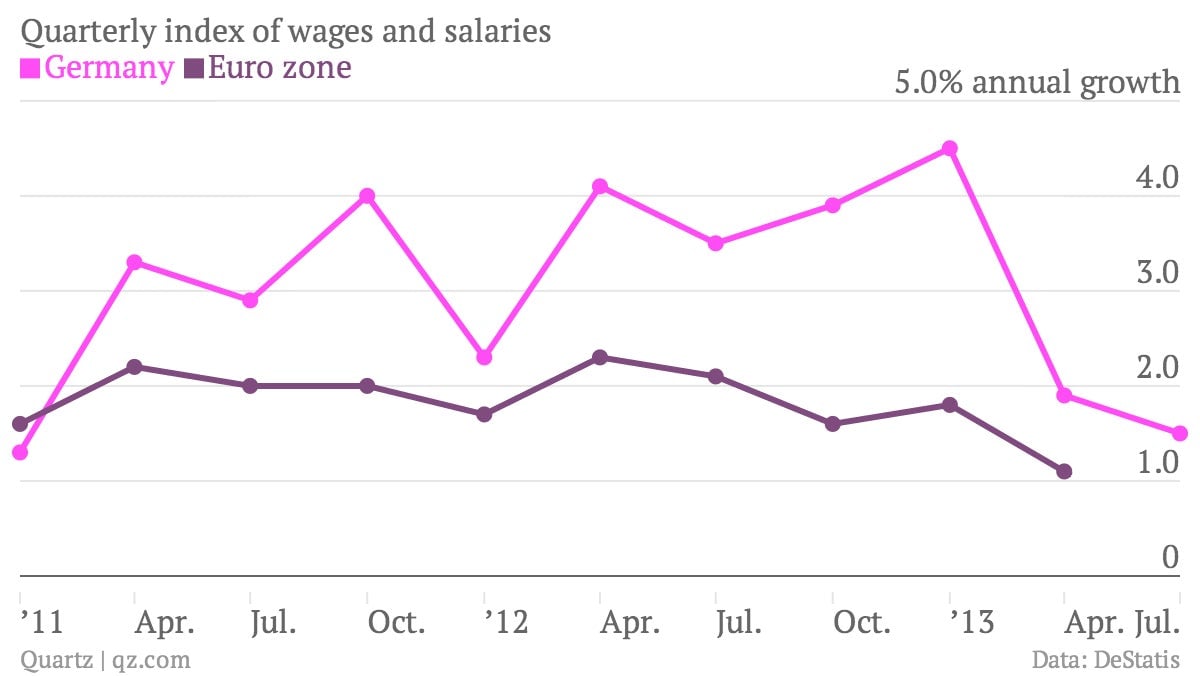

For Germany’s consumers to spend more, they need to make more. The final piece of data on today’s menu was labor costs. Wages and salaries for German workers rose by 1.5% in the third quarter versus the previous year. Although this was the smallest increase in more than two years, wage growth in Germany looks set to continue to outpace that in the euro zone as a whole.

This is welcome news for countries which compete with Germany for export market share—low German wages have long been a bugbear of countries like France, where labor costs are higher. Fatter wallets in German pockets will also encourage its neighbors to flog more of their goods to the country’s famously frugal shoppers.

It is always dangerous to read too much into a single monthly or quarterly figure, but the latest data dump from Germany certainly suggests that the longed-for rebalancing of Europe’s largest economy is under way.