Americans appear to have made real progress in patching up their personal finances.

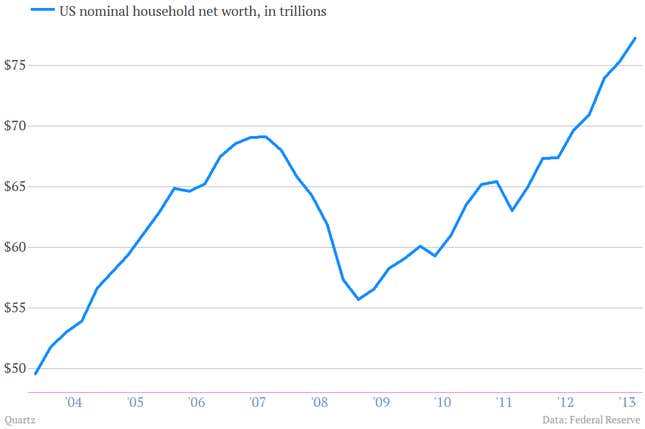

In nominal terms, US household net worth has surged over the past few years thanks to a recovery in housing prices and a rocking stock market. At the end of the third quarter, net worth was $77.26 trillion, up roughly 12% from the pre-crisis peak of more than $69 trillion, according to the latest report on the topic from the Federal Reserve.

Even in inflation-adjusted terms, US households have finally clawed their way back to where they were before the financial crisis hit. Here’s what those numbers look like, care of economists at the Federal Reserve Bank of St. Louis’s Center for Household Stability:

Adjusted for inflation, US household net worth in the third quarter of 2013 amounted to $71.93 trillion. That’s slightly better than in the first quarter of 2007, an improvement of 0.7% from when real net worth was $71.42 trillion. That means American households have dug themselves out of the hole created by the Great Recession, at least in the aggregate.

But there are some caveats. For one thing, there are many more households in 2013 than there were in 2007. That means that, on a per household level, US net worth is still below its pre-crisis peak. It’s also important to note that the nature of the rebound in household net worth was driven by the rip-roaring stock market. And that means that recoveries in household income are going to skew heavily toward the wealthy, since they’re the ones who own most of the stock market.