Policymakers in the US and Europe have long worried that terrorist groups might use cryptocurrencies to fund attacks and operations. Stateless digital money that can’t be blocked certainly sounds like a dangerous proposition. Zoobia Shahnaz, a Pakistani-American woman, helped feed that narrative when she was indicted for laundering money through bitcoin in December 2017. She pleaded guilty to “providing material support to ISIS” in November.

Seeing the words “bitcoin” and “ISIS” so close together may seem alarming. However, if you look closely, Shahnaz didn’t send bitcoin to ISIS. She bought bitcoin using credit cards and converted it into US dollars. Then, she wired those US dollars to the terrorist group through “shell entities” in Pakistan, China, and Turkey. That’s a critical distinction, and it demonstrates that using crypto as currency is a hassle—even for terrorists.

A European Parliament study found last year that terrorist groups rarely use crypto. “In their current form and at current levels of adoption, [virtual currencies] may not present terrorist actors with substantial advantages over other methods of funding and financing they already utilise.” Like civilians, terrorists have better options. Traditional, government-issued currency offers a stable medium of exchange. Precious stones and metals are other alternatives, says the OECD. These are reliable forms of money, with risks that are well understood.

In its Internet Organized Crime Threat Assessment, Europol—the EU’s law enforcement agency—also found minimal terrorist usage of crypto. Terrorist groups mostly use cryptocurrencies for “low-level transactions,” like paying for web hosting services, said the agency. “[T]heir main funding still stems from conventional banking and money remittance services.” However, Europol did document ISIS-affiliated websites, which solicited crypto donations in late 2017, near the peak of the bitcoin bubble.

For terrorists, crypto usage hasn’t really evolved in the last two years, but change could be on the horizon. In a report published in March, the RAND Corporation said that crypto could eventually become useful to terrorists. “The primary factors that will increase viability for use by terrorist organizations are broader use, better anonymity, lax or inconsistent regulation with associated improved security, and adoption in adjacent markets,” wrote the think tank.

Terrorists could use newer coins with privacy-enhancing features, like Monero and Zcash—that is, if the tokens gain a larger market share. Monero (market cap: $1.2 billion) is available on Kraken, a San Francisco-based trading platform, while Zcash (market cap: $450 million) is available on Coinbase and Gemini, two large US exchanges.

Ultimately, Europol “anticipate[s] a more pronounced shift” toward privacy coins. “There are a number of drivers for this in addition to greater privacy, such as faster transaction times, lower transaction fees and less price volatility compared to Bitcoin,” the agency said.

For now, though, cryptocurrencies are simply too much work for terrorists, who face many of the same obstacles to crypto usage as the general public. Virtually every onramp and offramp for digital currency is a bother. Mining crypto is resource-intensive, unpredictable, and has low profit margins (especially during a bear market). Buying from exchanges typically requires a linked bank account and government-issued identification, which is probably a non-starter for terrorists. The last option—purchasing digital currency Craigslist-style—is feasible, but volumes are often too small to warrant the effort.

With mining and over-the-counter purchases off the table, that leaves terrorists with only smaller, poorly-regulated exchanges. These bourses often have tenuous banking relationships and can fold at a moment’s notice, making the entire exercise more trouble than it’s worth. Furthermore, exchanges would be unwise to facilitate terrorists’ transactions because the association could jeopardize the rest of their business.

In addition to the obstacles of acquiring and liquidating cryptocurrencies, terrorists confront price volatility and security issues. Of course, price uncertainty makes cryptocurrency a poor form of money—a major problem for individuals and enterprises, even of the criminal variety. Security is especially vexing. Since crypto “wallets” are essentially personally-managed account numbers and passwords, that information must be kept secret at all times. Anybody with access to a private key (the password) can send or steal funds. For terrorist groups, public keys (receiving addresses) would also need to be kept under wraps. Otherwise, they can be blacklisted by exchanges or easily traced by authorities.

Altogether, bitcoin’s transparency makes it ill-suited to terrorist usage. Every unit of bitcoin can be tracked from wallet to wallet—it’s like having a record of all previous owners of each dollar in your pocket. Ether, the second largest crypto, is similarly conspicuous. While cryptocurrencies offer censorship resistance, the places that they intersect with the real world make them as inconvenient for terrorists as they are for the rest of society. So, unless privacy coins make significant inroads, terrorists will continue to rely on the conventional financial system.

🔑🔑🔑

De-jargonizer

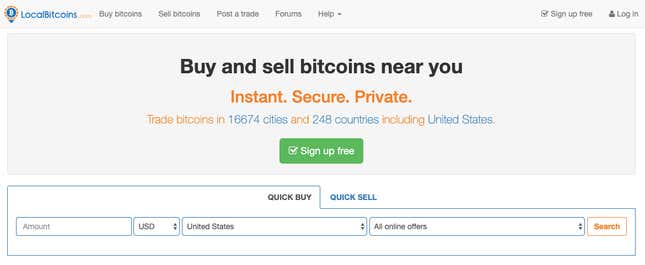

LocalBitcoins

LocalBitcoins is a popular over-the-counter cryptocurrency trading platform. Buyers and sellers can post the amounts of bitcoin that they would like to transact. Then, they can meet in person to swap cash for the digital currency, and avoid exchanges where ID is required.

Just because these transactions aren’t on an exchange, though, that doesn’t mean the Feds aren’t watching OTC activity. “OxyMonster,” a drug trafficker who used LocalBitcoins, was sentenced to 20 years in jail last year. What gave him away was using his real name—Gal Vallerius—on the LocalBitcoins site.

Please send news and tips to privatekey@qz.com. Today’s Private Key was written by Matthew De Silva, and edited by Oliver Staley. The two most powerful warriors are patience and time.