Polychain was one of the great success stories of the cryptocurrency boom. A hedge fund that once boasted more than $1 billion in assets under management, Polychain was founded in 2016 by Olaf Carlson-Wee, the colorful 29-year-old son of Lutheran pastors who works out of a secret location in a San Francisco warehouse. He sports a collection of vintage windbreakers and would spend weekday afternoons hiking without his phone, out of range of investors, according to a Wall Street Journal profile (paywall).

But what was endearingly quirky as cryptocurrency values soared may not seem as charming when they fall. Polychain lost nearly $400 million last year, and Ryan Zurrer, one of Polychain’s principals, was reportedly fired in December due to the performance. Neither Polychain nor Zurrer returned requests for comment.

Although Polychain’s 40% decline compares favorably to a 70% downturn in the wider crypto market, losing $400 million is still brutal. Considering that Carlson-Wee has reportedly liquidated $60 million in personal holdings and Polychain is being sued an investor who suspects underpayment, the situation seems precarious.

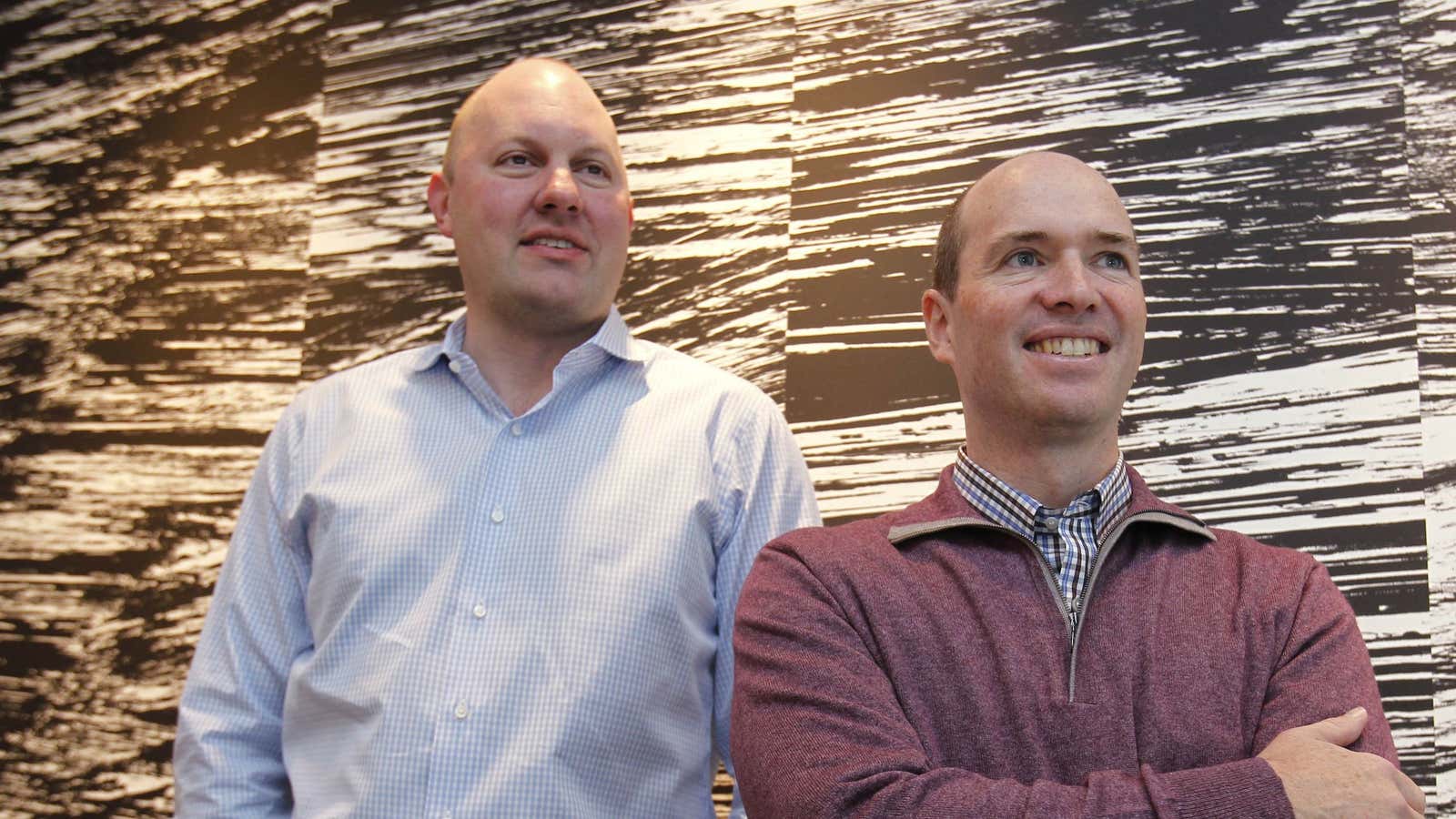

One of Polychain’s investors is Andreessen Horowitz (sometimes called a16z), one of Silicon Valley’s premier venture capital firms which has backed the likes of GitHub and Lyft. A16z made an early bet on Polychain in 2016 with a $10 million investment, which delivered a 2031% return in 2017 (paywall).

In an industry that’s been defined by overpromise and under-delivery, a16z’s crypto investment strategy is remarkably sober. While mom-and-pop investors drove little-known digital tokens to dizzying heights—and subsequent crashes—Andreessen Horowitz has focused on core services, like money, exchanges, loans, and digital currency storage. Portfolio companies include Coinbase (one of the largest crypto exchanges in the US), Filecoin (a long-delayed peer-to-peer digital storage system), and Maker (an over-collateralized cryptocurrency, which is meant to retain a peg to the US dollar). Andreessen Horowitz has other crypto bets, too, but broadly speaking, they’re foundational pieces for a blockchain-based future, not the obscure and private tokens which unjustifiably soared during 2017.

In March, a16z decided to renounce its status as a venture capital firm, remaking itself as a registered investment advisor. The reclassification could give a16z flexibility to invest in cryptocurrencies, operating partner Margit Wennmachers explained to CNBC.

Under its previous designation, Andreessen Horowitz faced a 20% cap on total assets that could be invested in “liquid securities.” To sidestep the cap, the firm created a $350 million dedicated crypto fund as an RIA, but the requisite legal wrangling and business separation caused headaches, Forbes explained. Since some cryptos may be classified as securities under US law, Andreessen Horowitz can more easily expand its crypto portfolio and improve its internal communication with the entire firm designated as an RIA. Today, the firm’s crypto portfolio includes popular cryptocurrencies, like bitcoin and ethereum.

Diogo Mónica, founder of Anchorage—one of a16z’s portfolio companies and a crypto storage solution for institutional traders—says his company is an example of a16z’s investing philosophy. “We call ourselves an ‘index bet on crypto.’ Basically, we’re the financial infrastructure for privacy protection. It doesn’t really matter what the privacy is, even though we’re fully integrated with crypto assets.”

“As long as one asset wins—it doesn’t matter if it’s bitcoin or ethereum or Zcash or what have you—as long as something wins over the long run, you will need a regulated, trusted party to store your keys and allow you to participate in the blockchain,” Mónica said.

Ultimately, Andreessen Horowitz’s approach reflects the experience of its employees, many of whom lived through the dotcom bubble firsthand, including general partner Chris Dixon. Polychain’s brash revolutionaries had their moment but more discerning crypto investors may win in the long run.

🔑🔑🔑

What you need to know—and why

Wikileaks receives crypto donations after Assange arrest

Following the arrest of Julian Assange, the founder of Wikileaks, last week, the non-profit whistleblowing website received a small influx of bitcoin donations. The organization’s latest wallet address shows a balance of 4.6 bitcoins ($23,300). Most of those funds were donated prior to Assange’s detention, but there were two notable contributions, of 1 BTC and 0.998 BTC, April 14.

Wikileaks began accepting bitcoin in 2011, and the organization has since expanded its crypto fundraising to litecoin and ethereum, as well as privacy coins Zcash and Monero. In April 2018, Wikileaks updated its bitcoin wallet address, but the bitcoin blockchain shows that its previous wallet contained more than 4,000 bitcoins (market value: $20 million). It’s unclear who controls those bitcoins today.

Takeaway: After bitcoin exploded in 2017, Assange taunted US legislators who blocked his financial access and thus forced him to use the cryptocurrency. The allegedly 50,000% return Wikileaks earned on bitcoin—and its $20 million windfall—likely overstates the amount of grassroots support for the organization.

Please send news, tips, and vintage windbreakers to privatekey@qz.com. Today’s Private Key was written by Matthew De Silva, and edited by Oliver Staley. Simplicity is the ultimate sophistication.