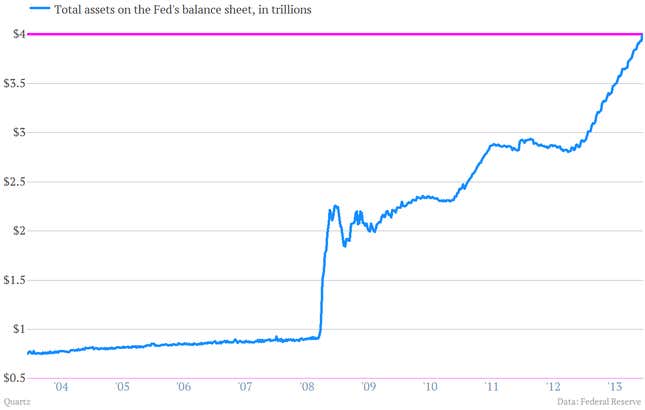

Even the journey of $4 trillion dollars begins with a single taper.

The Federal Reserve took its first concrete steps today toward unwinding the extraordinary monetary policy it undertook after the Great Recession hit in order to spur economic growth.

The US central bank announced it would reduce its monthly bond-buying program by $10 billion beginning in January. The much-awaited decision to ease up on economic support has preoccupied financial markets for months, ever since Fed chairman Ben Bernanke first raised the possibility in May.

Of course, even with the $10 billion taper, the Fed will be buying $75 billion in Treasurys and government-guaranteed mortgage bonds a month, which should continue to exert downward pressure on long-term interest rates, all else equal. And that means the Federal Reserve’s roughly $4 trillion balance will continue to grow for quite some time.

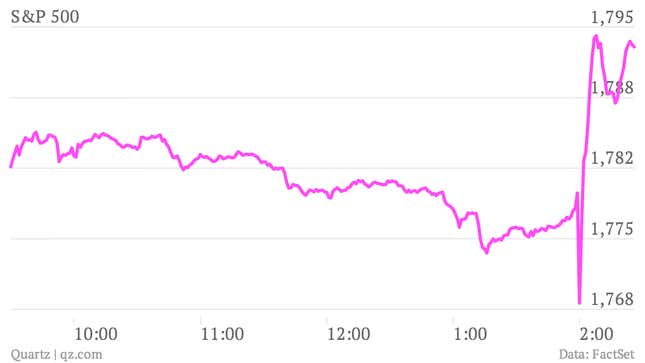

But in a heartening sign, the US stock market cheered the news—which hit at 2:00pm—that the Fed felt good enough about the economy to begin to ease up on the amount of support it’s providing. Many have credited the Fed’s bond-buying program—which essentially creates new money and tries to push it into the economy through the banking system—as one reason why stocks have done so well in recent years.

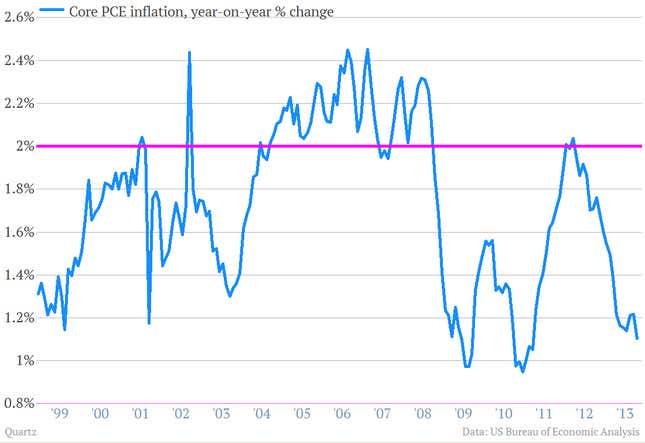

Perhaps the stock market is taking the taper in stride because it was accompanied by another change. The Fed moved to make sure short-term interest rates stay low by emphasizing that it would keep the key Federal Funds target rate parked near zero well past the time that unemployment falls to 6.5%. The Fed also signaled that it was keeping a close eye on inflation that continues to undershoot its target. (For central bankers, the risk of deflation—or a broad based decline in prices—is a very scary thing, as it can represent a serious headwind against economic growth.)

“The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, and it is monitoring inflation developments carefully for evidence that inflation will move back toward its objective over the medium term,” the FOMC statement said.

“This is a very dovish taper-lite where the Fed has done its utmost to provide an offset with its forward guidance, notably on the inclusion of inflation in the unemployment threshold,” wrote Deutsche Bank foreign exchange analysts after the Fed announced its move.

Translation? Even though the Fed announced the taper, its focus on low inflation suggests that it will continue to be a large presence in the markets for some time to come. Stock market investors seem to like the sound of that.