China puts out yet another credit market fire with more liquidity

China’s highly-leveraged and opaque financial system ranks high on the list of threats to global growth.

China’s highly-leveraged and opaque financial system ranks high on the list of threats to global growth.

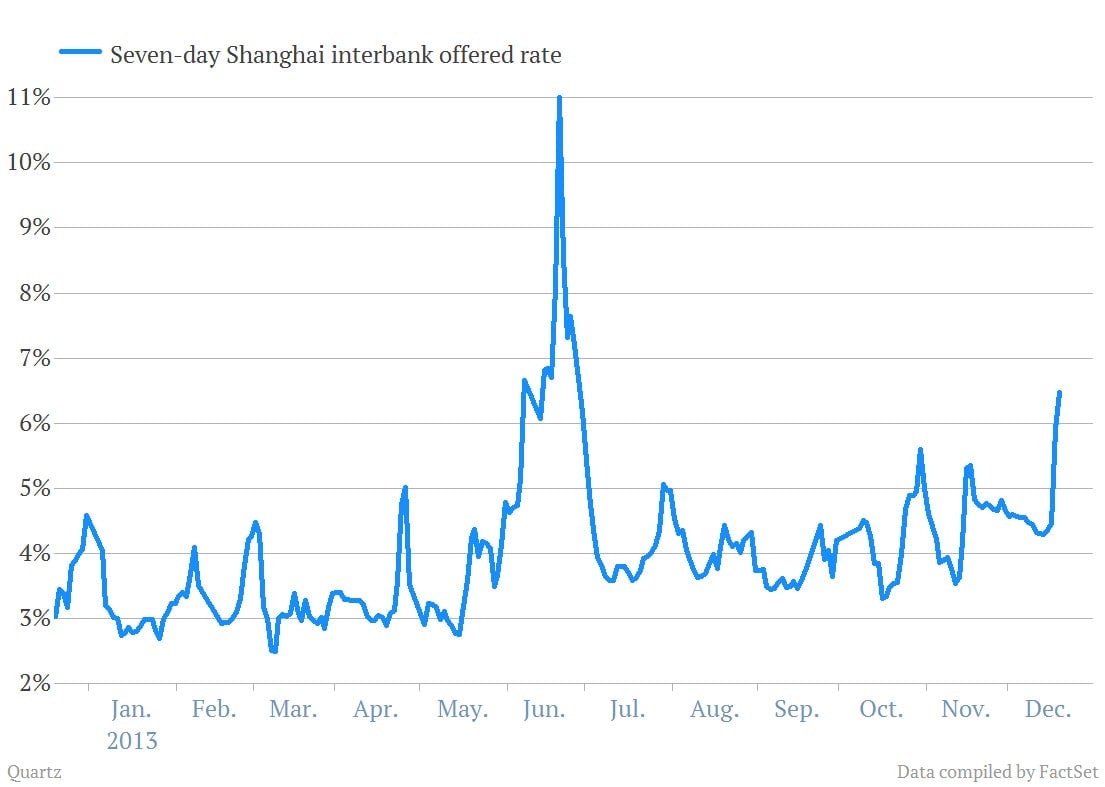

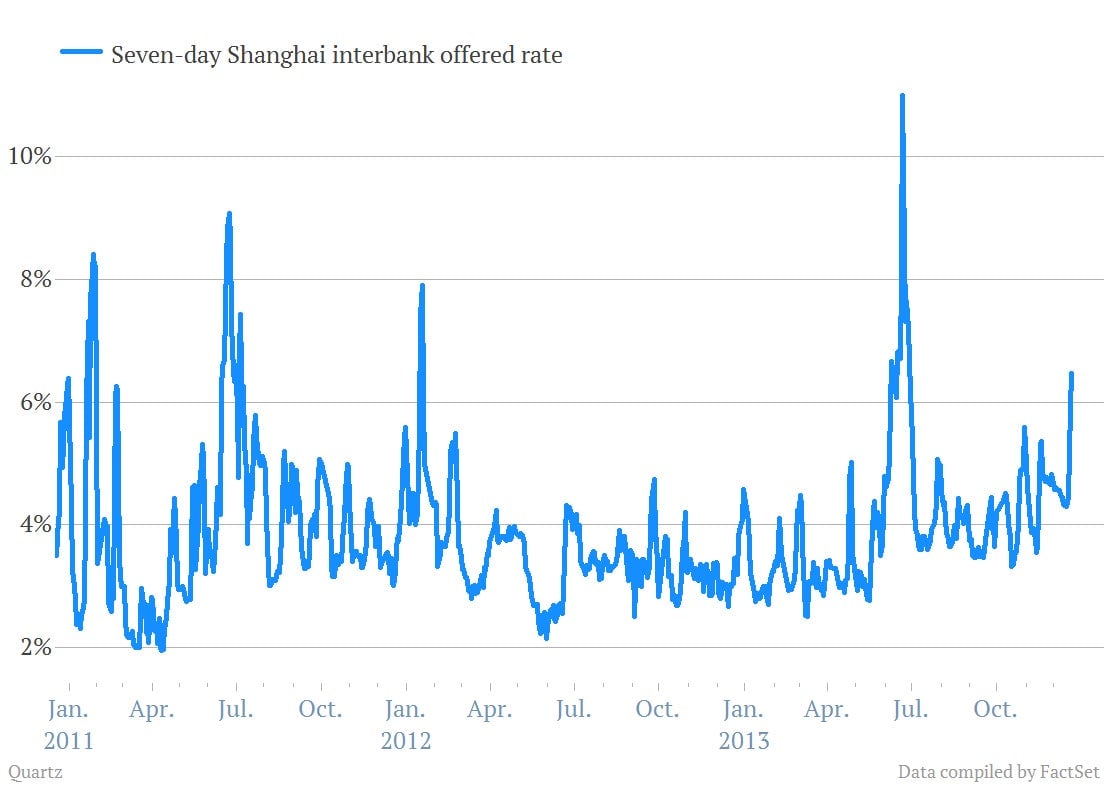

In recent days, there’ve been signs of sharply growing stress in the plumbing of Chinese financial markets. The Shanghai Interbank Offered Rate (Shibor) screamed sharply higher. Like the much-better-known Libor—which became a near-household word during the US financial crisis—Shibor is a gauge of how much banks charge to lend to one another. If the rates are low, it means banks feel flush with cash and more than willing t0 lend it out. But if it moves sharply higher, it means that banks are clinging to cash and view lending it as risky.

In recent days the Shibor has been moving up precipitously.

Some of this is seasonal. You can see that Shibor tends to surge at the end of the year as banks try to make sure they are in the strongest position during key reporting periods. That means there’s a lot of demand for cash, which tends to push the price up. (The price of money is the interest rate.)

But what’s interesting is that today the People’s Bank of China announced that it had injected cash into the short-term credit markets. While the PBOC does that regularly—twice a week via its regular, publicly announced open market operations—the cash injection that it announced today was a different kind of mechanism known as a short-term liquidity operation or SLO. It directs the central bank’s money to 12 large Chinese banks seen as crucial to the stability of the system. The Financial Times notes:

According to the central bank’s own rules, it is only meant to announce SLOs one month after their implementation, but on this occasion it was unwilling to brook such a delay. On Thursday afternoon, it used its account on Weibo, China’s Twitter-like platform, to tell a jittery market that it had provided banks with the emergency cash.

That the central bank has been so quick to try to ease stress in short-term markets indicates that policy makers are leery of repeating last-summer’s severe credit crunch. Understandably; In a worst case scenario, that could bring down a key financial institution.