Gold was by far one of the worst trades of 2013

The gold bugs have taken a beating this year.

The gold bugs have taken a beating this year.

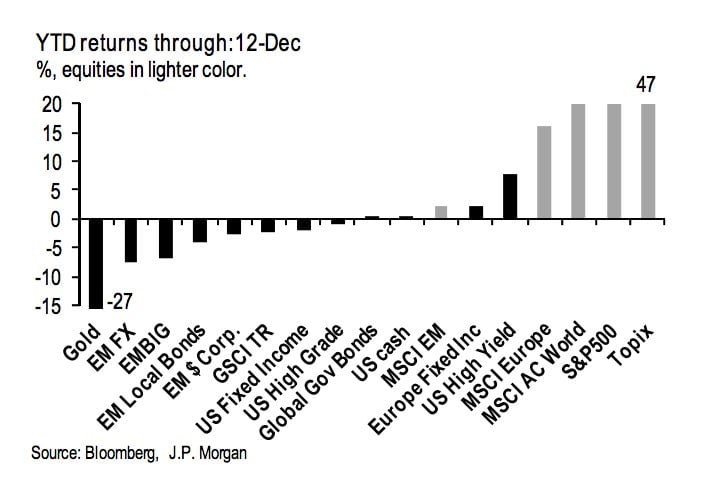

Spot prices for the yellow metal itself are down roughly 29% this year. And related assets have been brutalized as badly or worse. Widely-held gold ETF “GLD” is down roughly 29%, too. Colorado gold miner Newmont Mining will likely be the worst-performing stock in the S&P 500 in 2013, tumbling 51%. Here’s a look at how gold has done versus various asset classes over the year, from J.P. Morgan analysts.

What gives? Well, in the US the prevailing rationale for owning the shiny rock is to protect against the risk of inflation. And, frankly, there’s hardly any inflation. There hasn’t been for a while. If anything, risks seem skewed toward falling, not rising, prices.

Meanwhile, the demand for gold from India—a crucial market as one of the world’s top consumers of gold—has weakened considerably. India imposed restrictions on gold-buying as part of its effort to keep dollars from flowing out of the country and stabilize the tumbling rupee earlier this year. (China has picked up some of the slack, but not enough to keep prices from percolating higher.)

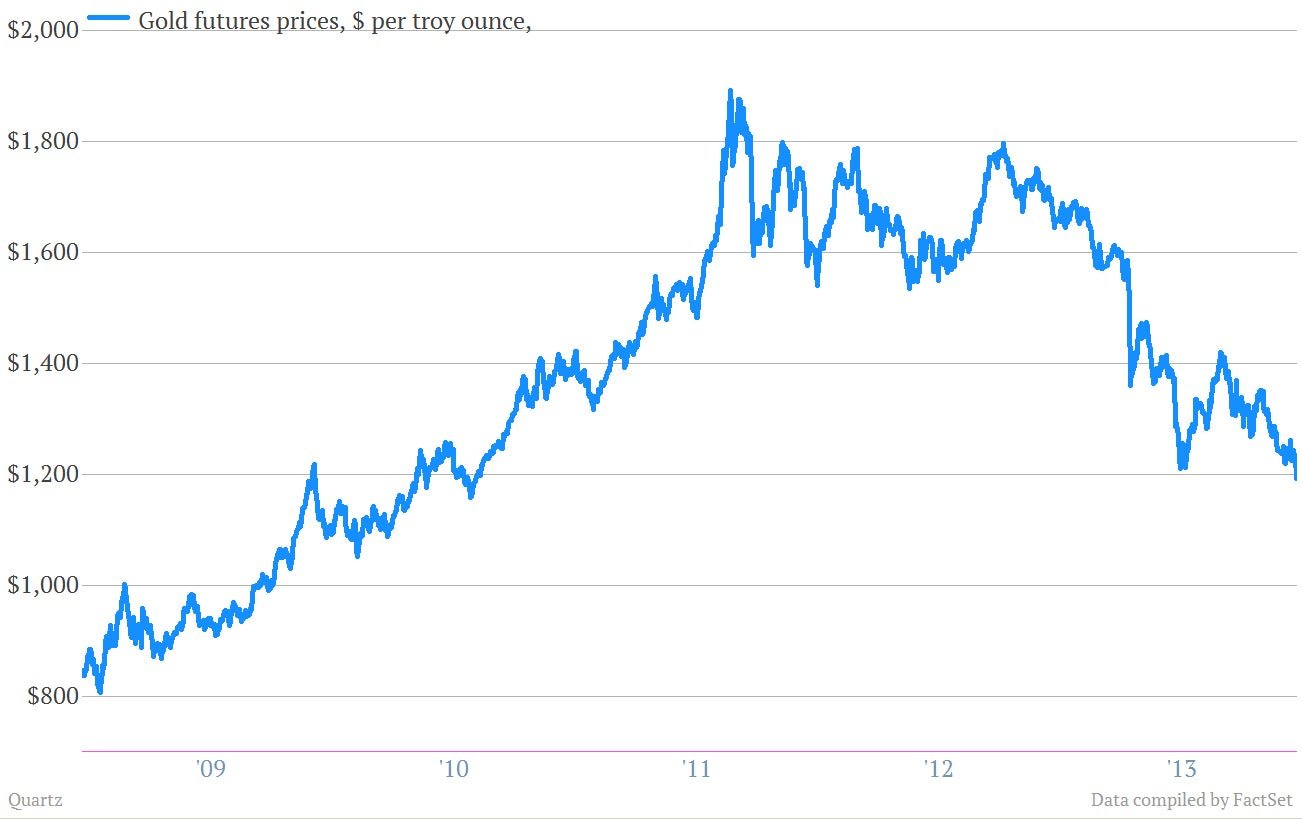

As for the prospects of a recovery in gold prices, they don’t look great. Smart money investors such as hedge funders George Soros and Dan Loeb sold out of their gold ETF positions back in the second quarter. Gold slipped into a bear market—traditionally defined as a 20% decline from a recent price peak—back in April.

Goldman Sachs analysts expect prices for the metal to continue to fall in 2014.

Is there any bright spot for gold? Well, at least it had a better year than its low-rent metallic cousin, silver. Silver prices slumped an even steeper 36% this year.