India is desperately trying to break its gold addiction

India’s central bank is trying to keep its population’s insatiable appetite for gold from driving the country deeper and deeper into debt.

India’s central bank is trying to keep its population’s insatiable appetite for gold from driving the country deeper and deeper into debt.

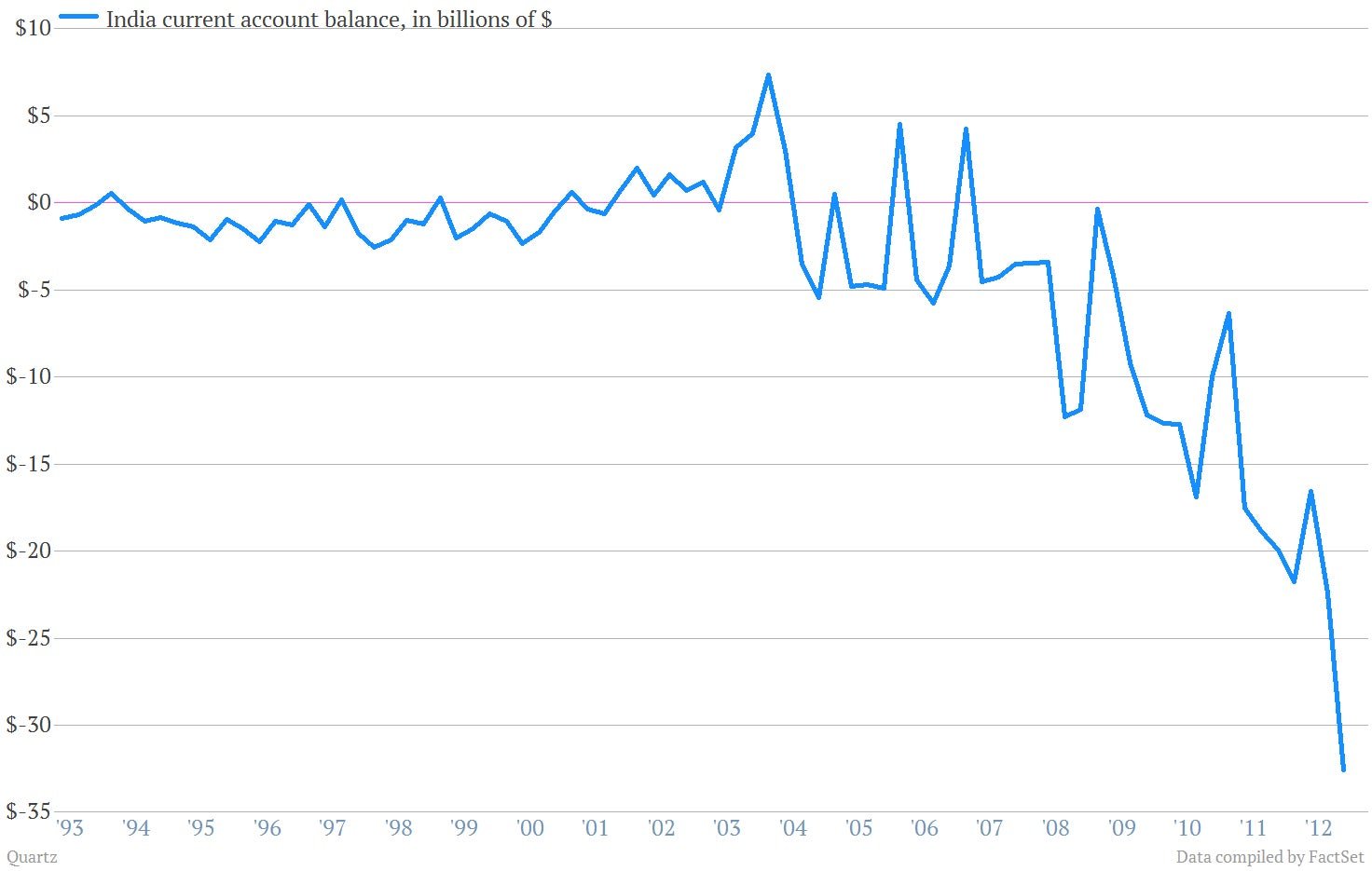

The central bank announced steps today to restrict the import of the metal by banks. Under the new regime such imports would be allowed “only to meet the genuine needs of exporters of gold jewellery.” As we’ve told you before, India’s gold buying has been driving the country’s current account deficit—the broadest measure of what a nation buys and what it sells—into sharply negative territory in recent months. The deficit hit $32.6 billion at the end of 2012, a record 6.7% of GDP. And during the last fiscal year, gold imports accounted for roughly 70% of the deficit, according to Barclays research. Here’s a look at the current account picture going back a good 20 years.

Such deficits mean a country is buying more from foreigners than it is selling, and by definition that means the nation has to borrow to pay for those delightful items it is shipping in. So as Indians buy more and more gold from abroad, it’s essentially driving the country into hock to foreign investors. Traditionally, that’s not a place emerging markets want to be because it exposes the economy to the threat that foreign investors yank their funding and disrupt the economy. At any rate, it remains to be seen whether the latest attempts to clamp down on India’s gold mania are going to bite. Fresh data released monday showed gold imports surged 138% in April, as buyers there jumped on the sharp drop in prices for the metal.