Five reasons for gold’s sudden, violent collapse

It’s getting disgustingly ugly for the gold bugs. The yellow metal is down more than 9% over the last two trading sessions, and was trading at around $1,418 in New York at last glance. That’s down roughly 25% from its August 2011 high, which puts it solidly into bear market territory. (Bear markets are traditionally defined as 20% lower than a peak.) Here’s a look at the price chart over the last year.

It’s getting disgustingly ugly for the gold bugs. The yellow metal is down more than 9% over the last two trading sessions, and was trading at around $1,418 in New York at last glance. That’s down roughly 25% from its August 2011 high, which puts it solidly into bear market territory. (Bear markets are traditionally defined as 20% lower than a peak.) Here’s a look at the price chart over the last year.

But what prompted the selloff now? As usual in the financial markets, nobody really knows. But that doesn’t stop folks from mooting several theories. Flat out, none of them are especially convincing. But taken as a whole they sketch out a change of sentiment on the metal.

1) Increasing supply. There’s been some speculation that the central bank of Cyprus could sell some of its reserves in order to finance parts of its bailout program. Increased supply, in the absence of increased demand, would send prices lower. So, some sold on the rumor before Cyprus supplies hit the market. Cyprus denies such plans.

2) Wall Street recommendations. Goldman Sachs put out a recommendation to short the precious metal in a recent note. French megabank Société Générale also suggests betting the price of gold will decline, calling it one of its best trade ideas for 2013. Goldman’s sell call did get some attention, which could have influenced sentiment.

3) Sluggish Chinese growth. As the sharp selloff today coincided with slower GDP numbers from China, some have linked the two. The theory is that slower Chinese growth means slower world growth, which means less inflationary pressure. (Gold is typically seen, albeit for dubious reasons, as a hedge against inflation.) But we doubt it. The fact that today’s selloff came amid the opening of Asian markets likely reflects the fact that Asian investors are getting a chance to catch up to Friday’s sharp turn lower in Western markets.

4) The Times of India. Bearish coverage of gold prices over the weekend (here and here, for example) may have influenced sentiment in the world’s biggest gold market.

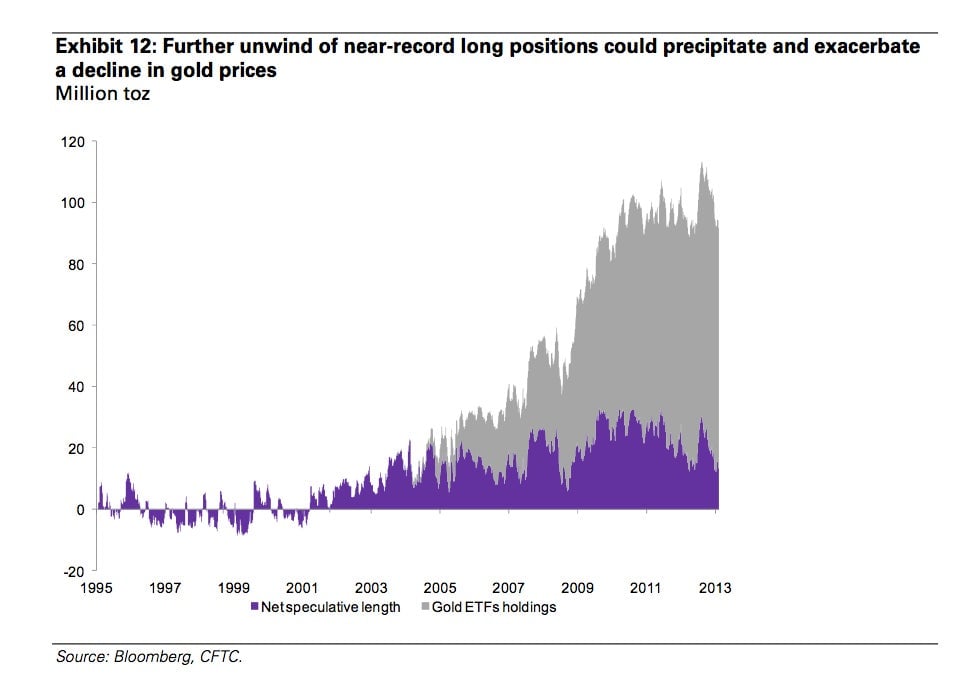

5.) ETF-ization of gold. Outflows from gold exchange-traded funds, some of the largest holders of the metal, have increased and still have a long way to run, which could add tremendous downward pressure to prices. Here’s a chart Goldman Sachs analysts used to make this point.

Of course, the ETF argument is a bit circular. Outflows have picked up because sentiment has turned sour, not the other way around. But circular logic is what makes the financial markets go round—and in this case, down. That negative feedback loop is clearly entrenched in gold, which means the bugs should run for cover.