There have to be defenders of Vikram Pandit, somewhere.

But there were few in the key conversations during the financial crisis, if recently published “you-are-there” books are to be believed. Here’s a look at how Pandit has been portrayed in such tomes, from his succession of former Citigroup chief Charles Prince in December 2007, to getting called a “jerk” by Jamie Dimon, to his famous—and blatantly obvious—observation at the peak of the crisis that the government bailouts to the banks would offer “cheap capital,” to his toxic relationship with FDIC chairwoman Sheila Bair.

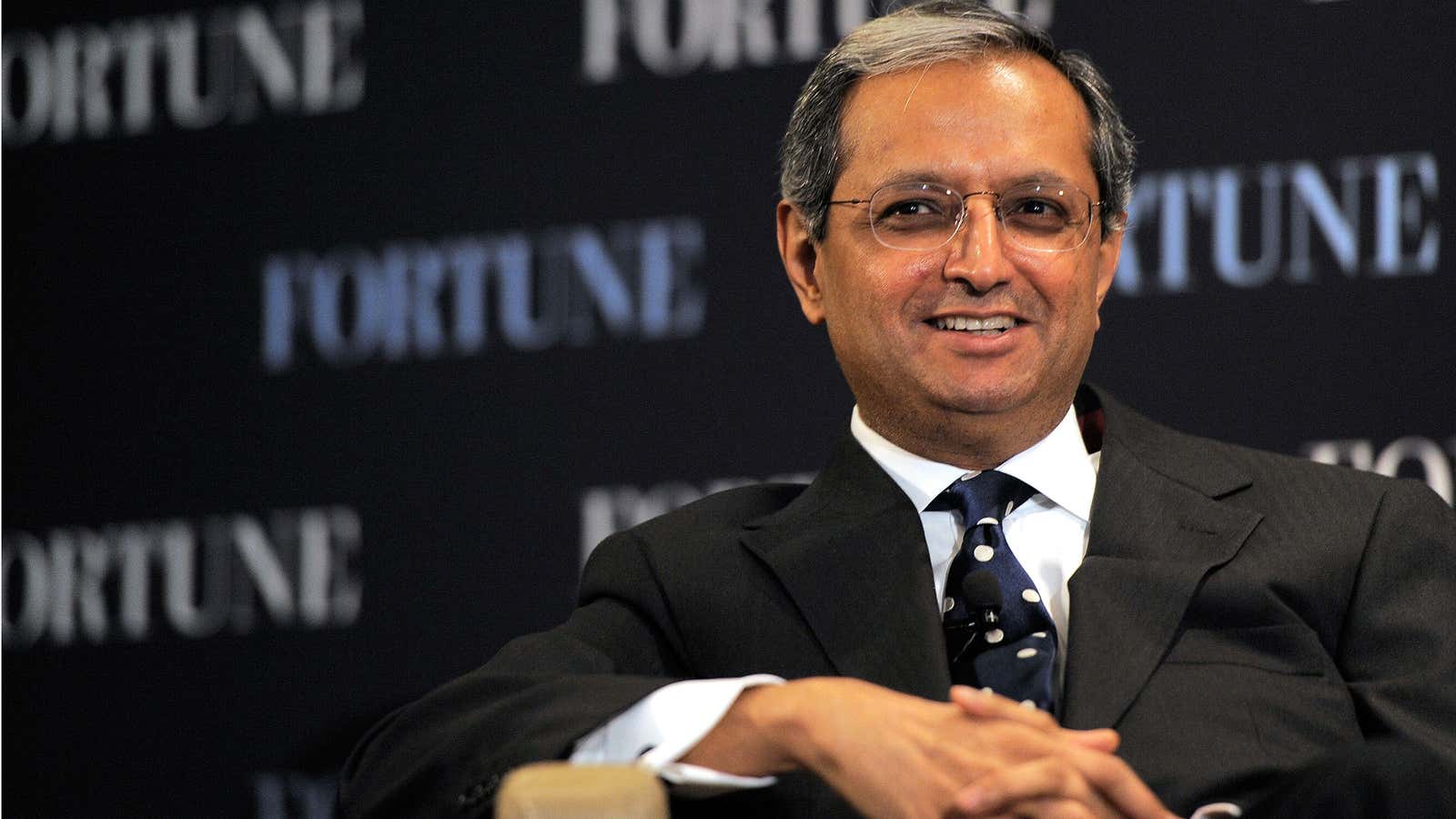

Roger Lowenstein, in The End of Wall Street, looks at how Citi under Pandit was “perennially undercapitalized”:

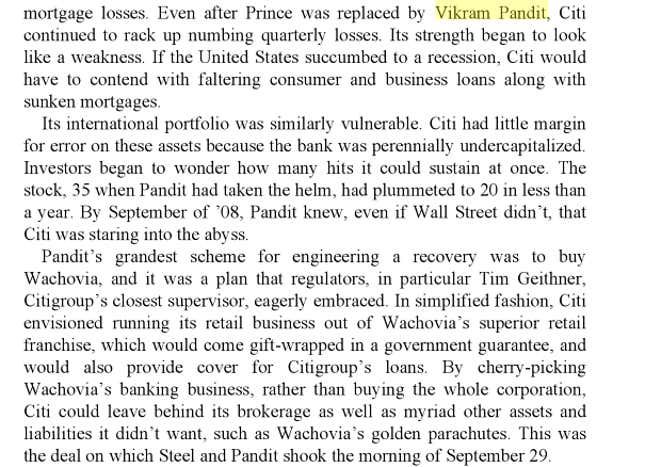

William Cohan, in House of Cards: A Tale of Hubris and Wretched Excess on Wall Street, recounts the time JP Morgan’s Jamie Dimon called Pandit a “jerk”:

David Wessel’s In Fed We Trust relates Pandit’s exultation over the government bailout terms:

Former FDIC Chair Sheila Bair, in Bull by the Horns: Fighting to Save Main Street from Wall Street and Wall Street from Itself, charges that Pandit was too inexperienced to run Citi:

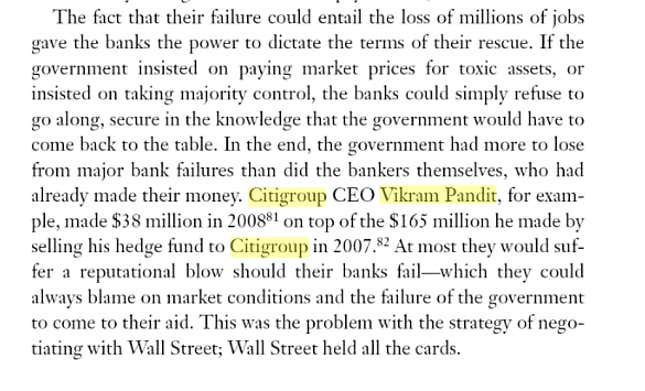

Simon Johnson’s 13 Bankers makes the point that Pandit, like many other bank chiefs, had too little to lose: