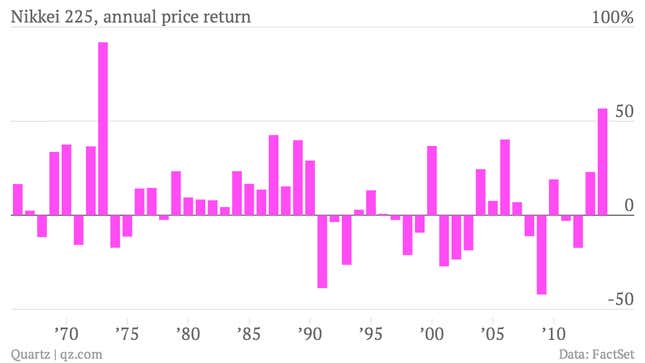

Any way you slice it, it was a tremendous year for Japanese stocks. One of the world’s best performing asset classes, the central bank’s effort to reflate the economy helped drive a 57% price gain in the Nikkei 225 this year. The stock market benchmark index ended the year today at 16,291, its highest level since December 2007. This year’s rise in the Nikkei was the best for the benchmark index since 1972, when it rose nearly 92%. And, in percentage terms, it outpaced all of of the best years of Japan’s red hot markets in the 1980s.

It’s worth noting that even with this year’s outsized gains, Japan’s stock market is still nowhere near the peaks it hit during the late 1980s—before a real estate bust and related banking crisis sunk the country into its current malaise. In fact, the Nikkei is still 58% below its December 1989 peak.