Conventional wisdom holds that American consumers have changed a lot in the past 30 years. Just look at millennials and the many things they’ve killed.

But that conventional wisdom is basically wrong, says the large consulting, auditing, and risk-management firm Deloitte.

The company spent a year wading through government data, talking to industry leaders and analysts, surveying more than 4,000 US consumers, and using its consumer-insights division to analyze more than 200 billion credit card transactions. Its conclusion, laid out in a new report, is that, while the environment around US consumers has changed significantly, consumers have barely changed at all. How much of their money they’re spending on different categories, such as entertainment, dining out, alcohol, and furniture, has remained relatively stable—with one exception. The share of spending devoted to clothing has dropped by more than half since 1987.

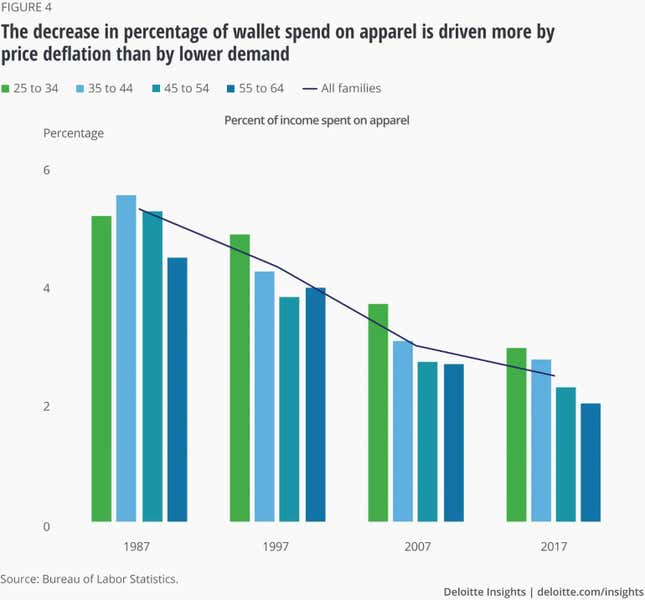

Data from the US Bureau of Labor Statistics show that in 1987 US shoppers devoted about 5% of their discretionary spending to clothes. In 2017 it was about 2%. Younger shoppers tend to spend a bit more, but the overall trend has been consistent across age groups.

What’s driving the decrease, though, isn’t consumers buying less clothing: Deloitte notes that the number of clothing items US shoppers are purchasing grew consistently over the period studied. Rather, clothes are getting cheaper because of pressure from “market forces,” the firm says.

For decades, fashion brands engaged in intense price competition have been seeking out ever-cheaper places to make their clothes. While retail prices overall have risen in the US, clothing hasn’t kept pace. Experts say the business model behind cheap fashion directly contributes to the labor and human rights abuses seen in the industry’s supply chain. Consumer behavior helps drive it. In its surveys, Deloitte asked shoppers their reasons for choosing to shop at a retailer. Price was the most common response, beating out product selection, convenience, and several other factors. Next to last on the list was “alignment with core values.”

“Much has been said and written about how consumers seem increasingly focused on where products are sourced from, child labor in product development, supply chain transparency, sustainability, and other ethical matters,” Deloitte notes. “We found that consumers still look to value, product, and convenience as the overwhelmingly important attributes while making decisions. This finding is in line with the values that have been held by generations of US consumers.”

The report also questions the common belief that millennials are spending more than older generations on experiences, versus things. In the entertainment category, for example, income level—rather than age—was a bigger factor in driving additional spending.

What millennials are spending more on are non-discretionary expenses, such as health care, housing, and education. At the same time, they’re “dramatically” worse off financially than previous cohorts, the report says. Since 1996, the average net worth of consumers under age 35 has fallen by 34%.

Perhaps cheap clothing offers consumers at least one low-cost thrill, while big purchases get tougher to afford. As Deloitte noted in a previous report, retail is polarizing toward the high and low ends just as the same happens in American incomes and the middle class shrinks.