On a May evening in Los Angeles, about 30 women gathered at the newly opened San Vicente Bungalows—a private West Hollywood club where actors like Armie Hammer read scripts in the courtyard and annual dues run upwards of $4,000. Mostly in their 30s, the women wore their jackets draped over their shoulders and sipped champagne. As dusk faded to night, they repaired to a small upstairs room with pink-striped wallpaper and a long table set with copious flowers and pewter candlesticks. The occasion was not a celebrity’s birthday, a film’s premiere, or even the launch of a new fashion brand.

Rather, the guest of honor was a mysterious molecule: cannabidiol, or, as many of us know it, CBD.

The event’s hosts, Ashley Lewis and Nandita Khanna, met one another at Gwyneth Paltrow’s wellness empire, Goop, where they both worked between 2016 and 2018. Lewis left Goop to start Fleur Marché, an online “cannabis apothecary” selling CBD-enhanced everything from $12 patches for menstrual relief to $110 sleep tinctures. In two weeks’ time, Khanna would start a new position as the editorial director for Feals, a CBD company marketing and selling its tinctures the way Casper does mattresses and Away does suitcases—with a data-informed, direct-to-consumer approach and Instagram-friendly photographs of satisfied customers in striped shirts.

This was the first in a series of events Lewis and Khanna conceived to bring together CBD brands with curious consumers—and the consumers are many. On this particular night, the dinner party sat rapt while Emily Heitman, the baby-faced chief marketing officer of a beauty brand called Leef Organics, talked about the wonders CBD could do for one’s skin.

And that’s not all. Across the US—and in other markets around the world—believers are rubbing CBD balm onto their aching joints, dropping CBD tinctures under their tongues, popping CBD gummies, puffing on CBD oil-filled vaporizers, sipping CBD lattes, and offering their dogs CBD-laced treats. CBD—which is derived from the cannabis plant, but doesn’t make users feel high—was not on most market researchers’ radars five years ago. Today, analysts modestly estimate the US market was several hundred million dollars in 2018, and that it will surpass $20 billion by 2022.

It’s easy to see how. Earlier this year, Kim Kardashian threw a “CBD-themed” baby shower and the fast food chain Carl’s Jr. topped a burger with “CBD-infused Santa Fe sauce.” Football hall-of-famer Terrell Davis—also the founder of a CBD beverage called Defy—is among the pro athletes lobbying for its acceptance as an alternative to prescription drugs. CBD is also the active ingredient in the seizure medication Epidiolex, the first cannabis-derived drug approved by the US Food and Drug Administration, and earlier this year a small study suggested it could help curb the cravings of heroin addicts.

Table of contents

What is even happening? • How did we get here? • How big is the market for CBD? • What do you mean when you say hemp-derived CBD? • What is this stuff? • How does it work? • What about side effects? • How well-proven are CBD’s miraculous results? • What about stress and anxiety? • Wait. Is this legal? • Where is all this CBD coming from? • What other players should I know? • What’s next?

What is even happening?

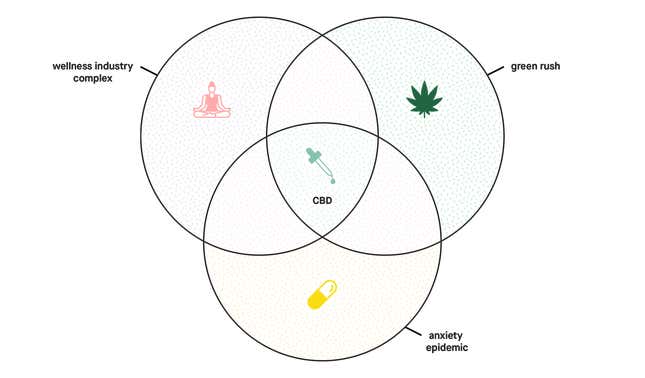

At the intersection of the $4 trillion wellness-industrial complex, the $17 billion legal cannabis industry, and the anxiety epidemic crippling America sits a little bottle of CBD oil.

US government agencies have fanned the flames of the CBD craze by fumbling to align themselves with a single understandable policy that allows for the responsible testing, labeling, and sale of the stuff. The regulatory and scientific grey area left behind provides just enough shade for hucksters, of which there are many, selling quasi-legal products—some of which contain what they purport to, but many that don’t.

Of course, there are also many responsible companies producing and selling CBD products. Some of the most significant players are legal cannabis operators—whether in Canada or in states such as Colorado and California—that are using CBD as a way to enter markets where weed isn’t legal yet.

HISTORICAL INTERLUDE

How did we get here?

How big is the market for CBD?

Analysts at Cowen and Company estimated 2018 retail sales of hemp-derived CBD products in the US alone fell somewhere in the wide swath between $600 million and $2 billion. The Brightfield Group, a research firm focused specifically on the cannabis industry, pegged the US hemp-derived CBD market in 2018 at $590 million, and predicts that number will increase tenfold by the end of this year, to $5.7 billion. Brightfield projects the US market will balloon to a whopping $22 billion by 2022—but that’s assuming US agencies such as the FDA give it a wholesale endorsement. (More on that later.)

Brightfield also estimates the two biggest markets behind the US—Europe and Canada—will be worth a combined $615 million in 2019.

DEJARGONIZER

What do you mean when you say hemp-derived CBD?

CBD comes from the cannabis plant, of which hemp and marijuana are both varieties. In the US, the THC content (THC being the psychoactive chemical compound that gets you high) of the plant determines whether it’s officially “industrial hemp” in the eyes of the government. If it has less than 0.3% THC, then it’s hemp. If not, it’s marijuana, pot, weed, the devil’s lettuce. (Fun facts: in Switzerland, the tolerance for THC in legal cannabis is higher, at 1%. In Italy so-called “cannabis light” can only have 0.2% THC.)

So when analysts lump it all together to include both hemp and cannabis-derived CBD in their market estimates, the numbers increase. Researchers at BDS Analytics recently released a report estimating that cannabis and hemp-derived CBD products were worth $1.9 billion in the US last year.

What even is this stuff?

CBD stands for cannabidiol—and spoken aloud, people choose to emphasize as many different syllables as that word has. Cannabidiol is one of many chemical compounds in a class called “cannabinoids” that naturally occur in cannabis plants. The other one you’ve likely heard of—and was once far better-known than CBD—is tetrahydrocannabinol, also known as THC.

Everyone’s new favorite cannabinoid is, at its core, just a molecule. Its chemical makeup—21 atoms of carbon, 30 of hydrogen, and two of oxygen—is actually identical to that of THC, but how those atoms are arranged in the chemical structure is different, and so is the way that it interacts with our bodies.

While THC is feared and beloved for its ability to get users high, CBD holds promise in part because it doesn’t. Among CBD’s reported benefits are relief from anxiety, joint pain, post-traumatic stress disorder, menstrual cramps, insomnia, nausea, seizures, bowel inflammation, and plain old moodiness. (More to come on what’s clinically proven.)

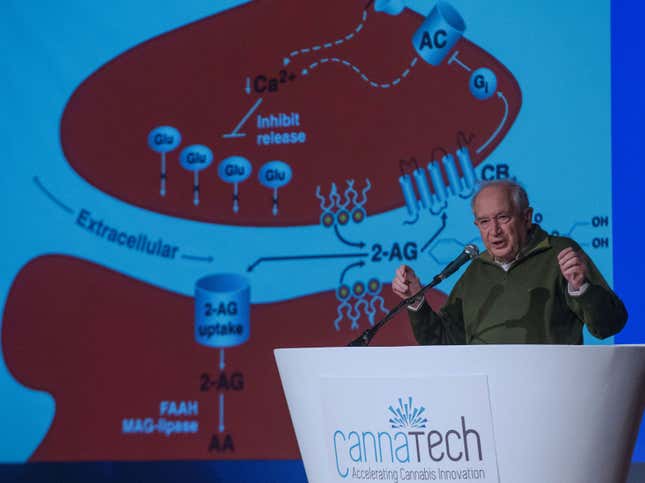

How does it work?

Our brains and nervous systems are packed with a network of neurotransmitters called the endocannabinoid system. That system is stimulated by cannabinoids, including CBD. Researchers hypothesize that this system acts as a powerful “dimmer switch,” helping modulate brain activity and mood. Some even suggest it’s the endocannabinoid system—rather than endorphins—that exercise activates, resulting in the euphoric elation of a “runner’s high.”

By interacting with the endocannabinoid system in various ways, CBD can provide relief from pain, anxiety, and nausea, says Yu-Fung Lin, an associate professor of physiology and membrane biology at the University of California-Davis School of Medicine, who teaches a course on the physiology of cannabis. And beyond our brains, CBD may benefit our bones and immune systems and work broadly throughout the body as an anti-inflammatory and antioxidant, which could help protect cells from damage associated with neurodegenerative diseases.

All this amounts to what writer Moises Velasquez-Manoff recently described for The New York Times Magazine as “a kind of full-body massage at the molecular level.”

What about side effects?

CBD is often touted as “non-psychoactive,” which is the source of some rightful controversy and consternation in the weed world. CBD won’t make us feel high, or affect our motor functions or perception of reality the way a high-THC strain of cannabis or a strong cocktail would. But it’s still working on our brains, says Lin. (For this reason, many prefer to say CBD is non-intoxicating or non-psychotropic, but not non-psychoactive.)

Other side effects, such as drowsiness and nausea, are minimal. A June 2018 report issued by the World Health Organization (pdf) declared CBD to be “generally well tolerated with a good safety profile.” That said, it can affect the way our bodies metabolize other drugs, including benzodiazepines, anti-depressants, and blood-thinners by inhibiting an enzyme that breaks them down.

And how well-proven are CBD’s miraculous results?

Aside from treating seizures as a result of childhood epilepsy, not very—at least not in humans. CBD is wildly understudied relative to its popularity, in part because the DEA classified all cannabis as a Schedule I drug until the end of 2018, hampering research in the US.

“Science is very far behind,” Ziva Cooper, the research director at the University of California-Los Angeles Cannabis Research Initiative, told me in April. “There really isn’t very much evidence in humans with respect to [CBD]’s effectiveness … And when I say evidence in humans, I’m really talking about rigorous, double-blind placebo-controlled studies.” On the other hand, Cooper says, there’s also not much research showing that cannabidiol doesn’t work for things. “There is just a general lack of studies—period.”

Much of the promising research has come from Israel, where medical cannabis has government support. Raphael Mechoulam—who, as you may recall, pioneered the study of cannabinoids and the endocannabinoid system—is now 88, and still keeps an office at the Hebrew University of Jerusalem’s school of pharmacy.

And as parents such as Charlotte Figi’s have demonstrated, when it comes to CBD, the pharmaceutical industry is taking cues from popular uses.

“People have this hope that [CBD] will really help to alleviate lot of disease states and symptoms that are not easily alleviated with traditional medication,” said Cooper. “Throughout the last 70 years cannabis has been a pretty polarizing topic, from people believing that it was the ‘devil’s lettuce’ to people believing that it’s medicine.”

Today, CBD is helping to push that social acceptance (and science) along.

Cooper is optimistic about CBD’s potential to treat various symptoms, based on studies done in animals. In humans, she says, the picture is “pretty complicated”—especially when it comes to effective dosages and varying ratios of CBD to THC.

ASKING FOR A FRIEND

What about stress and anxiety?

Data shows that most CBD users are seeking and relief from stress and anxiety—and studies of rats and mice have shown that CBD administered in moderate doses could show some promise there.

In one bonkers and somewhat upsetting 2012 study, scientists observed the behavior of mice, some of which were pre-treated with CBD, after a wild boa constrictor was introduced to an “arena” with them. Spoiler alert: “In no case did a snake eat an experimental mouse.” But the CBD-treated mice did exhibit fewer “panic-like” responses, such as freezing, urinating, or attempting an “explosive escape,” when faced with the snake. Researchers concluded the CBD-treated mice were experiencing less fear than those who got the placebo, despite this truly terrifying scenario. So there’s that.

For humans, the research is thinner. A couple of studies have shown CBD to have an anti-anxiety effect in very specific situations. In one of those, researchers gave 60 people either a placebo, the anti-anxiety drug clonazepam (sold under the brand name Klonopin), or one of three doses of CBD (100 mg, 300 mg, or 900 mg) before a public speaking test. Those who took the medium dose (300 mg) of CBD showed lower anxiety than those who took the lowest and highest doses of CBD, or the placebo. (The clonazepam worked well, too, though it also generated a more sedative effect than the medium-dose CBD.)

But as Cooper notes, “to understand cannabidiol’s effect on anxiety, you want to test it in a population that has anxiety, and look at what happens when they’re using cannabidiol every day for a couple of weeks.” In this study, each subject only got a single dose.

Other animal studies suggest CBD could also act as an antidepressant. In a 2010 study, scientists in Brazil injected mice with one of three doses of CBD, an antidepressant called imipramine (an uncommonly prescribed drug sold under the brand name Tofranil), or a placebo. Then, they dropped the mice into glass cylinders of water, forcing them to swim for their lives for six minutes. This procedure, commonly used to evaluate antidepressants, is sometimes called the “behavioral despair test,” the idea being that scientists measure how long the mouse will swim before giving up in despair. Lo and behold, the mice injected with the medium dose of CBD and the imipramine persevered for significantly longer than their compatriots given a low-dose, high-dose, and placebo. (If you’re interested in what else has been proven in preclinical trials when it comes to CBD’s most popular uses—and have a strong tolerance for harrowing animal studies—see here.)

The results of a new study published in the American Journal of Psychiatry, albeit with a sample size of just 42 people, found that CBD helped reduce cravings and anxiety in heroin addicts—a particularly promising area given the US’s rampant opioid epidemic.

Wait. Is this legal?

Let’s talk about the US, which is currently the world’s biggest CBD market.

On December 20th, 2018, US president Donald Trump signed the 2018 Farm Bill into law. The legislation removed CBD from Schedule I of the Controlled Substances Act (classified as dangerous and of no medical use) and clarified hemp’s status as an agricultural product, making benefits such as crop insurance available to hemp farmers. That’s pretty huge when you consider that until 2014, it was illegal for US farmers to grow hemp at all.

Although the FDA has been slower to act, commissioner Scott Gottlieb has clearly stated his agency’s intention to regulate products with CBD. So far, that has amounted to sending warning letters to companies making unfounded health claims—such as slowing the progression of Alzheimer’s or stopping cervical cancer growth—and holding a public hearing on May 31 for industry players to air insights and concerns. (More than 400 people applied for the privilege, which was granted to some 120.)

One of those players was Jonathan Miller, whose trade group includes the CBD companies CV Sciences and Lord Jones. Miller said he hopes to see the FDA formally recognize CBD as a dietary supplement or food additive within the next 12 months. He visualizes a future where CBD is treated similarly to fish oil—considered a “nutraceutical” (ie: available over-the-counter at health food stores and such, without any attached health claims) in less-concentrated amounts, and available with a prescription at higher strengths.

“It would once and for all establish the legality of all the CBD products that people are purchasing,” said Miller. “And would unleash what’s projected to be a multibillion-dollar industry”

Earlier this year, the European Union added CBD extract and foods containing CBD to a regulatory category called “novel foods”—a list of foods not conventionally consumed in the EU before 1997, which includes things like chia seeds and noni fruit juice. This means CBD producers have to jump through an additional regulatory hoop from the European Commission before selling their products in the EU.

Where is all this CBD coming from?

For starters, from farmers. Will Brownlow, who has been farming in southeast Kentucky for close to three decades, told me he first planted 10 acres of hemp in 2016 for the “novelty factor.” In 2018, he planted 40, and this year he plans to cover 60 to 80 acres (25 to 32 hectares) of the 340 acres he farms in hemp.

Brownlow is not the only farmer upping his hemp acreage. Since the US 2014 Farm Bill opened up industrial hemp cultivation to state-controlled pilot programs, the land area of planted hemp has more than doubled every year, according to data from the US Department of Agriculture.

In Brownlow’s case—and likely that of many other Kentucky farmers—those fields planted with hemp were once home to tobacco plants, and then soybeans. In December, he said an acre of soybeans only got him $500, but an acre of hemp—dense with flowers rich in CBD—could yield as much as $30,000.

“The plant is a weed, and it likes to grow,” he said. “The hope was it would move beyond the novelty stage and actually be worth something … There are a lot of things you can do on a farm, but there aren’t a lot of things you can do to make money.”

The leading exporters of hemp oil to the US in 2018—which includes oil such as that of the seeds, which does not contain CBD—were Canada, the Czech Republic, and China, according to the International Trade Centre. And within the first three months of 2019, China has already exported nearly 75% of last year’s total number. Hemp cultivation in China is highly regulated, and the bulk is grown in the Yunnan and Heilongjiang provinces. According to the South China Morning Post, those two provinces accounted for one-third of the world’s legal commercial hemp crop in 2017. Hanma Investment, the first company permitted to extract CBD in southern China, has partnered with Kentucky-based Kings Royal Biotech to build a $40 million processing facility, and has another one underway in Las Vegas.

What other players should I know?

So glad you asked. Here is a primer on some interesting and important names in the CBD business.

The game-changers

GW Pharmaceuticals

This British biopharmaceutical company was the first to gain approval for a cannabis-derived drug from the US Food and Drug Administration (FDA) for Epidiolex—a fruit-flavored liquid form of CBD. It is used to reduce seizures caused by two potentially fatal forms of severe childhood epilepsy, Lennox-Gastaut syndrome and Dravet syndrome.

Charlotte’s Web, or CW Hemp

Arguably the OGs of the CBD craze, this publicly-traded, Boulder, CO-based company started the craze when one of the Stanley Brothers—there are seven—provided an extract from a CBD-rich strain of cannabis to the despondent mother of Charlotte Figi, then a five-year-old who suffered hundreds of seizures per week as the result of Dravet Syndrome, a form of childhood epilepsy. The seizures went down dramatically, and Charlotte’s story was featured by CNN’s Sanjay Gupta in 2013. Today she is the namesake of the company that is publicly traded in Canada, where its valued at about $CAD 1.83 billion ($1.36 billion), and controls the largest share of the US hemp-derived CBD market with its value-priced tinctures, topicals, and capsules.

Curaleaf Hemp

This Massachusetts-based vertical operator started out in medical cannabis and has its own cultivation sites, processing sites, and dispensaries in states including New Jersey, New York, and California. In November, the company launched a hemp-based CBD line, and in March, it announced that line would be sold in—wait for it—CVS.

Tikun Olam

Established as a medical grower in 2005 in Tel Aviv with the permission of Israel’s Ministry of Health, Tikun Olam’s business model is now that of a cannabis brain-trust—and strain-trust. Exporting research and development, licensing the rights to its strains, and partnering with local companies in international markets has made Tikun Olam a global player. (When Tikun Olam’s Canadian partner, MedReleaf, merged with Aurora in 2018 Tikun Olam’s 10% stake was valued at $250 million.) Its star strain? Avidekel, an award-winning CBD-rich Indica. And just last week, Tikun Olam launched Tikun Hemp, a line of CBD tinctures, topicals, and softgels, in the US.

CV Sciences

This San Diego, CA-based public company has two distinct divisions: consumer products and pharmaceutical development. With the former, it controls the second-biggest share of the US hemp-derived CBD market, with its PlusCBD Oil brand in over 2,000 retailers—and now bound for Kroger stores in 17 states. With the latter, it is developing drugs including a chewing gum that contains nicotine and synthetic—as opposed to plant-derived—CBD to help tobacco users quit.

The Canadians are coming

These licensed cannabis producers—also known as LPs—have the Canadian government’s blessing (in the form of a federal license) to cultivate, process, and sell their product. Unlike US producers, they can also list on the US stock market, because (unlike US cannabis producers), they’re not breaking any federal laws.

Until cannabis is federally legalized in the US, hemp-derived CBD provides an inroad to the US market for Canadian companies. Below are two notable ones you should expect to see there by year’s end—but they probably won’t be alone for long. A recent Cowen and Company report notes that all the major Canadian LPs including Aphria, Aurora, Cronos, Emblem, Emerald Health Therapeutics, The Green Organic Dutchman, Hexo, and Neptune Wellness have voiced interest in the CBD opportunity.

Canopy Growth (NYSE: CGC)

One of the world’s biggest cannabis companies, this publicly traded Ontario-based producer announced in January 2019 that it would invest $100-150 million to build a “hemp industrial park … capable of producing tons of hemp extract on an annual basis” in New York. The following month CEO Bruce Linton saidhe expected to have product on the market there by Q4 of the same year. Construction reportedly begins this summer on a 48-acre property near the PA border. Canopy’s recent US patent filings for “Hemp Break” and “Hemp Buzz” include categories like skincare, supplements, snacks, and more.

Other things to know about Canopy:

• In August 2018, it got a $4 billion infusion from Constellation Brands, the booze giant that owns brands including Corona, Modelo, and Robert Mondavi.

• The company struck a deal to buy the US-based Acreage Cannabis (which boasts former US House of Representative’s speaker, John Boehner on its board) if and when cannabis is legalized in the US.

• Canopy also has an eye on the Latin American market. In February, CEO Bruce Linton said the company has 70 people working across four countries there.

• It has Martha Stewart on its side to market CBD for pets.

Tilray (NASDAQ: TLRY)

Tilray, which has been in the medical cannabis game in Canada since 2013, and sells its products internationally through pharmaceutical distributors, is making moves toward the US CBD market through recent partnerships. (Catherine Jacobson, a neuroscientist who heads up medical affairs for Tilray, was recently featured in a New York Times Magazine story about CBD, for her research-pushing role as the mother of a son suffering mightily from seizures caused by epilepsy.)

In February of this year, Tilray acquired hemp foods company Manitoba Harvest, which according to Cowen and Company already has its products in some 16,000 stores, including Whole Foods. (I used to sprinkle their hemp seeds on salads and smoothies; not bad!) In case those “hemp hearts” are making you thirsty, Tilray has also formed a $100 million joint venture with Anheuser-Busch InBev (AB InBev) to research CBD-infused beverages.

The company has also partnered with Authentic Brands Group (ABG), which includes sporty brands including Muhammad Ali, Shaquille O’Neal, Volcom, and Prince (the tennis brand, not the musician). Curiously, on a recent earnings call, ABG’s Nine West was the ABG brand Tilray CEO Brendan Kennedy cited in regards to seeing a product by year’s end. Maybe something for high heel-related pain?

The high end

These are a few of the premium US companies founded on cannabis containing THC that are moving into the CBD business. (Get it? High-end.)

Lord Jones

Robert Rosenheck and Cindy Capobianco, a couple of New York marketing veterans who transplanted to Los Angeles, started this luxury cannabis company in 2015. Two years later, they started using hemp-derived CBD in their sugar-dusted gumdrops, piney-scented lotion, and tinctures such as “Royal Oil” to take their products to a national audience. Today, Lord Jones’ CBD products are carried in Sephora and endorsed by celebrities including Mandy Moore, Busy Phillips, and Olivia Wilde, and the company has plans to open a “cannabis boutique” inside the West Hollywood Standard Hotel.

Beboe

Like Lord Jones, Beboe began in the luxury cannabis space—co-founder and tattoo artist Scott Campbell told me his company’s vape pens and pastilles were “grown-up drugs” in 2017. Since then, the company was purchased by the Chicago-based producer Green Thumb Industries (GTI), launched an exclusive partnership with Barneys, and has expanded with a brand called Beboe Therapies, which makes hemp-derived CBD face serum and face masks carried in stores including Neiman Marcus.

Bloom Farms

This San Francisco-based cannabis company is known in California for clean products, luxe branding, and a sense of social responsibility. (It donates a meal to a food bank for every product sold and has committed to sourcing 50% of its flower from female farmers by the end of 2020.) Bloom Farms introduced its first high-CBD oil-filled cannabis cartridge in 2016 and captured a significant share of California’s cannabis-derived CBD market, according to a Brightfield report. In January 2019, Bloom Farms went national with a series of hemp-derived CBD tinctures touted as “true full-spectrum, whole plant, and USDA Organic.”

Interesting indies

Foria

Sex sells. Founded by a veteran of a latex-free condom company, the California-based Foria sells CBD-enhanced lubricants that have won rave reviews from writers at Cosmopolitan and Vice, and suppositories for menstrual pain. A London-based company in the sexual health category, Daye, also just won $5.5 million from Khosla Ventures to manufacture and market CBD-enhanced tampons to fight cramps.

Lazarus Naturals

Health insurance—for those who have it—in the US doesn’t cover cannabis-derived drugs. This Seattle-based company offers a 60% discount for customers in need who can prove they’re veterans, have a long-term disability, or earn an income below the national poverty level. For everyone else, the tinctures are still priced at the high-value end of spectrum—$0.04 per mg of CBD, as opposed to $0.24 from Lord Jones.

Care By Design

The first CBD oil I ever encountered was Care By Design’s and amongst Californians, I’m probably not alone in that. A 2017 survey found this OG in the CBD category to be the #1 cannabis-derived CBD brand in the state. Today it sells tinctures, capsules, topicals, chocolates, and vape cartridges in five different ratios of CBD:THC. The most popular? The highest in CBD, 18:1.

What’s next?

CBD suppositories, miracle drugs, dog treats, and sports drinks are just the beginning. As Tilray CEO Brendan Kennedy said about this year’s Expo West natural foods show: “I made a joke the final day that the only thing I didn’t see was the CBD toothpaste. And two people sent me a CBD toothpaste.”

Is this a bubble? What’s next? The party is only starting, so relax and ready yourself for a CBD-enhanced deep dive featuring analysis, product roundups, and more CBD-charts than you can shake a vaporizer at.