Our everyday experience is increasingly blending the physical and digital worlds. The number of Internet of Things (IoT) connected devices in the world is closing in on 7 billion, or nearly one device for every person in the world. Quite simply, we’re more connected than ever. As the fourth industrial revolution (4IR) becomes pervasive, monitoring and analysis will get more precise as more IoT products are put out in the field.

Even before the term 4IR was coined, manufacturers were at its forefront. For example, automakers’ adopted the use of factory robots en masse in the 1970s, and most companies have been collecting operational and machine data for years.

But now manufacturers are in the deep end of the pool adopting advanced technologies. More importantly, they are finally converting all that data into productive insights and automated, closed-loop actions. They’re wading into other innovations such as virtual and augmented reality, 3D and 4D printing, nanotechnology, autonomous and collaborative robots called “cobots”, advanced analytics, and the Industrial Internet of Things. As performance improves and costs decline for these new technologies, mainstream adoption seems inevitable.

Understanding how and where manufacturers are applying 4IR tech—and what they’re getting out of it—offers lessons for many industries, from consumer products and electronics to durable goods makers and energy companies. A recent survey of US manufacturers conducted by PwC and The Manufacturing Institute, which is the research arm of The National Association of Manufacturers, reveals that manufacturers are currently in a phase of measured optimism and adoption.

What manufacturing can teach us about 4IR

Three overarching and cross-industry lessons clearly surface:

- Prioritize 4IR capabilities for products and operations

- Get your workforce 4IReady through re-training and recruitment

- Develop a goal-driven 4IR strategy

How widespread is 4IR?

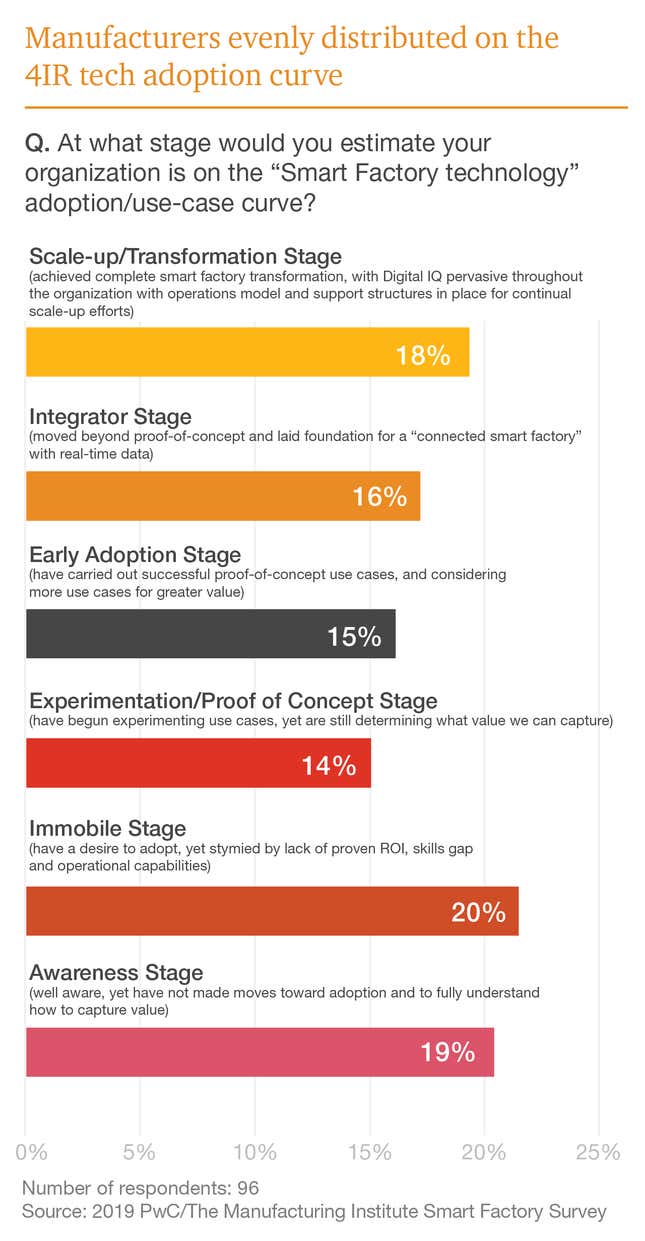

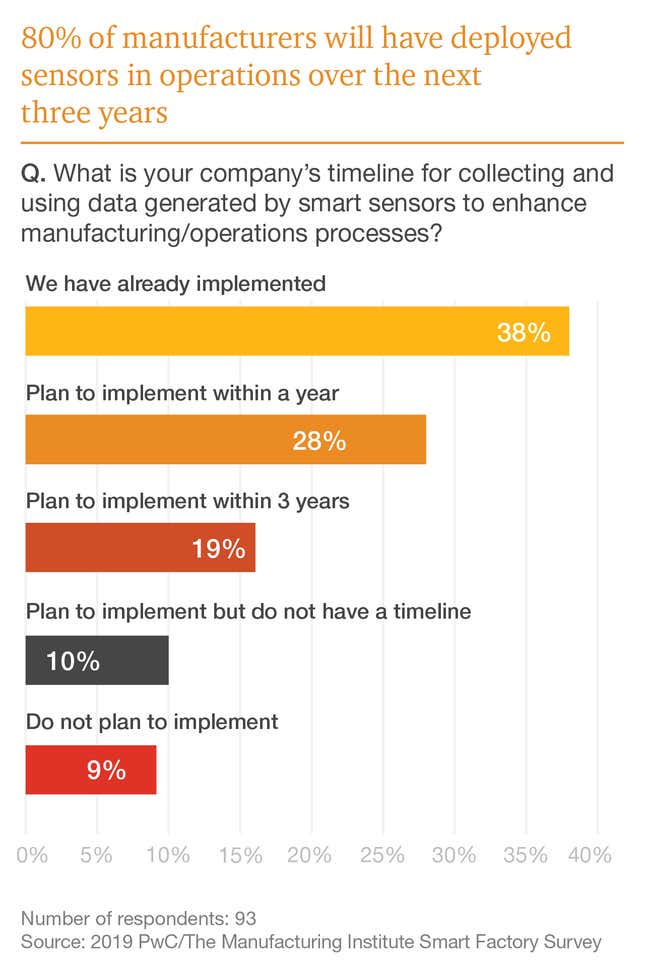

Manufacturers are spread evenly along the innovation adoption curve when it comes to 4IR. Only about 20% are implementing 4IR technologies at scale, but nearly half of manufacturers report they are in the early stages of transition. Getting to scale is a strategic priority: Nearly 70% of manufacturers plan to increase investments in 4IR tech over the next year and about 60% of manufacturers will have embedded smart sensors in products in the next year.

Long-term goals for this kind of investment include improved operations, expanded products and services, and faster, more proactive customer service. Additionally, manufacturers are adding a layer of connectivity to their product portfolios by creating new products and services.

Takeaway #1:

Scale inside—and outside—the organization

There’s a strong push within manufacturing sector to reach the fully scaled, fully implemented phase by deploying 4IR innovation inside the company (i.e., in operations and through the supply chain). Meanwhile, on parallel tracks, the sector is also breathing new life outside the company by introducing data-gathering capabilities and digital connectivity (i.e., combining sensors, IoT, and data analytics) in both legacy and new products.

How do you build a hybrid workforce?

Automating tasks, especially those that are onerous, tedious, or dangerous, has been a front-and-center ask of technology for some time. That could mean deploying autonomous forklifts and collaborative robots, or increasing asset performance through artificial intelligence.

But US manufacturers know that automation technology will only be as good as the people who drive it. According to our survey, nearly seven in ten manufacturers believe that an increased demand for talent to build and manage the robotic workplace—will have the biggest impact on the manufacturing workforce over the next three to five years.

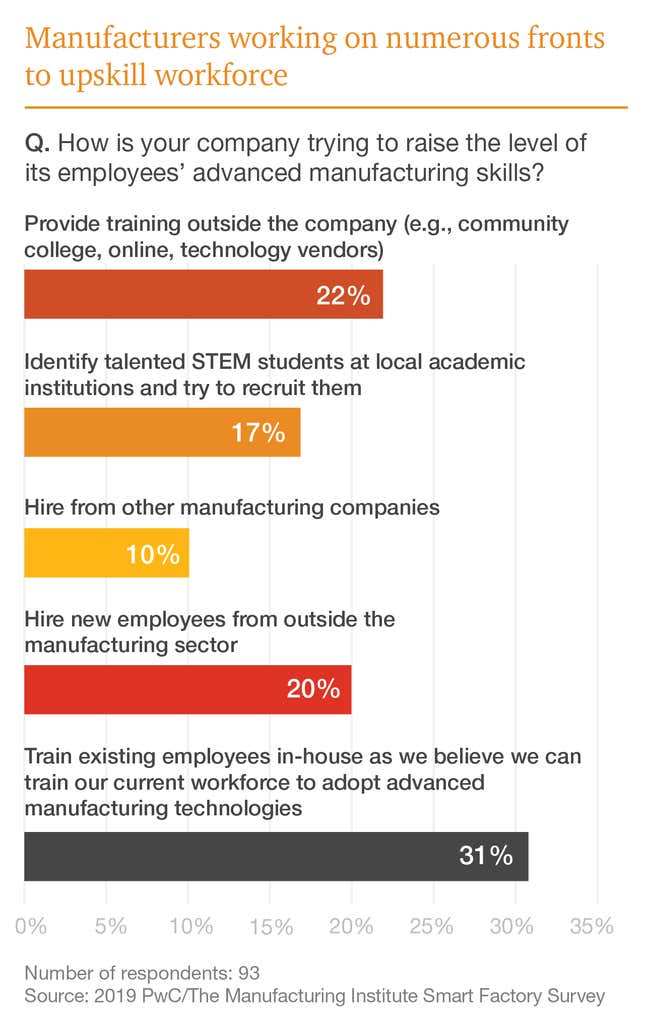

Manufacturers are working on many fronts to further develop skills. One-third of these companies train employees in-house, one in five provide training outside the company, and the same percentage recruit STEM students from academic institutions.

Takeaway #2: Strengthen your talent through re-positioning and recruitment

As with previous industrial revolutions, the nature of jobs will change. Any industry deploying 4IR technologies and innovation should take a two-pronged approach. That means identifying jobs for automation that do not require human soft skills (i.e. creativity, reasoning, communication) and identifying new roles for employees that move them from doing repetitive tasks to managing repetitive tasks.

How do you measure returns?

Manufacturers are learning to accommodate scalability and longevity as opposed to one-off, ad hoc pilot experimentation. They’re also realizing that bottom-line benefits come through a strategy that’s built on outcomes rather than technologies. One of the biggest questions hovering over 4IR adoption is how to measure returns.

Transitioning from short-term to long-term strategy means enlisting experts across the organization to create a cohesive and inclusive plan. Building out a strategy requires looking outside the organization to draw on skills and strategies to cross that wide chasm separating 4IR pilots and full-on scalability.

Takeaway #3: Let business strategy drive 4IR investments

Focus first on articulating the business outcomes you want, rather than the newest technology. Once an organization begins to see micro benefits from early 4IR investments (e.g., greater workforce productivity, higher production volume, and improved customer service) they’ll be prepared to create macro benefits such as accepting more volume, re-positioning labor, and improved reliability in operations.

Economic cycles will influence 4IR strategy. In a growth cycle, innovations should be used to create capacity and productivity and lessen dependence on a tight labor market. During a downturn, these same tools can carry out market expansion, price protection, product innovation, and increased operational flexibility and responsiveness.

Many organizations trying to go it alone might find that getting beyond the piloting phase requires outside help. Assuming that a solid strategy is already in place, partnering with third-party vendors can enable a company to speed up the process of building a 4IR architecture and ecosystem that enables scaling.

A comprehensive 4IR strategy will go a long way, whether you’re in the early planning stages or have already adopted new technologies. By incorporating technology for both production and oversight, investing in both humans and machines, and letting business needs drive their strategy, manufacturers will be well-equipped for the new digital era.

This article was produced by PwC and not by the Quartz editorial staff. Sources are provided for informational and reference purposes only. They are not an endorsement of PwC or PwC’s products.