Every time I use a credit card to buy a cheeseburger at In-N-Out Burger, Mint dutifully subtracts $3.12 from my net worth. When I receive my biweekly paycheck, the money management platform automatically sends me a corresponding email notification: “Deposit into Chase Bank.” Mint gives me a comprehensive overview of my situation, and it reminds me when to tighten the purse strings—or let loose.

Through Mint, I’m able to closely monitor my earning and spending. For example, I know that I was $11 over budget on groceries last month, but $50 under my clothing budget. (Yes, I realize this level of precision isn’t for everybody.) But I don’t have to visit each credit card company’s website to view my balances; they’re tabulated together on Mint. Same goes for my retirement accounts at Fidelity and Vanguard. Mint makes things simple, and it’s helped put me on track for financial freedom. Well, eventually.

Since 2006, millions of users have used Mint to create categorized budgets and keep track of their credit scores, as well as outstanding student loans, car payments, and mortgages. Mint is only able to accomplish this because it has complete access into their financial lives. When new users join the platform, they hand over their full slate of usernames and passwords, trusting Intuit—Mint’s parent company, which also owns TurboTax—to protect their logins.

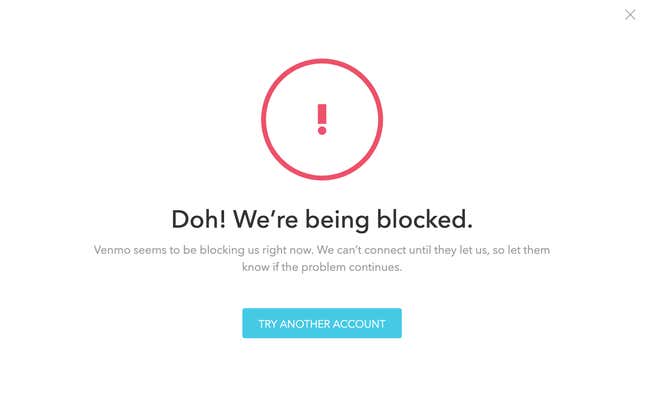

This can go awry, however, when Mint is no longer omniscient—for instance, when the app loses access to a connected account. This can happen because a user changes a password, a service goes down, or one platform no longer supports the other. Usually, it’s a quick fix.

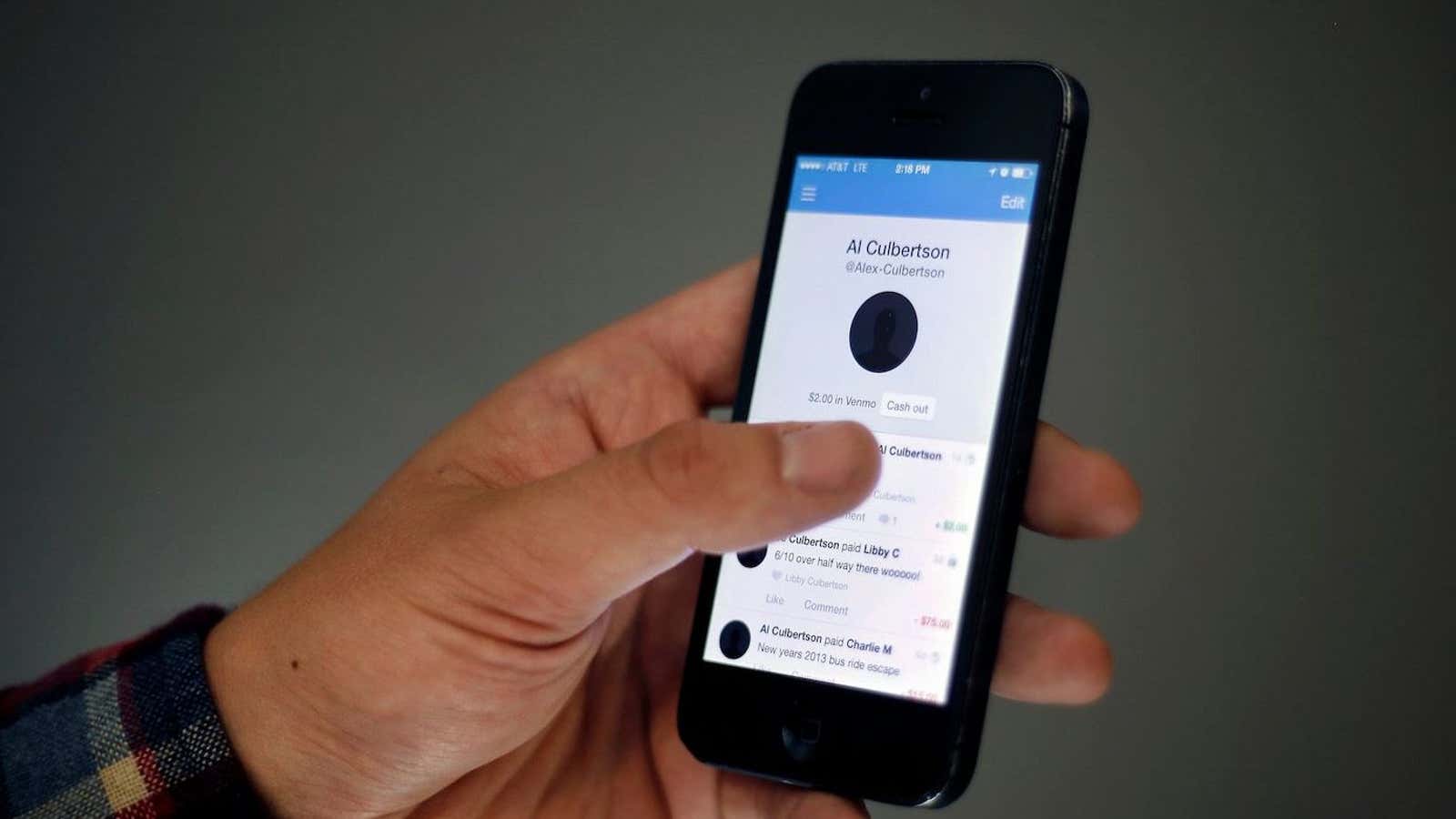

A few weeks ago, I noticed that Venmo—a popular payments service owned by PayPal—was no longer connecting with Mint. This was concerning because I use it to pay rent, my largest recurring expense. My friends also use Venmo to split rent payments and other bills, such as Netflix subscriptions, Uber rides, and bar tabs.

For many, Venmo is an integral part of their daily lives, and its sudden absence from Mint makes personal finance, well, harder. It’s not a complete picture anymore.

At the moment, it’s not clear who’s at fault. “We are working closely with Venmo and their parent company, PayPal, to reestablish the connection for our shared customers,” said Keri Danielski, a Mint spokesperson. However, Mint has been aware of its Venmo glitch for almost two months, judging by a “Known Issue” post on its site, and Danielski repeatedly declined to explain the actual hiccup.

Venmo declined to provide comment for this article. Oddly, Venmo parent PayPal’s own integration with Mint seems to work just fine.

“Mint is an incredibly efficient way to monitor your financial life and anything that takes away from its holistic nature would be a loss for users,” said Monica Padineant, a certified financial planner at Seattle’s Laird Norton Wealth Management. “It is still an incredibly useful tool, even if some synching glitches emerge from time-to-time.”

Neither Mint nor Venmo have actually explained the lapse in connectivity, so we’re left to speculate. Did somebody spill coffee on a really, really important laptop? Is PayPal creating its own money management service? Did Mint suffer a data breach and Venmo decided to pull out?

“It could be a technical problem with the ways their APIs or processes are structured,” said Uday Karmarkar, a professor of technology and strategy at UCLA’s Anderson School of Management. “Perhaps one or the other company wants specific agreements related to branding, or it might just be a hissy-fit on someone’s part.”

The breakdown is a reminder that digital financial management is not foolproof. “Online technologies are great for efficiency, but they don’t replace the human element,” Padineant cautioned. It’s important to pay attention to what is—and isn’t working—to ensure that problems don’t go overlooked.

Whatever the reason for the digital impasse, it’s especially frustrating that Venmo broadcasts it when friends pay one another for Chipotle (or even pay their therapists), but won’t share payment data with a useful financial management tool.

Mint loyalists may consider switching from Venmo to another payments service, like Zelle. This should be viable as long as your bank and your recipient’s bank are participating members in the Zelle payments network. Money should be transferred directly to or from your bank account.

Mint users who want to continue using Venmo can try backfilling transactions—essentially inputting them manually. (That undermines Mint’s convenience factor though.) Another option is linking a credit or debit card to Venmo, so the transaction will be visible in Mint. Beware though, a credit card incurs 3% transaction fee from Venmo, and money received on Venmo won’t be reflected on Mint until you move it to your bank account.

Of course, extra-peeved penny-pinchers may consider dropping Mint in favor of other financial management tools, such as Personal Capital and You Need A Budget. Or they could just learn how to balance a checkbook.