Suddenly, investors can’t get enough of the euro zone’s riskiest bonds

Traders appear to have made a new year’s resolution: Always look on the bright side.

Traders appear to have made a new year’s resolution: Always look on the bright side.

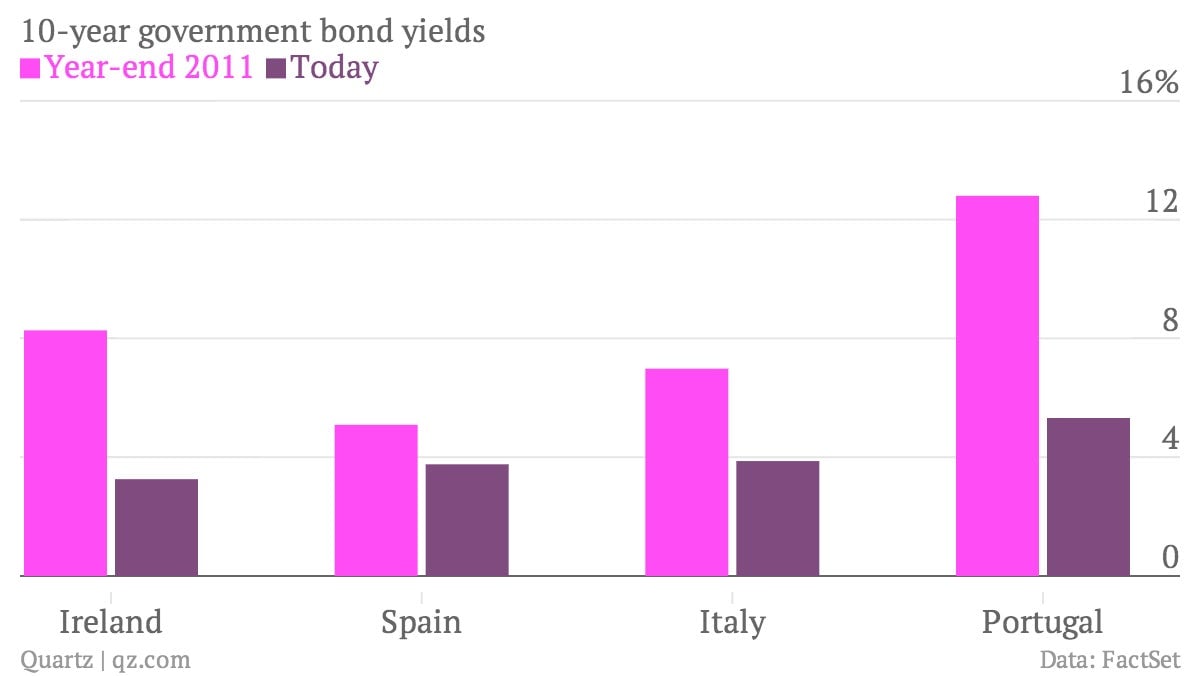

Ireland exited its international bailout less than a month ago. When it asked the markets to lend it €3 billion ($4.1 billion) in its first post-bailout bond issue earlier this week, some €14 billion worth of orders came pouring in—more than the government’s funding target for the entire year. The government boosted the bond issue’s size to only €3.75 billion, despite the demand, to prove that it can tap the markets regularly now that it must determine its own financial destiny. The yield on Irish five-year bonds even dropped below that of their UK counterparts today.

Other borrowers in “peripheral” Europe saw that investors had discovered a new taste for risky debt, and leapt at the chance. The part-nationalized Bank of Ireland drew strong demand for a bond issue yesterday. Spain sold more than €5 billion in government bonds today, with a five-year issue fetching the lowest yield since 1993. The Portuguese government is reportedly reading its first bond issue since May, and steadily trimming the price it will pay to borrow. Even Greece suggests that it may venture back into the bond markets sometime this year, even as it recorded yet another record-high unemployment rate.

Perhaps most surprisingly, Bankia, a state-controlled Spanish banking group, returned to the bond market today, raising €1 billion. This is the bank that last year recorded the biggest loss in Spanish corporate history, wiping out billions of euros in investors’ and savers’ money after its emergency nationalization. It accounted for around half of the €41 billion in bailout funds that Spain received to clean up the wreckage in its banking system.

Despite some economic warning signs, today the European Central Bank left interest rates unchanged and announced no new measures to support the convalescent euro zone economy. The 2012 pledge by ECB president Mario Draghi to “do whatever it takes to preserve the euro” still looms large in investors’ minds, giving them confidence that bets on risky bonds are protected in the event of another crisis. This could explain some of the market euphoria in recent days. So too, perhaps, could a shift away from emerging market assets on the part of yield-hungry investors. An extended period of calm in the euro zone, combined with the natural bouts of optimism that often comes at the beginning of a new year, may be yet another factor. As an asset manager put it to Bloomberg, “we are gradually moving from fear to greed.”