Here are just a few of the folks who were massively wrong about QE3

In both the run-up to and the aftermath of the Federal Reserve’s announcement of a third round of money creation and bond-buying—quantitative easing—known as QE3, the fashionable position on Wall Street and among the financial commentariat was that it wouldn’t work. Sure, the thinking went, the Fed might be able to set off a rally in financial markets such as stocks and commodities, but it won’t be able to do anything for the real economy.

In both the run-up to and the aftermath of the Federal Reserve’s announcement of a third round of money creation and bond-buying—quantitative easing—known as QE3, the fashionable position on Wall Street and among the financial commentariat was that it wouldn’t work. Sure, the thinking went, the Fed might be able to set off a rally in financial markets such as stocks and commodities, but it won’t be able to do anything for the real economy.

Such thoughts were often delivered with a world-weary sigh and frequently while wearing a bow-tie.

And like plenty of positions that become popular in and around Wall Street, these views turned out to be two things: Dead. And wrong.

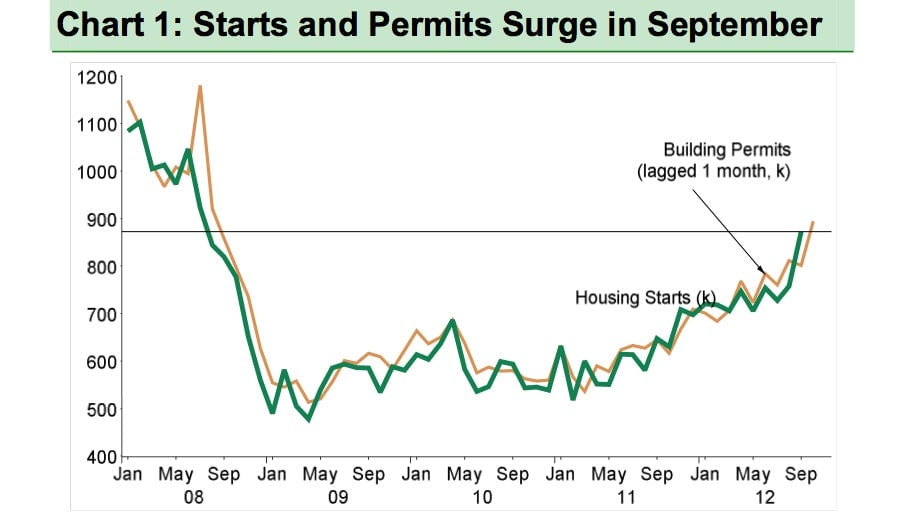

There’s really no other way to explain the massive—and apparently strengthening—turnaround that we’ve seen in housing lately (see chart above) except for the Fed. This morning’s jump in US housing starts is just the latest tidbit of data to support what’s becoming a widely held view.

Of course, all the requisite caveats apply. The US economy still looks weak. The labor market, while showing signs of improvement, is fragile. And whether the benefits of any boost to housing spreads to the broader economy remains very much an open question. And by the way, it’s also true that housing was showing signs of “green shoots” even before the Fed announced QE3.

But policymakers at the central bank recognized that trend early and pushed hard to keep it going. And that largely explains how and why they unveiled their plan for unlimited purchases of federally guaranteed mortgage bonds. (Here’s a chart-laden explainer on why this might be Ben Bernanke’s masterstroke.)

So, for the historical record, here are a few purveyors of the conventional wisdom who now look anywhere from slightly misguided to quite wrong. Of course, being wrong isn’t a crime. It is, however, a fact.

- Doug Kass, Seabreeze Partners: “I don’t think QE3 will positively impact the real economy. Monetary solutions of fiscal problems won’t prepare the growth trajectory. The role of the fed and its easing has waned with each QE.” (Bloomberg Surveillance, Sep. 19, 2012)

- Anthony Sanders, Distinguished Professor of Real Estate Finance at George Mason University’s Mercatus Center — “It won’t help housing because with tight credit, only wealthier Americans with perfect credit benefit from lower mortgage rates. Additionally, seniors get hurt again with aggressive Fed action because bank deposit rates fell. This action will not help the housing market, it will not help unemployment, but it will create bubbles in asset prices.” (Link)

- David Malpass, former chief economist of Bear Stearns, now of economic consulting firm Encima Global: “QE3 won’t help because the Fed’s really just shuffling the deck chairs. I think they should be pointing back at the executive branch, at the government, and saying look, you’re spending too much money. People don’t want to invest in the US. It’s not a monetary policy problem that we’re dealing with.” (Bloomberg Surveillance, Sep. 7, 2012.)

- Stephen Roach, Yale lecturer and longtime chief economist at Morgan Stanley: “[The Fed] is flailing and has been flailing really for the better part of the last three years. We’ve had QE1, which worked, and that’s it. We’ve had QE2, Twist 1, Twist 2, now maybe QE3. The economy is in the doldrums … The Fed – the Fed knows this, but they’re dangling this raw meat in front of the markets and the markets are salivating as they always do in their sort of frenetic way to try to believe in the Fed, but it’s – it hasn’t worked and it won’t work.”