The Federal Reserve just cut rates for the first time in a decade—and landed itself in a dilemma.

This afternoon (July 31), the Fed open market committee trimmed the target range of the federal funds rate by 25 basis points (or .25%), to between 2% and 2.25%. It also revealed that it will end the runoff of its balance sheet, known as quantitative tightening, tomorrow morning, two months ahead of schedule. The committee’s messaging—which is more important for shaping market expectations than the cut itself—changed a bit too, in particular the addition of “global developments” as a chief reason for its cut.

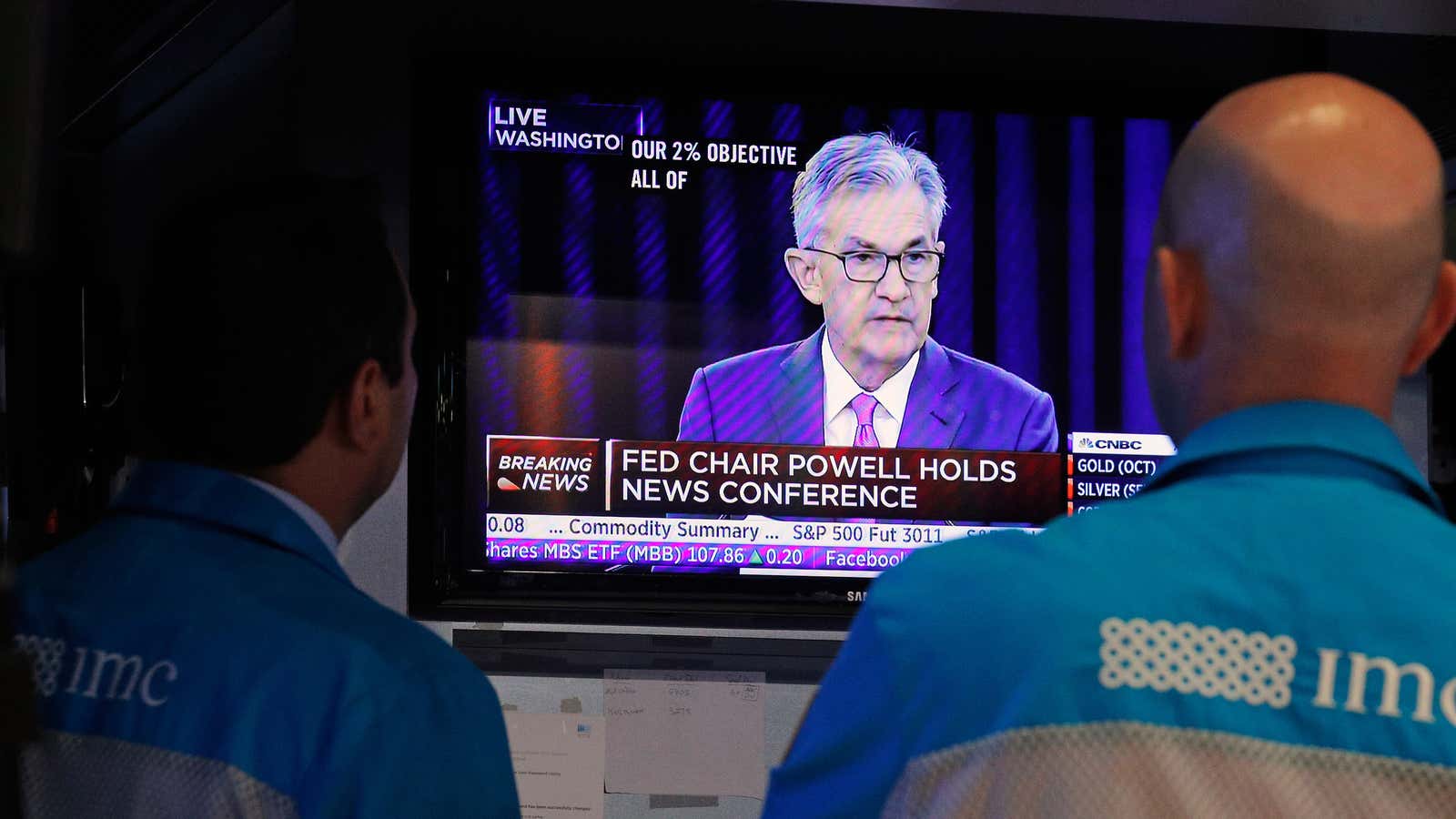

However, in his press conference, chair Jerome Powell emphasized that the move was likely to be a “one-and-done” affair, and not the beginning of a series of cuts, observed economist Mohamed El-Erian. This position was reinforced by the fact that two of the 10 committee members voted to keep rates and qualitative tightening unchanged, and none voted to slash by 50 basis points. In other words, the Powell and his compadres signaled that as long as US growth remains stable and global activity doesn’t deteriorate, rates will stay where they are.

Markets clearly didn’t like that. A stock sell-off ensued, with the S&P 500 slumping 0.6% as Powell’s press conference wore on. This might seem a little strange given that investors expected most of what the Fed delivered. Markets had almost fully priced in the expectations that the Fed would cut today, as Citi analysts flagged in a note this morning. However, they’d also anticipated more cuts in September—and possibly another couple further down the road.

This brings us to the tight spot in which the Fed now finds itself. No matter how restrained it says it’s going to be, the Fed still cut rates. This could undermine confidence in its motivations—a challenge that could weaken the effectiveness of an institution that wields unparalleled influence over the global economy. At the same time, if markets continue to react badly, the Fed’s move could wind up destabilizing things even more.

First off, it’s useful to remember that no matter how widely expected the Fed’s decision became, it still represents a stunning reversal. Recall that as of December 2018, the Fed was expecting to hike rates twice more in 2019. That announcement really didn’t go over well, though—particularly in the bond market, which reacted in a way that caused borrowing costs to tighten perilously, and with US president Donald Trump, who fulminated about the damage higher rates would to to the economy. By March the Fed had reverted to signaling its intent in merely keeping the federal funds rate stable. Today, it cut. Markets might not like the Fed’s messaging but they are nonetheless navigating much more favorable waters than they were a year ago.

While today’s cut may not have major implications for the economy, it does raise worrying questions about Fed independence.

The Fed has a dual mandate, a promise to keep prices stable and maximize employment. That means the main reason to cut rates should generally be to combat economic weakening that might lead to joblessness. The Fed is not supposed to respond directly to anything else—not the pressures of investors and especially not the yearnings of politicians for easy money to juice short-term growth in an election year. More on that in a second.

First, to be fair to the Fed, it did offer sound reasons for cutting. The US economy is clearly losing momentum. Second-quarter GDP slowed to 2.1%—more growth than expected, but still down from the 3.1% pace in the first quarter. American factories have already landed in a rough patch. Last month, for the first time since December 2015, the US manufacturing sector reported no growth in new orders.

The big wild card here is global growth, as the Fed noted in its statement. The unresolved trade war with China continues to dampen trade flows. A “hard” Brexit is suddenly looking more likely, and things with Iran are getting hairy. With so much uncertainty, businesses everywhere are cautious about spending. (So much so that the investment shrank unexpectedly in the second quarter, dragging down growth.) And even though wages are steadily rising, Americans are saving more diligently than in the past.

Then again, lots of things in the economy aren’t bad at all. Unemployment is at nearly unprecedented lows. US consumers are also spending freely even though they are saving a lot, and with consumer confidence closing in on an 18-year high, they’re clearly bent on buying more. That’s important since consumer spending drives nearly 70% of the US economy.

But, wait—if things are so solidly okay, why cut now? That brings us to the elephant in the room—or, more accurately, the White House.

For the last two years, Trump has bullied Powell for keeping rates too high—and has done so with increasing vehemence. The swiftness of the Fed’s swivel will make it seem to some like Powell caved to Trump.

In theory, eroding central bank independence should increase the risk of an inflationary flare up—provided you accept that what’s been suppressing price-growth all these years is confidence in the Fed’s commitment to curbing inflation. That might still be the case. But price growth has been so feeble for so long, it’s hard to tell if that dynamic is indeed keeping inflation in check. Sill, if markets begin to believe the Fed can be bullied into action by the president, they may have less faith in its ability to hold the line on inflation.

And with investors seemingly pricing in another rate cut in September, Powell risks further undermining today’s messaging if he tries to appease them.

Regardless of the Fed’s motivations, though, it’s unclear whether lowering rates will do anything for the real economy. If things worked the way they do in textbooks, cheapening money could be counted on to halt the US economy’s slowdown long enough for everyone to start spending again. But with businesses skittish about investing and consumers saving fairly aggressively, that’s seems wildly optimistic. “In our opinion, the Fed will achieve nothing of significance with today’s action, but only temporarily satiate market expectations and possibly satiate the White House twitter account,” wrote Ward McCarthy, economist at Jefferies. “Both will want more.”