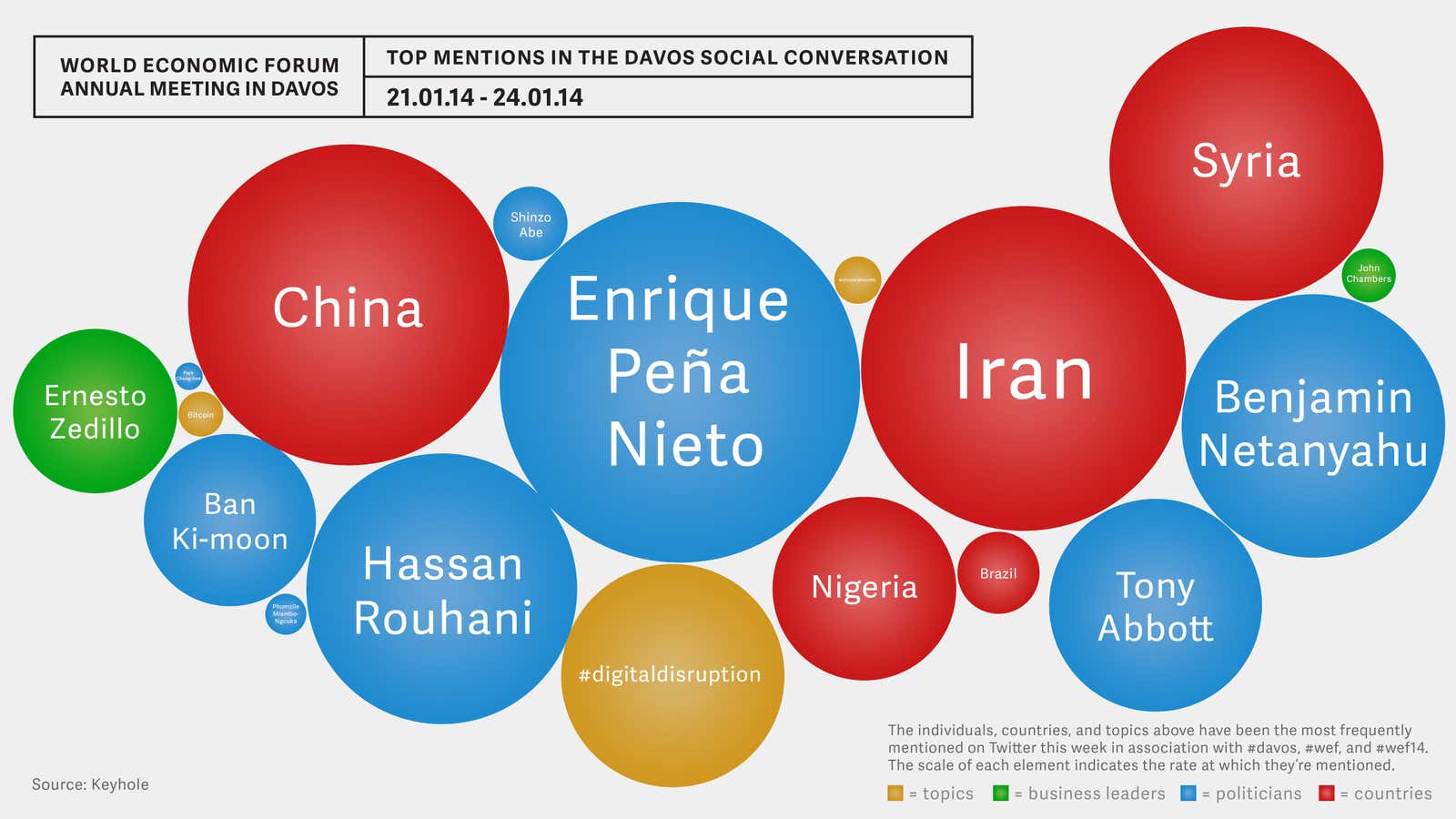

The visualization above shows the individuals, countries, and topics most frequently mentioned on Twitter this week in association with #davos, #wef, and #wef14. The scale of each element indicates the rate at which they’re mentioned. View it enlarged here.

The drive for growth, both social and economic, took center stage in Davos on Friday–from post-recession policy in the U.S. and UK to transformations in China and Brazil to the overarching pull of environmental and gender equality issues. Here are the highlights.

HOT TOPIC While mildly optimistic about global “Millennium Development Goals” progress, UN Secretary General Ban Ki-moon expressed deep concern at several panels at WEF 2014 about the current status of climate change, including at a star-studded “Changing the Climate for Growth and Development” panel that linked poverty and climate change. Lifting people out of poverty will inevitably require more energy, but it must be the “right kind of energy,” said Bill Gates. Nigerian Minister of Finance Ngozi Okonjo-Iweala pointed to climate change fallout such as floods in Nigeria that set back development. Unilever CEO Paul Polman, underscored the business incentive of consumers calling for sustainably-produced goods. World Bank President Jim Yong Kim called on politicians to make long-term decisions on issues like oil subsidies to break the cycle of jostling for elections.

CHINA’S CHALLENGE As China’s growth slows from the glory days of double-digit growth to the 7% range, NYU’s Nouriel Roubini told a panel called “The China Outlook” that the country’s greatest problem today is a quantity/quality imbalance in growth, with too much fixed investment and saving and not enough private ownership and consumption.

BUILDING UP BRAZIL In a special address, Brazilian President Dilma Rousseff reflected on the “deep social transformation” of the country’s last decade, with the creation of a huge and robust middle class. She expanded on her central bank chief’s earlier comments that the economy is “close to full employment” and seeking significant growth. In her optimistic vision for Brazil’s future, Rousseff emphasized an infrastructure development effort–from trains and airports to low-income housing programs, and from scholarship programs to internet penetration.

DEFINING DEFICITS At a panel on “The Future of Monetary Policy,” Harvard professor Larry Summers made a typically blunt case for the merits of public investment as the United States seeks a recovery of growth without bubble-building behavior. “If a moment where we can borrow money for 30 years in the 3 percent range, in currency we print ourselves, and the construction unemployment rate is in double digits–if that is not the moment to fix Kennedy airport, when will that moment ever come? And you laugh, Summers said. He pled with American policy makers to move from a fixation on the budget deficit to other deficits we are leaving for future generations, particularly in fields like the life sciences in which there is 25% less investment than five years ago despite incredible promise.

GROWTH FOR SHORE UK Prime Minister David Cameron’s address cited the U.S. shale drilling boom, which he pegged at $500 billion added to U.S. GDP every year through 2035. Cameron criticized European policymakers who have already put in place environmental regulations for shale extraction, saying that investors may be driven elsewhere and questioning whether certain EU bureaucrats pursue stricter regulation by default. He also envisioned a partial reversal of offshored manufacturing. Other than the potential of shale gas, Cameron said that this “re-shoring” push looks to entice companies, especially in industries like fashion that value niche production and quick turnaround, with shorter and more manageable supply chains. Mentioning Indian investment in Jaguar Land Rover and Chinese investment in the High Speed 2 railway, Cameron called the UK the world’s largest recipient of inward foreign direct investment already.

NEXT ACT Nigerian Minister of Finance Ngozi Okonjo-Iweala shone bright alongside the likes of Bono and David Cameron during the panel “The Post-2015 Goals: Inspiring a New Generation to Act.” Okonjo-Iweala picked up her comprehensive development theme from earlier, blasting the patchiness and exploitability of foreign aid and asserting that only true job creation can lift struggling countries. She fixated on the potential of women to lead the way. “Gender equality is not just a problem in the developing world. It is here in Davos,” Okonjo-Iweala said to applause. “Because [Nigeria and developing nations] are poorer, we can’t afford it.” She also touted the African Risk Capacity initiative to provide disaster insurance within the African Union that’s more immediate and reliable than from foreign aid.

TIMELY PURCHASE Fresh from Google’s $3.2 billion acquisition of Nest, a company at the center of the “internet of things” movement, Nest CEO Tony Fadell, who worked at Apple on the iPod and iPhone teams, surveyed his past projects of varying success to reflect on the importance of timing and simplicity in tech.

TO THE LETTER On Thursday morning, PepsiCo CEO Indra Nooyi offered a brief glimpse into recruiting and HR methods that feature a strong personal touch.

This article was produced on behalf of Bank of America by the Quartz marketing team and not by the Quartz editorial staff.