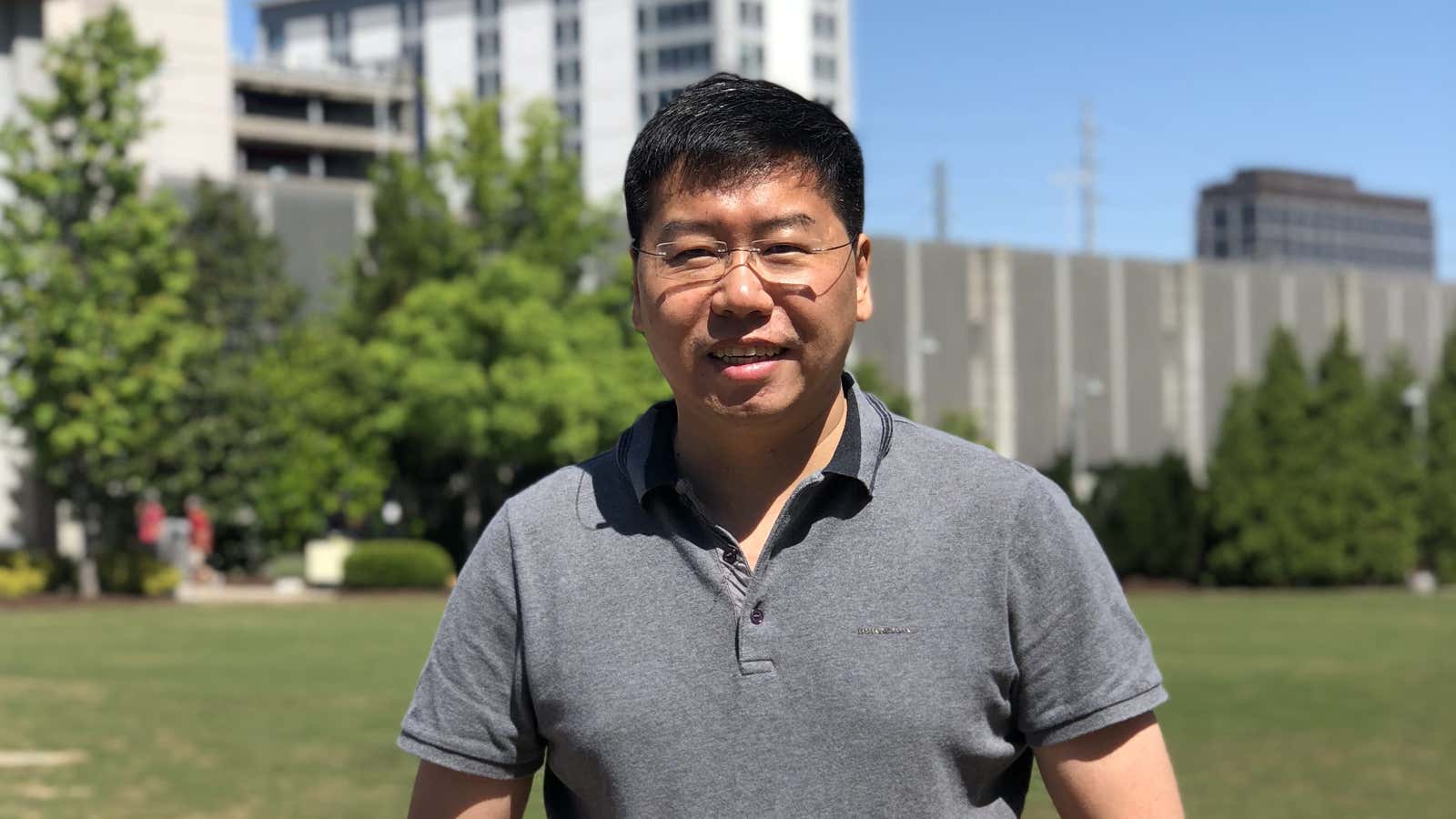

WeRide is one of the Chinese startups vying to roll out robo-taxis in China. Zhang Li, WeRide’s chief operating officer, joined the company in 2018. He shared his views on how important government regulation is to the burgeoning industry in an interview with Quartz at WeRide’s headquarters in Guangzhou.

This interview was lightly edited for clarity.

What differentiates China and the US?

In the US, there is weak regulation. In China, there is strong regulation. Strong supervision means the government is involved in basically every step in road tests. In the US, regulation basically equates autonomous vehicles with ordinary vehicles. If there are no accidents, the government will not interfere with the details and results of your tests—you are only required to issue an annual MPI (miles per intervention) number and a report. The government is not involved in much of the process. It only takes a look when it feels it’s necessary. China needs to know every step. It’s like you can only go to junior high school if you are good enough to graduate from primary school, you can only go to college when you graduate from high school. This is a huge difference.

How do you see China’s approach—slow but aggressive at the same time?

The situation in China is different from that in the US. After all, China is a country with a huge population. The responsibility of the government in this aspect of supervision is relatively large. So they are more cautious and are using a prudent attitude to gradually open autonomous road tests.

Many cities have issued licenses and announced the parameters of the road test areas. But different cities vary: Beijing is faster and has basically opened up more than 300 kilometers [of open roads to autonomous vehicles]. It’s good to put the threshold high so that not any company can get a license. We are responsible for the safety of the citizens.

I hope the government opens more open roads for testing. It doesn’t make any sense to test in closed areas. It makes no difference whether I test for a week or a year. So our second point of view is that the range of autopilot driving tests must be wide.

We also hope that the road test regulations can open up for testing on highways. Many cities’ fast lanes have similar speed limits to highways. It’s forbidden to test on highways in domestic roads, but if you don’t test the speed at 120 kilometers per hour (75 miles per hour), how can we address urban express [lanes]?

The fourth thing we need is to lower the cost of testing. Many cities have issued road test licenses, but the cost is relatively high.

What is the cost of the testing license?

Basically, the cost of a license per car is between 200,000 yuan to 400,000 yuan ($28,000 to $57,000). Sometimes it can be up to 600,000 yuan ($85,000) a year.

It is the cost of the test. For example, an autonomous car needs to go to the inspection site designated by the government. You have to rent this inspection site. It costs tens of thousands or hundreds of thousands a day. You have to run the miles required inside. If he asks you to run 5,000 kilometers, you can’t do it on the open road, you have to run in this site. There are other test indicators, such as left turn, right turn, there may be some test sites on the municipal road, and if so, the organizer needs to close the road. That costs a lot.

In Beijing, a license is issued to you only for one quarter. You can extend for another quarter. After that, you need to do the tests mentioned above again. That’s why on average a license for one year costs at least 200,000 yuan to 300,000 yuan and if it is expensive, it is 600,000 yuan. If you have 20 cars, you need to book the whole testing field, and the accumulated cost is high.

Critics say autonomy might never be ready for passenger cars. Why do you believe a robo-taxi is the right application for self-driving cars?

What we see today in commercialization—be it robo-taxi, freight cars, logistics vehicles, ferry cars, cleaning cars—it all goes to one essential question: What is the ratio of the labor cost to total cost?

The highest cost is labor, and that is the most valuable thing in autonomous driving. That is why Waymo has a value of $175 billion. It only focuses on two businesses, the robo-taxi and trucks. I think the first thing to look at is where the business value is. It must be robo-taxi because taxi drivers account for 70% of the revenue. In China’s freight cars, two drivers account for about 22% of the revenue, tolls account for 30%, and gas accounts for 20%. The labor costs in a bus are even lower. So that means if your substitute [for those vehicles] is low, the commercialization value isn’t very high.

How do you see the relationship between self-driving software companies and carmakers? Do you worry they will kick you out once they have the technology they need? After all, they are the ones making those cars.

I feel like Level 4 self-driving companies are far more advanced [than carmakers].

Our view has always been that there should be more and more cooperation between the two parties. Carmakers control the chassis and related technologies. Without their support, it is difficult to crack them. On the other hand, carmakers opening the chassis and wire controls means opening up your own intellectual property. So this requires a certain degree of trust and cooperation between the two parties.

Are you thinking about an IPO? Do you have any pressure from your investors?

I can’t comment on an IPO. I think the entire capital market is very optimistic about self-driving. Self-driving faces obstacles, for instance, laws and regulations which are lagging behind. But other artificial intelligence applications also face a similar problem in China. No investors so far have asked to cash out.