In the beginning, there was Adam.

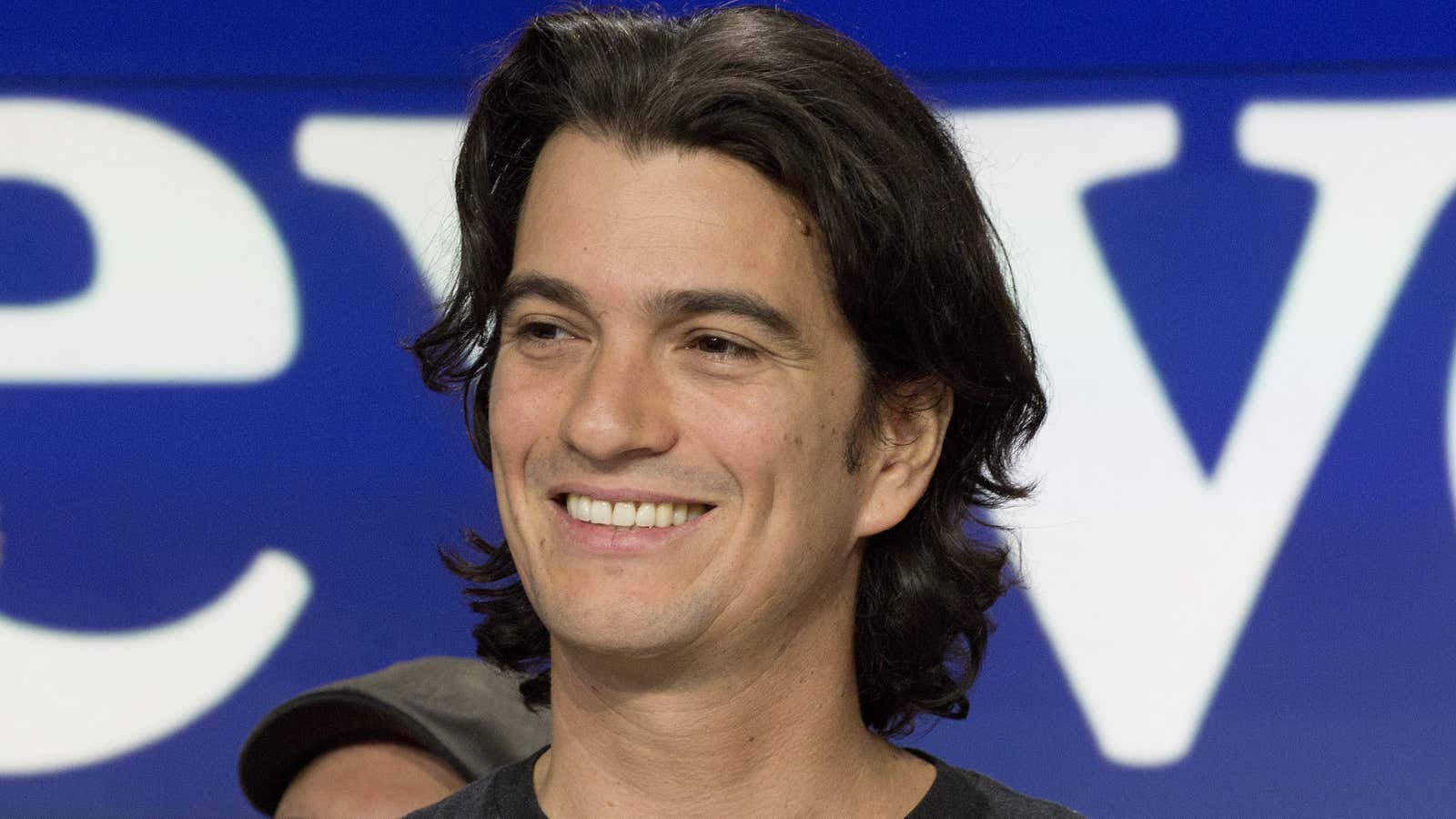

In this case, Adam is Adam Neumann, co-founder and chief executive of WeWork, now The We Company. But to the company—and for this story—he is just Adam.

“From the day he co-founded WeWork, Adam has set the Company’s vision, strategic direction and execution priorities,” WeWork says in the IPO filing it unveiled today. Even by the tech industry’s standards, Adam has a uniquely close relationship with his company.

The word “Adam” appears 169 times in WeWork’s IPO filing. It’s the most distinctive term in the “risk factors” section of the form compared with the annual reports of S&P 500 companies over the past several years, a Quartz analysis found. Even Tesla, whose CEO Elon Musk is a cult figure in his own right, didn’t mention “Elon” or “Musk” nearly as much when it filed to go public in 2010.

Adam is a superstar in the WeWork community—the WeWorld, if you will. He’s tall and lanky with long dark hair, known for taking tequila shots in meetings, and prone to hyperbolic pronouncements. “WeWork Mars is in our pipeline,” he declared in 2015.

Adam has invested personally in real estate “based on his vision of the future of real estate.” He has an ownership stake in four commercial buildings leased to WeWork, three of which were signed on the same day that he took a stake in the property.1 From 2016 to June 2019, WeWork paid $20.9 million in cash to the landlords of these properties, which includes Adam.

Those four leased properties, plus six other commercial properties Adam owns, were recently transferred to ARK Capital Advisors, a property management and acquisition vehicle launched by WeWork. The name ARK, Adam has explained, comes from “Adam, Rebekah, and Kids”—he and wife Rebekah have five children—though he also welcomes a more biblical interpretation. “Noah’s Ark represents a covenant between God and the people to never destroy the world,” Adam told Bloomberg.

Adam has from time to time received personal loans from his company, including a loan of $7 million issued in June 2016 he repaid in full, with interest, the following year. Adam also currently has a $500 million line of credit secured by WeWork common stock he beneficially owns.2 In April, WeWork issued Adam a $362 million loan connected to early exercise of a stock option.

Adam earns no salary from WeWork3 but he controls a majority of its voting power through his ownership of super-voting shares with 20 votes each.4 His wife is also a co-founder and WeWork’s “chief brand and impact officer,” as well as CEO of WeGrow, the company’s experiment in early childhood education. (She doesn’t earn a salary either.) One of Adam’s immediate family members was paid $200,000 to host events for WeWork’s 2018 “Creator Awards.” Another immediate family member is WeWork’s head of wellness.

Adam’s personal passions have guided a series of WeWork investments. These include a $32 million bet on Laird Superfood, a natural foods company owned by Laird Hamilton, a surfer Adam admires, and a $13.8 million investment in Wavegarden, a Spanish company that makes pools with surfing waves. WeGrow, the private elementary school overseen by Rebekah, emerged after she and Adam failed to find a suitable schooling option for their children in Manhattan. Adam and Rebekah have pledged $1 billion in cash and equity to fund charitable causes over the next 10 years; their first contribution went toward the conservation of tropical forest, a photo of which concludes WeWork’s IPO filing.

“Adam is a unique leader who has proven he can simultaneously wear the hats of visionary, operator and innovator, while thriving as a community and culture creator,” says WeWork. “Given his deep involvement in all aspects of the growth of our company, Adam’s personal dealings have evolved across a number of direct and indirect transactions and relationships with the Company.”