Abolishing net neutrality in the US was supposedly about spurring telecoms— freed from regulations—to expand and upgrade their networks.

At the Federal Communications Commission (FCC), it was a top rationale for discarding Obama-era rules that prohibited telecoms from blocking, slowing, or otherwise discriminating against content and services, and from charging for “fast lanes,” or giving preferential treatment such as higher download speeds.

FCC chair Ajit Pai argued in 2017 (pdf) that “broadband providers will have stronger incentives to build networks, especially in unserved areas, and to upgrade networks to gigabit speeds and 5G.”

The USTelecom trade association, which represents the industry, claimed vindication this week. Broadband investment rose from $72 billion in 2017 to $75 billion last year. It’s part of a “positive momentum shift that began in 2017,” the organization says, “when the FCC initially signaled its intention to restore a forward-looking regulatory framework for broadband.”

The news comes on the heels of an Oct. 1 court win (perhaps a Pyrrhic one) for opponents of net neutrality that upheld the FCC’s repeal but handed states the authority to impose stricter standards—threatening to balkanize US regulations.

So is $3 billion really a vindication? Historically, the evidence is muddy. A 2012 study in the United Kingdom suggested “fast lanes”—allowing telecoms to charge companies for faster delivery of certain content—increased industry revenue and customer benefits. A second study in 2017 found mobile and broadband markets in the US grew following deregulation moves between 2003 and 2015, but it was unclear if they were responsible for more investment in infrastructure and service.

Industry executives, when speaking candidly, have said net neutrality rules do not affect capital investments. In 2005, a Verizon spokesman indicated that then-new net neutrality principles would not stifle investment stating, “Our plans haven’t changed.” AT&T CEO Randall Stephenson told investors in December 2015 that plans to expand his company’s network wouldn’t be affected by Obama-era regulations (although he later amended this to say the new rules could be “suppressive to [industry] investment”).

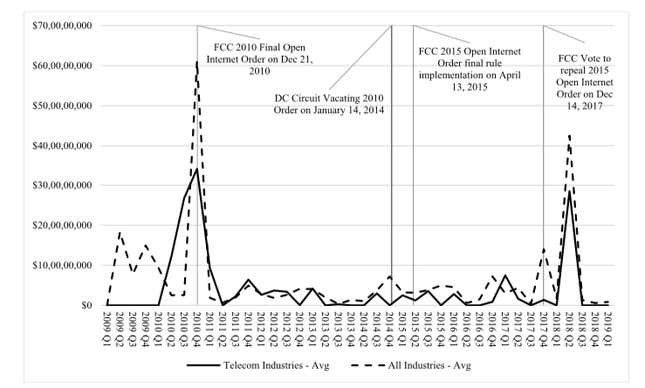

To answer the question empirically, Christopher Hooton, an economist at both George Washington University and the Internet Association trade group (no friend of the FCC’s decision to repeal net neutrality), dug into data filed with the US Securities and Exchange Commission. In a paper published this month in the peer-reviewed journal Telecommunications Policy, he analyzed quarterly capital expenditures between 2009 and 2018 among 8,577 companies, including 270 telecommunications firms.

He found that capital investments did not show any discernible impact from policy decisions. “The key finding is there were no impacts on telecommunication industry investment (as measured by new capital expenditures incurred) from the net neutrality policy changes,” wrote Hooton. “In other words, net neutrality rules were not a strong enough factor to cause ISPs to decrease their investment as measured by new capital expenditures incurred.”

The chart below shows average capital expenditures for the telecom industry and across all industries in the study. It shows quarterly investment rising and falling mostly in line with other industries, and with no correlation to policy decisions.

Ultimately, Hooton argues, the lack of correlation undermines the argument that the repeal of net neutrality increases investment, and potentially other claims such as that it fosters innovation or promotes free speech. “This is not to say they are necessarily wrong,” he wrote, “but that they are likely equally hard to back up empirically.

Update: The USTelecom trade association pointed Quartz to its previous analysis of capital expenditures, but did not comment on this specific research.

Net-neutrality decisions will now be up to the states, per this week’s legal decision, which was made by the DC Circuit Court of Appeals. It ruled that “in any area where the Commission lacks the authority to regulate, it equally lacks the power to preempt state law.”

That makes California’s net neutrality law SB 822, which went into effect on Jan. 1, the new battlefront. It’s the first state-level law restoring all of the 2015 net neutrality protections.

Enforcement of SB 822 has been on hold as court cases were resolved. If there are no appeals to the most recent ruling, then California will likely begin enforcement. Other states are also free to forge ahead. More legal battles await, says Ryan Singel, a research fellow at Stanford University Law School’s Center for Internet Society. The Department of Justice had given every indication it will go after these laws, he says, but now its case “is much, much harder than it was before.”