Robinhood’s newest feature shows financial regulation is working

After scrapping plans in December for a checking account that paid 3% interest, Robinhood has returned with a refreshed offer for customers—a cash management program that pays about 2.05% interest. It’s an added feature for Robinhood’s stock-brokerage accounts (rather than a separate checking account), and unlike last time, it’s appropriately insured. If it had made it to market, the previous iteration could have put customer funds at risk.

After scrapping plans in December for a checking account that paid 3% interest, Robinhood has returned with a refreshed offer for customers—a cash management program that pays about 2.05% interest. It’s an added feature for Robinhood’s stock-brokerage accounts (rather than a separate checking account), and unlike last time, it’s appropriately insured. If it had made it to market, the previous iteration could have put customer funds at risk.

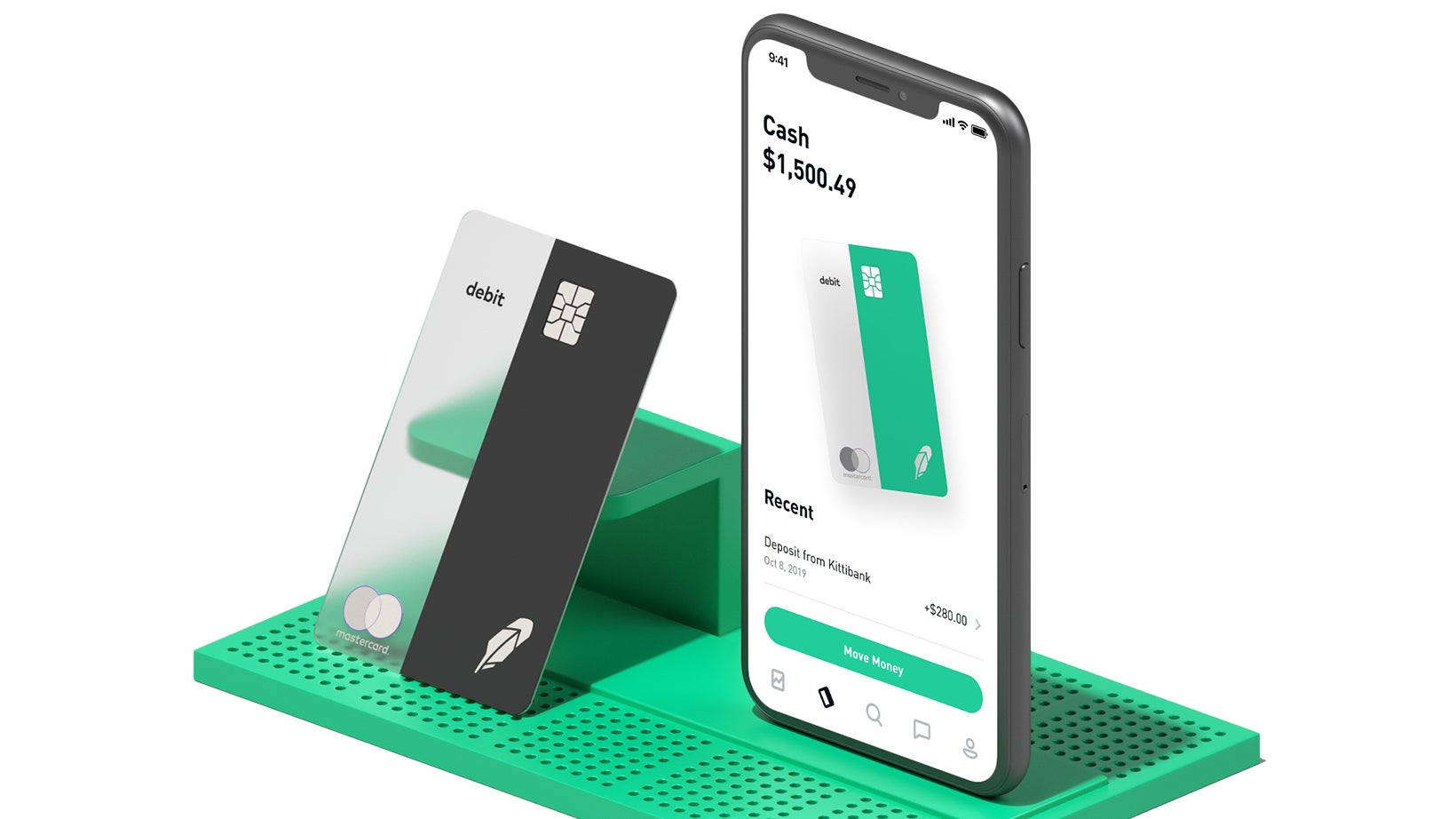

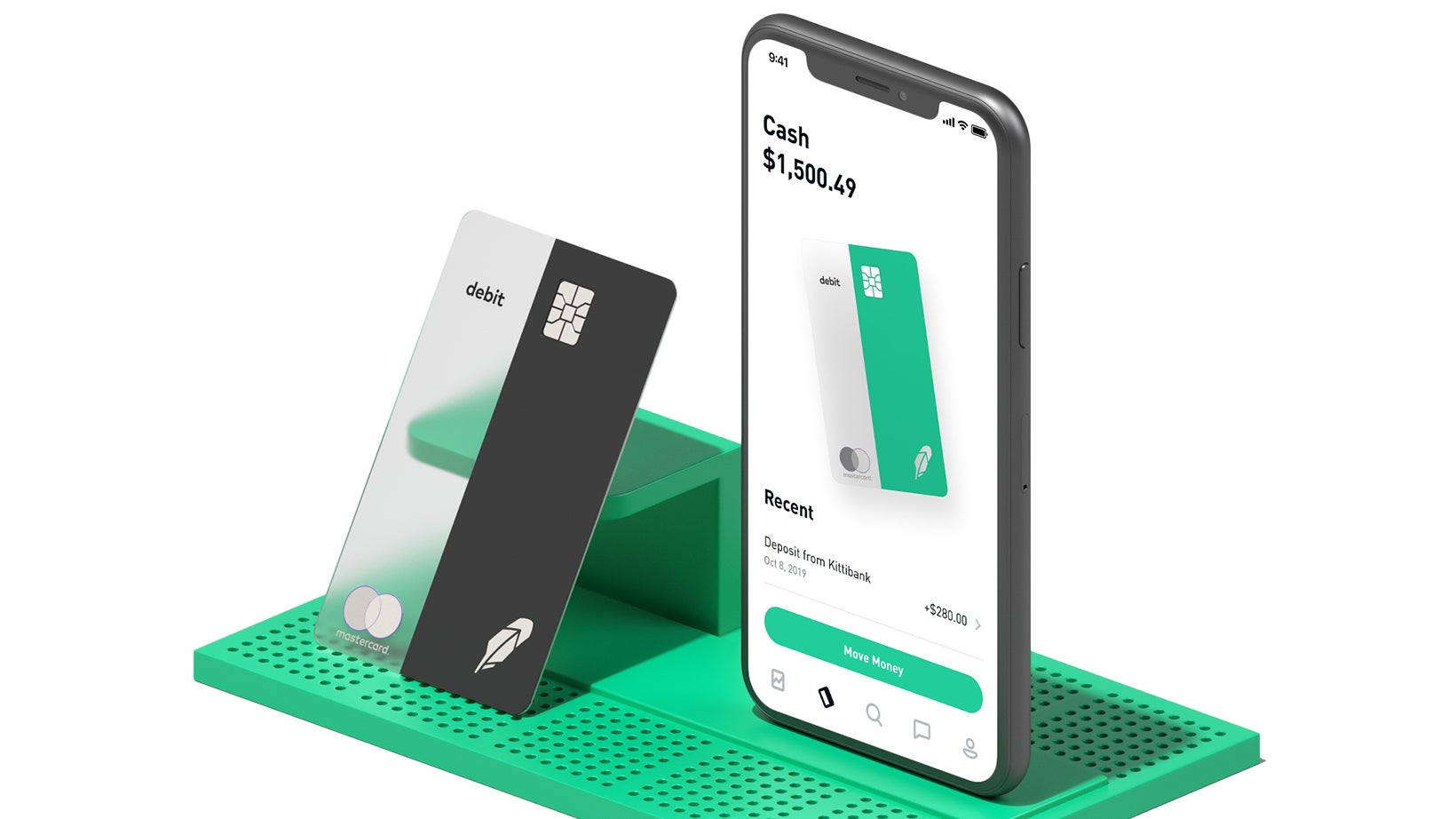

Uninvested money in Robinhood brokerage accounts will be swept into partner banks, which will pay interest on the cash. Participating customers will receive Mastercard debit cards issued by Sutton Bank, allowing them to withdraw or spend cash from their brokerage accounts at will. The feature could help customers who struggle to balance money between accounts dedicated to investment or payments.

Robinhood began accepting sign-ups on a waitlist today (Oct. 8) for the new program, billing it as an opt-in feature. Unlike the earlier checking account product—which erroneously claimed insurance coverage by the Securities Investor Protection Corporation (SIPC) alone—Cash Management is insured by the Federal Deposit Insurance Corporation (FDIC) through a handful of banking partners. These include Wells Fargo, HSBC, Goldman Sachs, Citibank, US Bank, and Bank of Baroda. Collectively, customer deposits spread across the six banks will be FDIC insured up to $1.25 million, with a maximum of $250,000 per bank.

In the fine print, Robinhood explains it’s still using SIPC, but that insurance—which only covers brokerage accounts—is for cash that hasn’t been swept into an account with one of its banking partners.

Practically speaking, the customer experience of a high-yield checking account and Robinhood’s cash management program shouldn’t be all that different. If anything, Robinhood could offer customers greater opportunity to quickly access funds from liquidated investments. Instead of needing to transfer money from a brokerage account to a separate checking account, people will be able to spend their cash more directly.

Robinhood’s revamping of an interest-bearing product demonstrates how the startup quickly responded to the backlash to its poorly-insured checking account. The company is playing by the rules this time—and it’s using them to push for regulatory arbitrage, chances to make money by using the law to their advantage, when possible. As John Detrixhe wrote for Quartz last year, traditional finance execs “should be concerned because tech entrepreneurs have a knack for skirting the complex rules and regulations that provide protective moats around entrenched industries.” Money management is no different.

Perhaps signaling its increased attention to its regulatory requirements, Robinhood announced yesterday (Oct. 7) that ex-SEC commissioner Dan Gallagher joined its board, and in April, the company hired a chief compliance officer. That month, it also created new vice-president roles for legal and regulatory, and compliance affairs.

Robinhood’s SIPC-FDIC resolution also shines a light on Brex, another Silicon Valley fintech company. Brex, which offers credit cards to startups, unveiled its own cash-management account last week, imploring customers to “replace [their] bank account with Brex Cash.” But like Robinhood before it, Brex said it would use only SIPC insurance. It’s not clear yet whether that coverage is sufficient.