Americans buying stuff. But you knew that!

The first official estimate of US growth in 2013 is out, and real GDP—all the economic value produced in the country—increased by just 1.9%. That’s a decent return but nowhere near the heady days of the 1990s, or even 2.8% growth in 2012. For the optimists out there, the fourth quarter saw the economy growing at a clip that would increase GDP 3.2% if it continued for a full year.

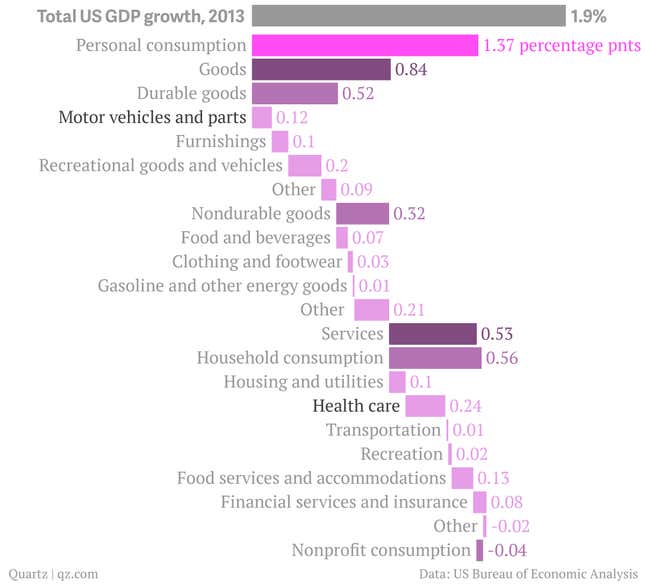

Here’s a chart breaking down where that growth came from:

You’ll notice a few things:

Americans bought a lot of stuff.

Personal expenditures were the single largest contributor to US GDP growth. This was mostly purchasing more goods, with spending on vehicles playing a big role, and but services growth was important as well, with health care unsurprisingly taking a top spot.

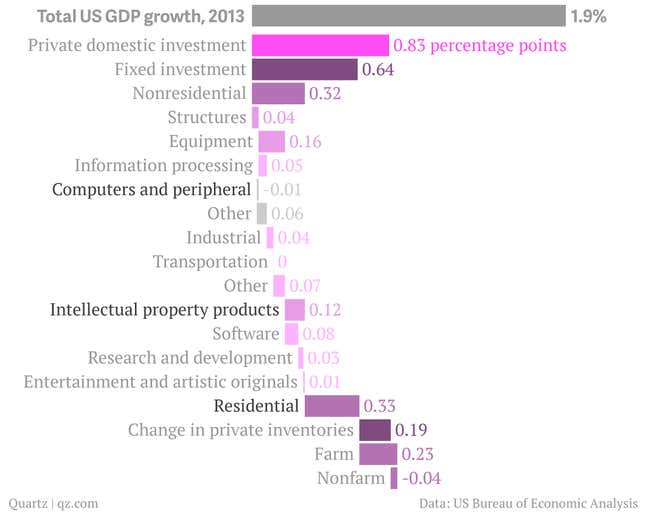

Private investment came in next.

That included investment in homes, which made up 0.33 percentage points, and business equipment—although, weirdly, investments in computers actually shrank last year. And, while many wondered if the new accounts for “intellectual property products” like media, software and pharmaceuticals would goose growth, they contributed just 0.12 percentage points, less than they did in the last two years.

Inventories didn’t make a big contribution. Expanding private inventories boosted GDP throughout 2013, and some worry it was a false dawn—those inventories might not get sold and would end up counting for a loss or hang over into future quarters. In the end, private inventories contributed 0.19 percentage points to growth on the year, about the same as 2012.

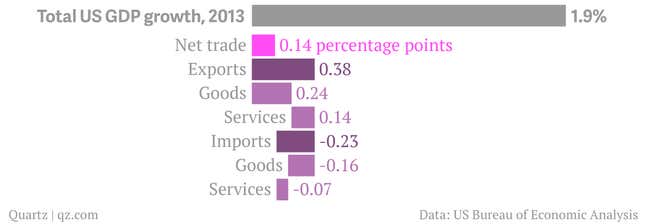

Trade continues to boost GDP.

US net exports contributed 0.14 percentage points of new growth, thanks mostly to reduced imports of goods compared to 2012 and 2011; it’s an open question whether that growth can continue, given that the US depends largely on petroleum product exports.

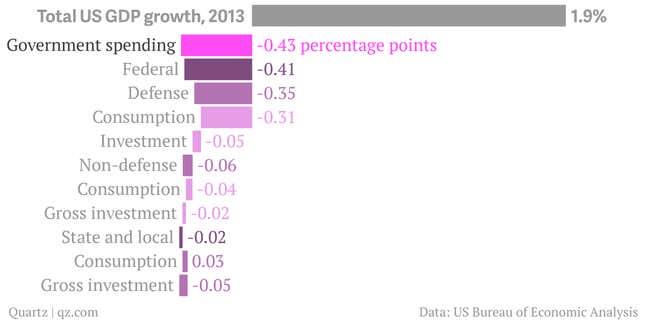

And the government continues to drag it back.

The fiscal headwind is a real thing: Government at the state and federal level continued its contraction last year, subtracting 0.43 percentage points from growth as spending on everything from new purchases to national defense to teachers was scaled back for the third year in a row. It’s a reminder that while the private sector is expanding, slow growth in the US is as much a policy choice as anything else.

But if you’re wondering why jobs growth is slow and Americans aren’t happy with the economy, consider this comparison: From 1992 to 2000, and during the bubble years from 2003 to 2006, US growth never dipped under 2.7%.